- Home

- Personal Loan

- Tata Capital Personal Loan Eligibility Calculator

Tata Capital Personal Loan Eligibility Calculator

- Personalized Personal Loan solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Personal Loan Interest rate comparison

Tata Capital’s Personal Loan Eligibility Calculator is an online tool designed to help potential borrowers determine their eligibility for a personal loan. The calculator typically takes into account various factors, such as the applicant’s age, monthly income, existing financial obligations, and sometimes credit score, to provide an estimate of the loan amount one might be eligible for.

Tata Capital Personal Loan Eligibility Calculator – Key Features & Benefits

Here are the key features and benefits of the Tata Capital Personal Loan calculator.

- User-Friendly Interface: The calculator is usually designed to be simple and intuitive, requiring just a few inputs for quick results.

- Instant Results: Just input your financial details, such as monthly income, existing liabilities, and age. The calculator instantly shows you the approximate loan amount you could be eligible for.

- Multiple Parameters: The calculator typically considers various factors like age, income, existing debts, and sometimes credit score, for a more accurate eligibility estimate.

- Customizable: Some versions of the calculator allow you to adjust variables like interest rates or loan tenures to see how they impact your eligibility.

- Accessible: Being an online tool, it is accessible 24/7, allowing you to check your loan eligibility anytime, anywhere.

Benefits of Tata Capital Personal Loan Eligibility Calculator

- Informed Decision Making: Knowing your eligibility beforehand can guide you in making informed decisions regarding the loan amount and tenure that are suitable for you.

- Time-Saving: The instant estimate saves you the time you might otherwise spend in consultations or paperwork just to check eligibility.

- Financial Planning: By providing a realistic picture of your borrowing capacity, the calculator helps you plan your finances better.

- Transparency: It provides a transparent view of how lenders would perceive your application, reducing uncertainty in the loan application process.

- Better Preparedness: Knowing your estimated eligibility can help you gather the necessary documents and meet the other requirements for the loan application, making the entire process smoother.

- Risk Assessment: You can also use the calculator to assess the risk involved in taking a loan by understanding the financial commitments you would be making.

How to Use Tata Capital Personal Loan Eligibility Calculator?

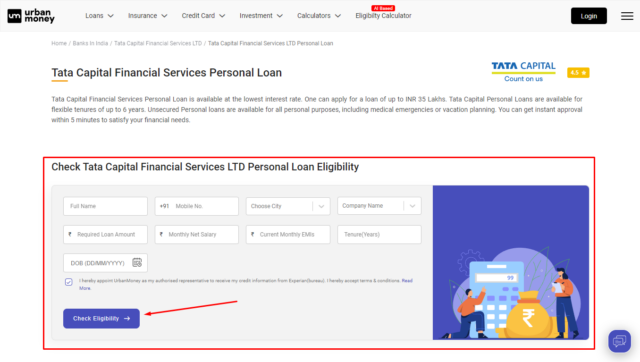

Urban Money offers an easy to use Tata Capital personal loan eligibility calculator in these simple steps:

- Log on to www.urbanmoney.com

- Select ‘Personal Loan’ from the ‘Loans’ category.

- Choose “Tata Capital Financial Services Ltd Personal Loan” from the available banks and NBFCs list.

- The portal will direct you to the ‘Tata Capital Personal Loan’ page.

- Fill in the required details and accept the terms and conditions.

- Click on ‘Check Eligibility’.

- Complete the OTP verification and get instant estimates.

The calculator also provides loan terms like interest rates, loan tenure, EMI payments, and the estimated personal loan amount. Click ‘Apply Now to apply for the loan, or select ‘View All Offers’ to browse through other options.

Tata Capital Personal Loan Eligibility Criteria

- Minimum Salary Requirement: Tata Capital usually has a minimum salary requirement to ensure that the borrower can afford the monthly repayments. This can vary depending on the city of residence and the applicant’s job profile.

- Debt-to-Income Ratio: This ratio, which represents the percentage of your income that goes towards paying debts, is another critical factor. A lower ratio generally increases your loan eligibility.

- Net Monthly Income: The ‘take-home’ salary after all deductions, like Provident Fund (PF) and taxes, can also influence loan eligibility. Lenders may specify a minimum net monthly income for loan eligibility.

|

Type |

Age |

Monthly Income |

Work Experience |

|

Personal Loan Overdraft |

22-58 years |

INR 35,000 |

2 years |

|

Wedding Loan |

21-58 years |

INR 20,000 |

2 years |

|

Education Loan |

16-26 years |

Loan applicant must have a stable income |

|

Tata Capital Personal Loan Eligibility Based on Salary

- Loan Amount: Generally, higher salaries lead to higher loan eligibility. The lender views a higher income as an indicator of greater repayment capability.

