- Home

- Personal Loan

- Idfc Personal Loan Eligibility Calculator Plelgcalc

IDFC Personal Loan Eligibility Calculator

- Personalized Personal Loan solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Personal Loan Interest rate comparison

Different banks adhere to distinct eligibility criteria. And remember that meeting the minimum salary requirement for a personal loan is not the only factor a bank considers when assessing your eligibility. Thus, estimating the right loan amount to apply for or knowing how much you are eligible for, is not a straightforward task.

Hence, the bank provides an IDFC personal loan eligibility calculator that assists you in understanding the maximum loan amount you are eligible for, along with the corresponding interest rate, tenure, and monthly EMI. All you need to do is just enter some fundamental information, such as age, income, occupation, phone number, etc. In a jiffy, the calculator will display the result. Moreover, this calculator proffers several additional benefits for its users, ultimately guiding them to find the right loan option that perfectly aligns with their financial situation and needs. Let’s scroll down to know more.

IDFC First Bank Personal Loan Eligibility Calculator – Key Features & Benefits

Here are the key features and benefits of the IDFC bank personal loan eligibility calculator:

Completely Digital

IDFC personal loan eligibility calculator is an online tool. You can avail of this calculator via the Urban Money website at no cost. As a result, there is no longer a need to visit the bank branch occasionally. Instead, you can conveniently check your eligibility, compare various options, and apply for a loan.

Easy to Understand

IDFC bank personal loan eligibility calculator is renowned for its user-friendly UX design. Namely, this handy calculator employs a more visually engaging interface to display results, rather than presenting a cumbersome textual description. This approach lets you easily grasp your loan eligibility and current financial status with a quick glance.

Comparison Capabilities

This dynamic feature empowers you to compare various loan options the Bank offers. For instance, you can compare interest rates, loan amount, tenure, monthly payment, and other associated costs with different financing options you might qualify for. Thereby, you can pinpoint the most cost-effective loan available from the bank.

Real-Time Updates

The IDFC personal loan eligibility calculator is regularly updated with real-time financial parameters. This proactive approach guarantees that you can perform calculations using the most up-to-date parameters, thereby improving the accuracy and relevance of the results.

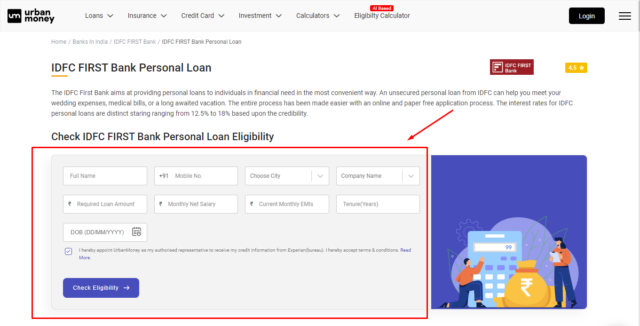

How to use IDFC First Bank Personal Loan Eligibility Calculator?

To use the IDFC bank personal loan eligibility calculator, follow these simple steps:

- Visit the official website of “Urban Money.”

- Click on the “Loans” option and “Personal Loan.” You can locate these options from the horizontal menu bar of the home page.

- You will be redirected to the “personal loan” page, where you can find an array of leading banks and NBFCs in India.

- Scroll down and select “IDFC First Bank.”

- The calculator will be displayed under “Check Personal Loan Eligibility” in “IDFC FIRST Bank Personal Loan” page.

- Enter the required details, such as your name, phone number, city, desired loan amount, loan tenure, etc.

- Click the “Check Eligibility” button.

- Within a minute, you receive a 6-digit OTP to the phone number you entered before.

- Enter the OTP and click “Submit.”

- The calculator will promptly display the total amount you can avail of from the bank. Besides, you can also view the interest rate, tenure, monthly EMI, and total amount alongside the result.

- Moreover, if you wish to apply for an IDFC First Bank Home Loan, click the “Apply Now” button. Alternatively, click “View All Offers” to explore and compare offers from other lenders alongside IDFC First Bank.

IDFC First Bank Personal Loan Eligibility Criteria

Mainly, the bank offers three different types of personal loans. Each aims to cater for a variety of individuals and their needs. The following are the types and eligibility criteria for IDFC First Bank Personal Loan.

IDFC First Bank Personal Loan Eligibility Based on Salary

Here are the required eligibility criteria for personal loans based on salaried individuals:

- The applicant must be between 23 and 60 years of age.

