Aadhaar Card Pan Card Link Process

- Personalized solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Interest rate comparison

Table of Content

According to the latest announcement by the Central Government, it is now compulsory to link your PAN card to your Aadhaar card. This is mandatory as this will help you to process your income tax returns with utmost ease. The Aadhaar Card Pan Card Link Process also needs to be completed if you are carrying out transactions of Rs. 50,000 or above. This process can be completed online as well as various different methods. The process is actually quite simple. In this piece, we will take a look at the importance of linking PAN to Aadhaar, and the various different ways you can do so.

Your PAN card with Aadhaar card link is a very straightforward process. We’ll look at some of the procedures on how to link PAN with Aadhar card.

Ways to Link PAN Card With Aadhaar Card

Given below are the two different ways you can link your PAN card to Aadhaar card:

- Online through Income Tax e-Filing website

- SMS

Linking PAN with Aadhaar Online, Quickly

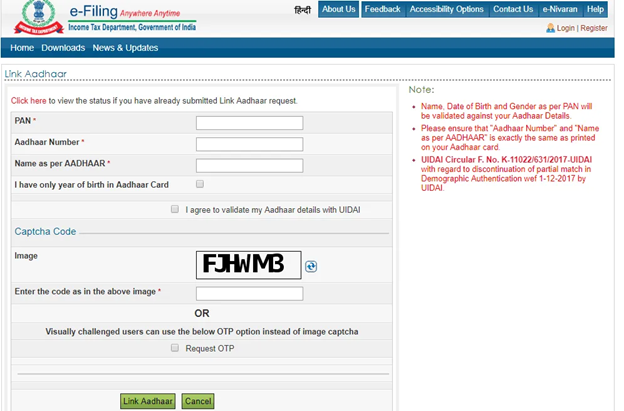

Given below is the step-by-step process to link your Aadhaar card to PAN card via the income tax filing portal:

Step 1: Visit the official Income Tax portal.

Step 2: Click on the ‘Aadhaar card’ under the ‘Quick Links’ tab on the homepage. Enter your PAN number, Aadhaar number, and name as it is recorded in the Aadhaar database.

Step 3: Further enter details like PAN number, name in Aadhaar, Aadhaar number, and registered mobile number. Check the square if only the year of birth is mentioned on your Aadhaar card. Click on the boxes to agree to get your Aadhaar details validated.

Step 4: Verify the Captcha code.

Step 5: Click on the ‘Link Aadhaar’ button.

Link PAN with Aadhaar Via SMS

Given below are the steps to link your PAN card with Aadhaar card:

Step 1: Type UIDPAN 12-digit Aadhaar 10-digit PAN on your SMS application.

Step 2: Send the same to 56161 or 567678.

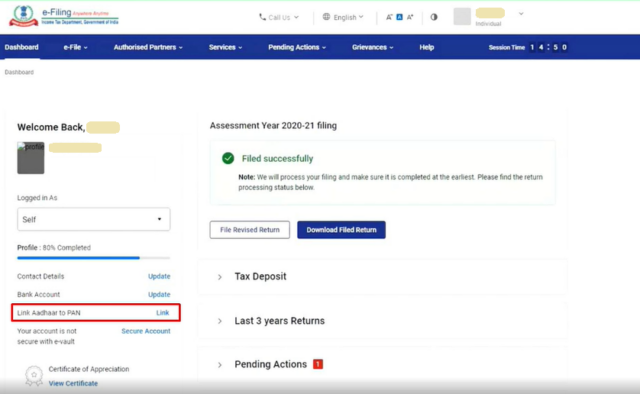

PAN with Aadhar Link Through Website (Logging In)

The procedure to be followed once you log in is:

Step 1: Register at the income tax e-filing portal.

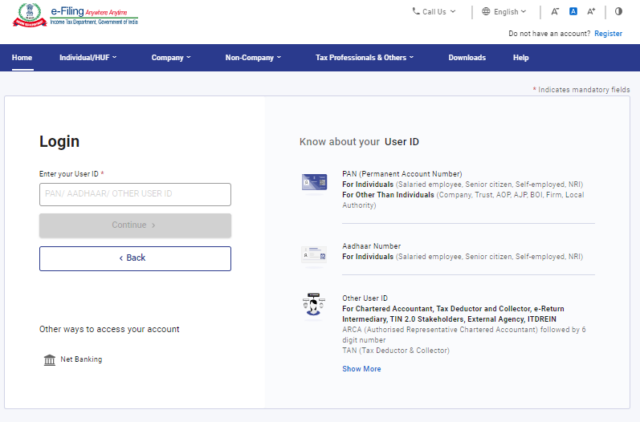

Step 2: Enter the user ID to access the income tax department’s e-filing system.

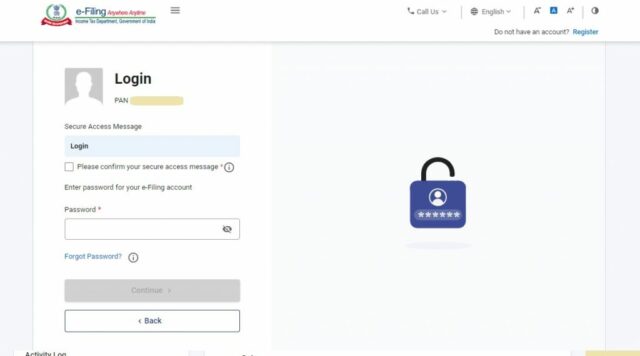

Step 3: Enter your password and confirm your safe access message. And to continue, click

‘Continue.’