- Repayment Tenure: Your salary can influence the maximum loan tenure that Tata Capital might offer you. A stable, higher income might qualify you for a longer repayment period.

- Interest Rates: While this isn’t a direct correlation, some lenders may offer more favourable interest rates to applicants with stable, high-income jobs.

Tata Capital Personal Loan Documentation

- Salary Slips: Most lenders require recent salary slips to verify your income.

- Bank Statements: To corroborate the salary slips, bank statements (usually for the last six months) may also be required.

- Employment Stability: Lenders may ask for proof of employment stability, such as employment tenure with the current employer or years of overall work experience.

Tata Capital Personal Loan Special Cases

- Self-Employed Individuals: If you are not salaried but self-employed, the income consideration can be a bit different, often requiring assessment through income tax returns and business stability.

- Variable Income: For those with variable income like bonuses or freelance payments, an average income may be calculated over a specific period to determine eligibility.

Tata Capital Personal Loan Eligibility Criteria for Self-Employed Individuals

Here is the basic personal loan eligibility criteria for self-employed individuals.

- Age: Usually, the minimum age requirement is around 21 years, and the maximum can go up to 65 years at the time of loan maturity.

- Residence: You must be a resident of the country in which you’re applying for the loan. For example, if you’re applying for a loan in India, you generally need to be a resident of India.

- Business Stability: Lenders often require that the business be operational for a minimum number of years, often 2 to 5 years, to demonstrate stability and viability.

- Minimum Annual Income: There will typically be a minimum annual income requirement. This figure can vary significantly between lenders and even between different loan products from the same lender.

- Credit Score: A good credit score is usually essential for loan approval. The exact threshold can vary, but scores above 700 are generally considered favorable.

- Existing Debts: If you have other loans or credit card debts, this could affect your eligibility and the loan amount you may be approved for.

Special Tata Capital Personal Loan Eligibility for Women Applicants

For women, Tata Capital offers a relatively easy going personal loan eligibility criteria. All one needs to do is meet the basic eligibility criteria to avail a personal loan.

- A female age must be between 22-58

- One should have a minimum monthly income of INR 15,000

- One must have at least 1 year of work experience

List of Factors Affecting Tata Capital Personal Loan Eligibility

Here is the list of factors that affect Tata Capital’s Personal Loan eligibility.

- Age – One must be at least 22 years of age to apply for a personal loan.

- Monthly Income – The higher one’s monthly income, the higher personal loan amount one is eligible for

- Nature of Employment – One’s nature of employment also becomes one of the deciding factors of what kind of loan amount one is eligible for

- Credit Score – A healthy credit score would be 750 and above.

How Can You Improve your Tata Capital Personal Loan Eligibility?

Here is how you can improve your Tata Capital Personal Loan eligibility criteria.

- Pay Your Bills On Time: It is very important to pay your bills on time. It will help in improving your credit score.

- Maintain Low Credit Utilization: As compared to your credit limit, keeping one’s credit card balance at a low helps in improving one’s personal loan eligibility.

- Increase your income: An increased income level helps you improve your loan eligibility as higher income levels mean one’s ability to repay the loan faster.

- Show Additional Income Sources: Declare all the additional sources of income if you have any. It will significantly help you improve your personal loan eligibility.

- Lower Your Debt-to-Income Ratio: Reduce or try to pay off your existing debts. A lower debt-to-income ratio makes you more attractive to lenders.

Understanding Impact of Credit Score on Tata Capital Personal Loan Eligibility

Financial institutions are generally more inclined to approve loans for people with a credit score of 750 or higher. A score in this range not only enhances your reputation as a reliable borrower but may also lead to reduced interest rates as a reward for your strong creditworthiness. Thus, it is important to have a healthy credit score. You can always check the amount of loan