- The applicant must have at least one year of working experience.

- The applicant must have a minimum salary of ₹20,000.

- The applicant must have a good credit history with a favourable CIBIL score.

- The applicant must be an Indian resident.

IDFC First Bank Personal Loan Eligibility Criteria for Self-Employed Individuals

Here are the required eligibility criteria for personal loans based on self-employed individuals:

- The applicant must be between 25 and 65 years of age.

- The business must have existed for a minimum period of 3 years.

- The applicant should submit income proof such as income tax returns, balance sheet, profit and loss account, and bank statements.

- The applicant must have a good credit history with a favourable CIBIL score.

- The applicant should be an Indian resident.

Special IDFC First Bank Personal Loan Eligibility for Women Applicants

Here are the required eligibility criteria for personal loans for women applicants:

- The applicant must be between 21 and 58 years of age.

- The applicant must have a minimum salary of ₹15,000.

- The applicant must have a good credit history with a favourable CIBIL score.

- The applicant should be an Indian resident.

List of Factors Affecting IDFC First Bank Personal Loan Eligibility

Following is the list of factors affecting IDFC First Bank personal loan eligibility:

-

Credit Score

As your credit score is the foremost thing the bank considers, having a good credit score greatly boosts your loan eligibility. Ideally, the bank assesses your credit score to gauge your repayment behaviour and financial capability.

-

Income

Applicants with a high income bolster the bank’s confidence, often resulting in low interstate rates. On the other hand, applicants with lower income or frequent job changes may find it difficult to obtain a loan, as the bank deems them as risky.

-

Age

The bank shows a preference for younger applicants. Thus older applicants may find it challenging to secure loan approval, and they could encounter unfavourable terms and shorter repayment periods.

-

Debt-to-Income Ratio (DTI)

The debt-to-income ratio measures how much of your monthly income goes to debt payments. A low debt-to-income ratio ideally enhances your likelihood of loan approval. Conversely, a high debt-to-income ratio may result in the rejection of your loan application.

-

Loan Amount

The interplay between the loan amount you wish to borrow, your income, and the value of your property holds significant sway over your eligibility for a home loan.

-

Co-applicants

Incorporating a co-applicant with a formidable financial profile and credit history can profoundly enhance the prospects of your loan approval. This strategic move resonates well with the bank, as it considers the combined financial capabilities of both applicants for loan repayment.

How Can You Improve Your IDFC First Bank Personal Loan Eligibility?

You can follow certain tips for improving your IDFC First Bank personal loan eligibility.

Maintain a Good Credit Score

Ensure punctual settlement of your bills and existing loans, and reduce your credit card utilisation. Such actions wield substantial potential to enhance your credit score. Ideally, the bank considers a credit score of 750 and above as favourable.

Reduce Your Debt-To-Income Ratio

Debt-To-Income Ratio entails comparing your aggregate monthly debt and your monthly income. A heightened debt-to-income ratio signifies you have fewer funds available for loan repayment. So this may lead to the bank rejecting your loan application. As a prudent course, you can lower your debt-to-income ratio by increasing your income or curtailing your indebtedness.

Present All Your Income

Present a comprehensive panorama of your diverse income sources, including your monthly salary. This may encompass investments, rental properties, retail businesses, and income-yielding hobbies. Thus the bank becomes more confident about your capability to repay the loan amount. Adhering to this approach ultimately amplifies your eligibility for obtaining a personal loan.

Affix Co-applicant

Adding your spouse, sibling, or other family members to your loan application as co-applicants can significantly bolster your chances of securing loan approval. In such instances, the bank assesses the financial capacity of both applicants, ensuring a robust evaluation of the loan repayment potential. As a result, the overall eligibility of your home loan application gains substantial reinforcement.

Avoid Multiple Loan Applications

Every loan application you submit leaves a mark on your credit report, potentially leading to a reduction in your credit score as well. Besides, an excessive number of loan applications within a short span of time can evoke concerns from the bank. Ultimately, the bank might perceive the applicant as someone seeking an abundance of credit and potentially struggling with loan repayment.

