TAN Verification — Different Ways to Verify TAN Number

- Personalized solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Interest rate comparison

Last Updated: 3 January 2026

Before you dive into the TAN verification process or figure out how to verify the TAN number, let us first comprehend the concept of TAN.

According to Income Tax Act, 1961, it is mandatory to quote the TAN number in every TDS (Tax Deducted at Source)/TCS (Tax Collected at Source) return or the taxpayer may have to pay a fine of ₹ 10,000 to the Income Tax Department.

This blog pertains to various methods to check/verify TAN numbers through name and number, the structure of PAN, and more.

What is TAN?

TAN is an acronym for Tax Deduction and Collection Account Number. It is a 10-digit alpha-numeric number that must be obtained by every accountable person for deducting tax at source (TDS) or who collects tax at source (TCS).

The first 4 digits of TAN contain capital letters of the alphabet, the 5th to 9th digit is numerical and the 10th digit is again an alphabet. For instance, a TAN number should be like BCDE05678G.

Under Income Tax Act, 1961, it is obligatory for every tax deductor or tax collector to obtain a TAN number.

TAN Verification

TAN is required by taxpayers specifically at the time of filing TDS (Tax Deducted at Source) or TCS (Tax Collected at Source) returns. Everybody who is responsible for deducting TDS from their payments has to obtain a TAN card. They must quote TAN in all TDS/TCS payment challans, returns, and certificates to be issued.

The banks won’t accept any challans or payments unless you mention TAN in TDS/TCS returns. Moreover, the failure to apply for TAN or not mentioning it in the defined documents lures a fine of ₹ 10,000. Hence, it is significant to apply for TAN.

TAN verification is a hassle-free process that can be done online through the Income Tax Department website. Let us find out how.

TAN Number Verification Online Procedure

TAN number verification is a simple process. You are required to visit the Income Tax Department’s website and proceed ahead by providing relevant information.

Given below are the steps you must follow to verify your TAN number online:

Step 1: Navigate to Income Tax Department’s e-filing process.

Step 2: Go to the ‘Quick Links’ section on the left-hand side of the page and click on the ‘Know TAN Details’ option.

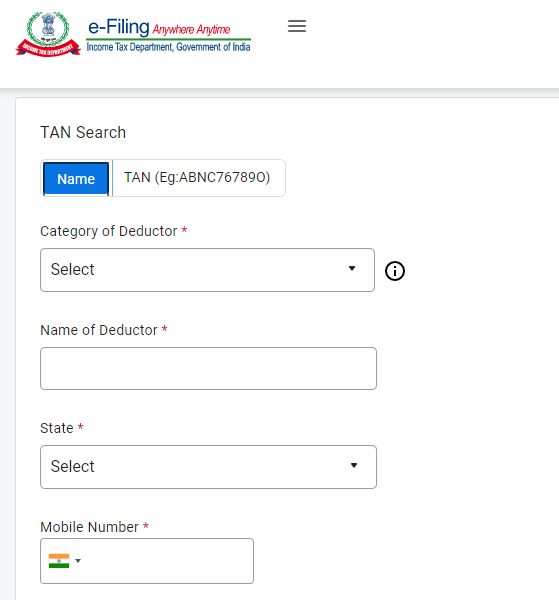

Step 3: You will be redirected to the TAN page with an application form. Choose whether you want to search by name or number.

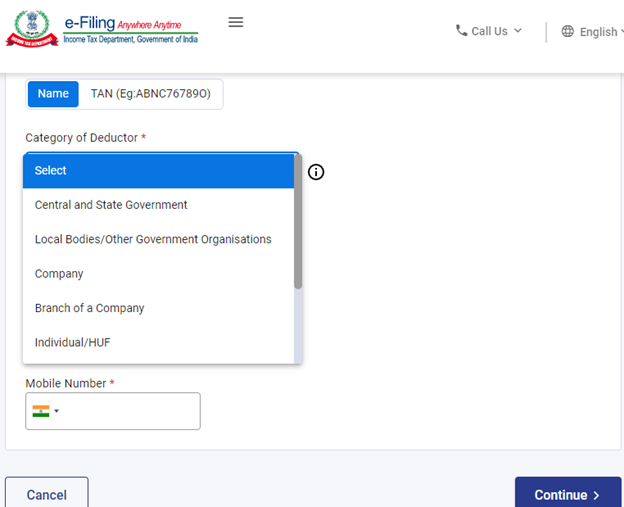

Step 4: Click on ‘Category of Deductor’ from the following drop-down list:

- Central and State Government

- Local Bodies/Other Government Organisations

- Company

- Branch of a Company

- Individual/HUF

- Branch of Individual (sole proprietorship concern)/ HUF

- Firm/AOP/AOP(T)/BOI/Artificial Juridical Person

- Branch of Firm/AOP/AOP(T)/BOI/Artificial Juridical Person

Step 5: Provide the name of the deductor.

Step 6: Select the ‘State’ from the drop-down menu.