Comparing Eligibility across Different Tata Capital Personal Loan Products

|

Products |

Age |

Monthly Income |

Work Experience |

Tenure |

Loan Amount |

Interest Rate |

|

Personal Loan |

22-58 years |

20,000 |

Minimum of 1 year work exp |

Up to 6 years |

40,000-35,00,000 |

10.99% p.a. |

|

Overdraft Loan |

22-58 years |

15,000 |

Minimum of 1 year work exp |

Up to 84 months |

2,00,000-35,00,000 |

13.55% p.a. |

|

Wedding Loan |

21-58 years |

20,000 |

Salaried individual with 2 years of work exp |

Up to 6 years |

40,000-35,00,000 |

10.99% p.a. |

|

Medical Loan |

22-58 years |

20,000 |

Minimum 1 year of work exp |

Up to 6 years |

40,000-35,00,000 |

10.99% p.a. |

|

Education Loan |

16-26 years |

16,000 |

Good academic record |

Up to 6 years |

40,000-35,00,000 |

10.99% p.a. |

|

Travel Loan |

22-58 years |

15,000 |

Minimum 1 year of work exp |

Up to 6 years |

40,000-35,00,000 |

10.99% p.a. |

|

Home Renovation Loan |

21-58 years |

20,000 |

Minimum 2 years of work experience |

Up to 6 years |

40,000-35,00,000 |

10.99% p.a. |

|

Personal Loan for Govt. Employee |

22-58 years |

15,000 |

Minimum 1 year of work experience |

Up to 6 years |

|

10.99% |

|

Personal Loan for Salaried Individuals |

22-58 years |

15,000 |

Minimum 1 year of work experience |

Up to 6 years |

75,000-35,00,000 |

10.99% |

|

Personal Loan for Doctors |

21-65 years |

Must be self-employed with a degree |

Minimum 1 year of work experience |

12-60 months |

5,00,000-75,00,000 |

12% |

|

Personal Loan for Women |

22-58 years |

15,000 |

Minimum 1 year of work experience |

Up to 6 years |

40,000-35,00,000 |

10.99% p.a. |

|

Small Personal Loan |

22-58 years |

15,000 |

Minimum 1 year of work experience |

18 to 36 months |

40,000 up to Rs 1.5 lakhs |

10.99% |

People Also Asked

How much salary is eligible for personal loan in Tata Capital?

Depending upon the type of personal loan you are planning to avail, the monthly income will differ. Usually the average monthly income of an individual required for a personal loan is 15,000-20,000.

What is the minimum CIBIL Score for Tata Capital Personal Loan?

A healthy CIBIL score is required for availing any loan be it personal loan or home loan. Usually, a CIBIL score of 750 is considered a good score.

Do I need to be an existing customer of Tata Capital to get their personal loan?

As long as one satisfies all the eligibility criteria, one is eligible for applying for a personal loan with Tata Capital.

Will my income ensure my eligibility for a Tata Capital personal loan?

Yes, your income plays a major role in determining whether you are qualified for the loan.

How can I increase my eligibility for a higher Tata Capital personal loan amount?

By maintaining a healthy credit score, having a higher income, lower-debt to income ratio you can ensure that you increase your chances of securing a Tata Capital personal loan.