Understanding the Impact of Credit Score on IDFC First Bank Personal Loan Eligibility

A credit score is a numerical representation of your creditworthiness, meticulously computed by the Credit Information Bureau India Limited (CIBIL). To calculate your credit score, CIBIL considers various factors, including your credit history, repayment behaviour, outstanding debts, and other pertinent financial dimensions. Generally, your credit score ranges from 300 to 850; the higher your credit score, the greater your eligibility for a personal loan. The bank typically considers a credit score of 750 and above as ideal. Ultimately, possessing a high credit score enables you to secure a loan with a low-interest rate, a substantial loan amount, an extended tenure, swift disbursal, and more favourable terms.

Comparing Eligibility Across Different IDFC First Bank Personal Loan Products

|

Product Name |

Minimum Age |

Maximum Age |

Minimum Income |

Credit Score |

|

Personal Loan |

23 years |

60 years |

Rs 20,000 p.m. |

700 or more |

|

Consumer Durable Loan |

21 years |

60 years |

Rs 15,000 p.m. |

700 or more |

|

Car Loan |

21 years |

60 years |

Rs 25,000 p.m. |

700 or more |

|

Two-wheeler Loan |

18 years |

60 years |

Rs 8,500 p.m. |

700 or more |

|

Loan Against Property |

23 years |

60 years |

Rs 35,000 p.m. |

700 or more |

People Also Asked

How much salary is eligible for a personal loan in IDFC First Bank?

The minimum salary requirement for an IDFC First Bank personal loan ranges from ₹15,000 to ₹35,000, contingent upon the city of your residence and the type of loan you have opted for.

What is the minimum CIBIL Score for IDFC First Bank Personal Loan?

700 is the minimum CIBIL Score requirement for IDFC First Bank personal loan. Notably, the CIBIL Score of 650 is also negotiable.

Do I need to be an existing customer of IDFC First Bank to get their personal loan?

No, you do not need to be an existing customer of IDFC First Bank to get their personal loan.

Will my income ensure my eligibility for an IDFC First Bank personal loan?

Your income is one factor determining your eligibility for an IDFC First Bank personal loan. However, it is not the only factor; you must also meet other criteria such as age, credit score, occupation, and existing liabilities.

How can I increase my eligibility for a higher IDFC First Bank personal loan amount?

Following are tips you can consider for securing a more substantial loan amount: maintain a positive credit score, lower your debt-to-income ratio, Affix a co-applicant, showcase all your income sources, and avoid multiple loan applications.