Step 7: Enter your mobile number and click on the ‘Continue’ button.

The page will display the TAN details.

Steps for TAN Verification by Name

The Department of Income Tax has made the process of TAN verification easy. Follow the below-mentioned steps:

Step 1: Visit the official portal of the Income Tax Department.

Step 2: Log in to the portal with the user ID which could be your PAN, Aadhaar or other user ID and password.

Step 3: Go to the ‘Quick Links’ section and click on the ‘Know TAN Details’ link.

Step 4: You will be directed to a new page where you have to select the ‘Category of Deductor’ and ‘State’ from the dropdown menu (if applicable).

Step 5: Since you want to search through name, enter your ‘Name’ and applicable mobile number in the required fields.

Step 6: Click on the ‘Continue’ button to obtain an OTP on the entered mobile number.

Step 7: Enter the OTP in the required field and click on the ‘Validate’ button.

Step 8: The page will display your TAN details.

How to Verify TAN by Number?

If you remember your TAN number, you can approach the TAN verification process by following the steps below:

Step 1: Log in to the official e-filing portal of the Income Tax Department at

Step 2: Navigate to the ‘Quick Links’ section and tap on the ‘Know TAN Details’ option.

Step 3: A new webpage will open. Select the TAN search option whether you want to search by name or number. Click on the TAN number.

Step 4: Now, select the applicable ‘Category of Deductor’ from the drop-down menu.

Step 5: Furnish the name of the Deductor, select the ‘State’ from the drop-down menu, and enter the mobile number in the required fields.

Step 6: Once you have filled up all the mandatory fields, click on the ‘Continue’ button.

Step 7: The system will send you an OTP on your registered mobile number. Enter it and click on the ‘Validate’ button.

Step 8: The website will present your TAN details.

Note: A deductor can only possess one Tax Deduction or Collection Account number for one category. It is illegal to have more than one TAN. It is crucial to obtain TAN registration online for TAN number verification. The registration process is pretty easy.

Structure of TAN

Each character in the TAN number defines different aspects. As abovementioned, it’s an alphanumeric number, wherein the first four digits are alphabets, the next five are numerics, and the last one is again an alphabet.

The first three alphabets of TAN symbolise the code of jurisdiction; the fourth alphabet defines the name of the TAN holder with the initial letter of the name. TAN holders can be firms, companies, individuals, etc.

The last alphabet of TAN is a random character. For example, the TAN number issued to Mr Akshat from Agra may look like AGR A 78945 S.

As per the provisions of Section 203A of the Income Tax Act, 1961, it is obligatory to quote the TAN for every tax deductor in all the below-mentioned documents.

- TDS Statements

- TCS Statements

- TDS/TCS Certificates

- TDS/TCS Payment Challan

- Annual Information Return

- Other prescribed documents

If the tax deductor doesn’t mention the TAN, the bank will not accept the payments of TCS/TDS. Also, there will not be any refund of TDS if the TAN is not quoted.

Under the provision of Section 203A of the IT Act, the entity deducting or collecting tax at source has to apply for the allotment of Tax Deduction or Collection Number. In case of any non-compliance with the rules specified as per the Section or if the person fails to apply for TAN, he will be liable to pay a fine of ₹ 10,000.

Why is TAN Important?

The primary purpose of TAN is related to the collection or deduction of tax at source. Under 203A of the Income Tax Act, it is obligatory for businesses or individuals to obtain TAN to collect or deduct tax.

FAQ's About TAN Verification

How do you verify a TAN?

You can verify a TAN using your name or 10-digit TAN number through the e-filing website of the Income Tax Department.

Can I deduct TDS without TAN?

No, you cannot deduct TDS without TAN. Under Section 203A of the Income Tax Act, 1961, it’s important to mention TAN on all the statements.

Is it possible to identify the person’s TAN who deducted TDS from my payment?

Yes, you can easily check the TAN of anyone who deducted the TDS from your payment. All you need is their complete name or TAN. It is recommended to check the TDS deductions from your payment to make sure it was legally and rightfully done.

How much fee do we have to pay for the TAN application?

The fee for a TAN application is ₹ 65 (₹ 55.00 application charge + 18.00% GST).

How can I get a TAN?

You can get a TAN by simply filing an application for allotment in Form 49B in duplicate and submitted to any TIN-FC.

Can PAN be used as an alternative to TAN?

A person filing a tax deduction under Section 194-IA or Section 194-IB or Section 194M can use PAN as an alternative to TAN as such a person doesn’t need to obtain TAN.

How do I find an employer's TAN?

The TAN number of an employer can be found on Form 16, 16A or Form 26AS.

Can we search TAN number with the PAN number?

If your PAN is linked to a TAN number, you can search TAN number with PAN.

Is TAN mandatory for all companies?

Yes, every company must have a TAN number.

Can I download the TAN certificate?

Yes, you can download the TAN certificate by simply visiting the income tax department website and searching for your TAN using your name or TAN number.