Quick Links

Personal Loan by Private Bank

- RBL Bank Personal Loan

- DCB Bank Personal Loan

- karnataka bank Personal Loan

- Reliance Capital Personal Loan

- Federal Bank Personal Loan

- IDBI Bank Personal Loan

- karur Vysya Bank Personal Loan

- IDFC FIRST Bank Personal Loan

- YES Bank Personal Loan

- Kotak Bank Personal Loan

- ICICI Bank Personal Loan

- CITI Bank Personal Loan

- Deutsche Bank Personal Loan

- HDFC Bank Personal Loan

- HDFC Sales Personal Loan

- Axis Bank Personal Loan

- IndusInd Bank Personal Loan

- HSBC Personal Loan

Personal Loan by Nationalized Bank

Personal Loan by NBFC

- CASHe Personal Loan

- Prefr Personal Loan

- Tata Capital Financial Services LTD Personal Loan

- Ujjivan Small Finance Bank Personal Loan

- Edelweiss Financial Services Personal Loan

- PaySense Personal Loan

- MoneyWide Personal Loan

- Clix Capital Personal Loan

- Muthoot Finance Ltd Personal Loan

- InCred Financial Services Personal Loan

- IndiaBulls Personal Loan

- DHFL Personal Loan

- IIFL Finance Personal Loan

- FT Cash Personal Loan

- Shriram Urban Co Operative Bank Limited Personal Loan

- Fullerton India Personal Loan

- L&T Finance Personal Loan

- Bajaj Finserv Personal Loan

- Loantap Credit Products Private Limited Personal Loan

- AU Small Finance Bank Personal Loan

- Tata Capital Housing Finance Limited Personal Loan

- Capital First Ltd. Personal Loan

- Aditya Birla Finance Limited Personal Loan

- Poonawalla Fincorp Limited Personal Loan

- Privo Personal Loan

- Hero FinCorp Personal Loan

Personal Loan Calculators

Bank wise Personal Loan Calculators

- Punjab National Bank Personal Loan Calculator

- Indusind Bank Personal Loan Calculator

- Bank Of India Personal Loan Calculator

- Lic Housing Finance Personal Loan Calculator

- Punjab Sind Bank Personal Loan Calculator

- Indian Bank Personal Loan Calculator

- Hdfc Bank Personal Loan Calculator

- Bank Of Maharashtra Personal Loan Calculator

- Hsbc Personal Loan Calculator

- Citi Bank Personal Loan Calculator

- Canara Bank Personal Loan Calculator

- Axis Bank Personal Loan Calculator

- State Bank Of India Personal Loan Calculator

- Rbl Bank Personal Loan Calculator

- Karnataka Bank Personal Loan Calculator

- Federal Bank Personal Loan Calculator

- Deutsche Bank Personal Loan Calculator

- Union Bank Of India Personal Loan Calculator

- Yes Bank Personal Loan Calculator

- Dcb Bank Personal Loan Calculator

- Idfc First Bank Personal Loan Calculator

- Kotak Bank Personal Loan Calculator

- Idbi Bank Personal Loan Calculator

- Icici Bank Personal Loan Calculator

- Bank Of Baroda Personal Loan Calculator

Bank Wise Personal Loan Interest Rate

- RBL Bank Personal Loan Interest Rate

- DCB Bank Personal Loan Interest Rate

- karnataka bank Personal Loan Interest Rate

- Reliance Capital Personal Loan Interest Rate

- Federal Bank Personal Loan Interest Rate

- IDBI Bank Personal Loan Interest Rate

- karur Vysya Bank Personal Loan Interest Rate

- IDFC FIRST Bank Personal Loan Interest Rate

- YES Bank Personal Loan Interest Rate

- Kotak Bank Personal Loan Interest Rate

- ICICI Bank Personal Loan Interest Rate

- CITI Bank Personal Loan Interest Rate

- Deutsche Bank Personal Loan Interest Rate

- HDFC Bank Personal Loan Interest Rate

- HDFC Sales Personal Loan Interest Rate

- Axis Bank Personal Loan Interest Rate

- IndusInd Bank Personal Loan Interest Rate

- HSBC Personal Loan Interest Rate

- Union Bank of India Personal Loan Interest Rate

- Punjab & Sind Bank Personal Loan Interest Rate

- State Bank of India Personal Loan Interest Rate

- Indian bank Personal Loan Interest Rate

- Canara Bank Personal Loan Interest Rate

- Punjab National Bank Personal Loan Interest Rate

- Bank of Baroda Personal Loan Interest Rate

- Bank of India Personal Loan Interest Rate

- Bank of Maharashtra Personal Loan Interest Rate

- CASHe Personal Loan Interest Rate

- Prefr Personal Loan Interest Rate

- Tata Capital Financial Services LTD Personal Loan Interest Rate

- Ujjivan Small Finance Bank Personal Loan Interest Rate

- Edelweiss Financial Services Personal Loan Interest Rate

- PaySense Personal Loan Interest Rate

- MoneyWide Personal Loan Interest Rate

- Clix Capital Personal Loan Interest Rate

- Muthoot Finance Ltd Personal Loan Interest Rate

- InCred Financial Services Personal Loan Interest Rate

- IndiaBulls Personal Loan Interest Rate

- DHFL Personal Loan Interest Rate

- IIFL Finance Personal Loan Interest Rate

- FT Cash Personal Loan Interest Rate

- Shriram Urban Co Operative Bank Limited Personal Loan Interest Rate

- Fullerton India Personal Loan Interest Rate

- L&T Finance Personal Loan Interest Rate

- Bajaj Finserv Personal Loan Interest Rate

- Loantap Credit Products Private Limited Personal Loan Interest Rate

- AU Small Finance Bank Personal Loan Interest Rate

- Tata Capital Housing Finance Limited Personal Loan Interest Rate

- Capital First Ltd. Personal Loan Interest Rate

- Aditya Birla Finance Limited Personal Loan Interest Rate

- Poonawalla Fincorp Limited Personal Loan Interest Rate

- Privo Personal Loan Interest Rate

- Hero FinCorp Personal Loan Interest Rate