Quick Links

Personal Loan by Private Bank

- RBL Bank Personal Loan

- DCB Bank Personal Loan

- Kotak Bank Personal Loan

- Reliance Capital Personal Loan

- Federal Bank Personal Loan

- YES Bank Personal Loan

- Deutsche Bank Personal Loan

- IDBI Bank Personal Loan

- karnataka bank Personal Loan

- karur Vysya Bank Personal Loan

- IDFC FIRST Bank Personal Loan

- HDFC Bank Personal Loan

- ICICI Bank Personal Loan

- CITI Bank Personal Loan

- Axis Bank Personal Loan

- HDFC Sales Personal Loan

- IndusInd Bank Personal Loan

- HSBC Personal Loan

Personal Loan by Nationalized Bank

Personal Loan by NBFC

- Prefr Personal Loan

- Tata Capital Financial Services LTD Personal Loan

- Bhanix Finance Personal Loan

- Ujjivan Small Finance Bank Personal Loan

- Hero FinCorp Personal Loan

- MoneyWide Personal Loan

- Piramal Finance Personal Loan

- PaySense Personal Loan

- Clix Capital Personal Loan

- Edelweiss Financial Services Personal Loan

- Muthoot Finance Ltd Personal Loan

- InCred Financial Services Personal Loan

- IndiaBulls Personal Loan

- DHFL Personal Loan

- IIFL Finance Personal Loan

- FT Cash Personal Loan

- Fullerton India Personal Loan

- Loantap Credit Products Private Limited Personal Loan

- L&T Finance Personal Loan

- Shriram Urban Co Operative Bank Limited Personal Loan

- AU Small Finance Bank Personal Loan

- Tata Capital Housing Finance Limited Personal Loan

- Capital First Ltd. Personal Loan

- Bajaj Finserv Personal Loan

- Aditya Birla Finance Limited Personal Loan

- Poonawalla Fincorp Limited Personal Loan

- Privo Personal Loan

Personal Loan Calculators

Bank wise Personal Loan Calculators

- Bajaj Finserv Personal Loan Calculator

- Tata Capital Financial Services Ltd Personal Loan Calculator

- Hero Fincorp Personal Loan Calculator

- Karur Vysya Bank Personal Loan Calculator

- Piramal Housing Finance Personal Loan Calculator

- Tata Capital Housing Finance Limited Personal Loan Calculator

- Punjab National Bank Personal Loan Calculator

- Indusind Bank Personal Loan Calculator

- Bank Of India Personal Loan Calculator

- Punjab Sind Bank Personal Loan Calculator

- Indian Bank Personal Loan Calculator

- Hdfc Bank Personal Loan Calculator

- Bank Of Maharashtra Personal Loan Calculator

- Hsbc Personal Loan Calculator

- Citi Bank Personal Loan Calculator

- Canara Bank Personal Loan Calculator

- Axis Bank Personal Loan Calculator

- State Bank Of India Personal Loan Calculator

- Rbl Bank Personal Loan Calculator

- Karnataka Bank Personal Loan Calculator

- Federal Bank Personal Loan Calculator

- Deutsche Bank Personal Loan Calculator

- Union Bank Of India Personal Loan Calculator

- Yes Bank Personal Loan Calculator

- Dcb Bank Personal Loan Calculator

- Idfc First Bank Personal Loan Calculator

- Kotak Bank Personal Loan Calculator

- Idbi Bank Personal Loan Calculator

- Icici Bank Personal Loan Calculator

- Bank Of Baroda Personal Loan Calculator

Bank Wise Personal Loan Interest Rate

- RBL Bank Personal Loan Interest Rate

- DCB Bank Personal Loan Interest Rate

- Kotak Bank Personal Loan Interest Rate

- Reliance Capital Personal Loan Interest Rate

- Federal Bank Personal Loan Interest Rate

- YES Bank Personal Loan Interest Rate

- Deutsche Bank Personal Loan Interest Rate

- IDBI Bank Personal Loan Interest Rate

- karnataka bank Personal Loan Interest Rate

- karur Vysya Bank Personal Loan Interest Rate

- IDFC FIRST Bank Personal Loan Interest Rate

- HDFC Bank Personal Loan Interest Rate

- ICICI Bank Personal Loan Interest Rate

- CITI Bank Personal Loan Interest Rate

- Axis Bank Personal Loan Interest Rate

- HDFC Sales Personal Loan Interest Rate

- IndusInd Bank Personal Loan Interest Rate

- HSBC Personal Loan Interest Rate

- Bank of Baroda Personal Loan Interest Rate

- Punjab National Bank Personal Loan Interest Rate

- Bank of India Personal Loan Interest Rate

- Union Bank of India Personal Loan Interest Rate

- Canara Bank Personal Loan Interest Rate

- Punjab & Sind Bank Personal Loan Interest Rate

- Indian bank Personal Loan Interest Rate

- State Bank of India Personal Loan Interest Rate

- Bank of Maharashtra Personal Loan Interest Rate

- Prefr Personal Loan Interest Rate

- Tata Capital Financial Services LTD Personal Loan Interest Rate

- Bhanix Finance Personal Loan Interest Rate

- Ujjivan Small Finance Bank Personal Loan Interest Rate

- Hero FinCorp Personal Loan Interest Rate

- MoneyWide Personal Loan Interest Rate

- Piramal Finance Personal Loan Interest Rate

- PaySense Personal Loan Interest Rate

- Clix Capital Personal Loan Interest Rate

- Edelweiss Financial Services Personal Loan Interest Rate

- Muthoot Finance Ltd Personal Loan Interest Rate

- InCred Financial Services Personal Loan Interest Rate

- IndiaBulls Personal Loan Interest Rate

- DHFL Personal Loan Interest Rate

- IIFL Finance Personal Loan Interest Rate

- FT Cash Personal Loan Interest Rate

- Fullerton India Personal Loan Interest Rate

- Loantap Credit Products Private Limited Personal Loan Interest Rate

- L&T Finance Personal Loan Interest Rate

- Shriram Urban Co Operative Bank Limited Personal Loan Interest Rate

- AU Small Finance Bank Personal Loan Interest Rate

- Tata Capital Housing Finance Limited Personal Loan Interest Rate

- Capital First Ltd. Personal Loan Interest Rate

- Bajaj Finserv Personal Loan Interest Rate

- Aditya Birla Finance Limited Personal Loan Interest Rate

- Poonawalla Fincorp Limited Personal Loan Interest Rate

- Privo Personal Loan Interest Rate