Step 4: Click ‘Link Aadhaar’ after logging in to the website. Alternately, you can access ‘My Profile’ and choose ‘Link Aadhaar’ from the ‘Personal Details’ menu.

Step 5: Name, date of birth, and gender must be entered exactly as specified in the PAN card. Compare the information displayed on the screen to the information on your Aadhaar card.

Step 6:Select ‘Link Aadhaar’ from the menu.

Step 7: You will see a pop-up notification confirming the successful linking of your PAN card and Aadhaar number.

Process to Link PAN Card with Aadhaar with Penalty

Given below is the step-by-step process to link your PAN card with Aadhaar with a penalty:

Step 1: Visit the official Income Tax Portal.

Step 2: Click on the ‘Link Aadhaar’ option under the ‘Quick Links’ tab.

Step 3: On the resulting page, enter your name, phone number, Aadhaar number, and PAN details

Step 4: Click on the ‘I validate my Aadhaar Details’ button.

Step 5: Click on the ‘Continue’ button.

Step 6: This will trigger an OTP being sent to your registered phone number. Input the OTP and click on the ‘Validate’ button.

Step 7: Once the penalty payment has been made, the Aadhaar Card Pan Card Link Process will be completed.

How to Link PAN with Aadhaar Card Offline

To link PAN with Aadhaar Offline, follow the below steps:

Step 1: Visit the nearest PAN service centres of NSDL and UTITSL.

Step 2: Carry your PAN and Aadhaar cards.

Step 3: Fill out the ‘Annexure-I’ form and attach the supporting documents, such as a copy of your PAN card and an Aadhaar card.

Step 4: After-verification, your Aadhaar will be linked to the PAN.

Note: Offline Aadhaar Pan linking It is not FREE . Such designated PAN Service Centres will charge you some nominal charges.

PAN-Aadhaar Linking Deadline

The final date to complete the Aadhaar card and PAN card link process has been extended to 31 March 2023, the previous date was 31 March 2022. Please note that individuals who have not registered their PAN by March 2022 will have to pay a small penalty. If the PAN and Aadhaar card are linked between 1 April 2022 to 30 June 2022, the penalty amount will be Rs. 500. If the linking process was completed after 1 July 2022, the penalty will be Rs. 1,000.

How to Check the Status of Aadhaar Card Link with PAN Card

Given below are the steps to check the status of your Aadhaar Card link to PAN card:

Step 1: Visit the official website of the Income tax Department.

Step 2: Click on the ‘Link Aadhaar Status’ option under the ‘Quick Links’ tab.

Step 3: Enter your Aadhaar number and PAN card number and then click on the ‘View Link Aadhaar Status’ button. You will now be able to view the status of your Aadhaar card and PAN card link.

You can also check the linking status via the SMS service as well. Just send an SMS to 56161 or 5676

UIDPAN < 12-digit Aadhaar number> < 10-digit Permanent Account Number>

If the Aadhaar and PAN linking process is successful, the message ‘Aadhaar (Aadhaar number) is already associated with PAN..in ITD database. Thank you for using our services’ will be displayed.

Importance of Linking PAN Card with Aadhaar

Both Aadhaar Card Pan Card Link can serve as unique identification proofs that are mandatory for various verification and registration purposes. Given below are some of the other reasons it is imperative to link both the cards:

Curb Tax Evasion

By ensuring that all cardholders link their PAN card to their Aadhaar card, the government can easily tax all the taxable transactions of individuals or entities. The address and identity of the taxpayer is validated by the Aadhaar card. This implies that every single taxable transaction can now be recorded by the government. This will effectively help abolish the problem of tax evasion.

Multiple PAN Cards

Another main importance of Aadhaar Card Pan Card Link is that it will lower the occurrence of duplicate PAN card applications in a bid to cheat the government and evade taxes. By having multiple PAN cards, a taxpayer can use one card for a certain type of transactions and deposit applicable taxes for the same. On the other hand, the other PAN card can be used for transactions that need to be hidden, and thus can avoid paying taxes on the same.

By linking the PAN card and Aadhaar card, the government is enabled to verify the identity, and therefore have details of the transactions made through the PAN card. The government will be able to efficiently identify such discrepancies, and take corrective action.

Benefits of Linking your PAN with Aadhaar

Given below are some of the benefits of linking your PAN card with Aadhaar card:

- It eliminates the possibility of an individual having multiple PAN cards

- It enables the Income Tax Department to to combat any form of tax evasion

- The process of filing income tax returns becomes immeasurably easier as the taxpayer is not required to submit any proof

- Linking the Aadhaar card to the PAN card prevents the cancellation of the latter

- This linking provides summarised details of the individual’s taxes linked to the Aashaar for future use

What to do if PAN Card and Aadhaar Card Link has Failed?

In certain scenarios you might not be able to link a PAN card to an Aadhaar card. Majority of the times, the reason for this can be a mismatch of the details as recorded in the Aadhaar and PAN card database. Once the corrections have been made successfully, you will be able to complete the linking process.

Process to Link Aadhaar Card and PAN Card in Case of Name Mismatch

In order to link a PAN card to an Aadhaar card, it is imperative that the name mentioned in both the documents are the same. The below mentioned procedure can be followed to link the cards in case of name mismatch:

Complete Name Mismatch

If there is a complete mismatch in the name mentioned on the PAN card and Aadhaar card, you will need to make the appropriate corrections on the PAN or Aadhaar database.

Partial Name Mismatch

If there is only a partial mismatch in the name mentioned on the Aadhaar card and PAN card, it can be resolved in the below mentioned way:

- If the name mismatch is minute, the OTP will be sent to the user who has the same name registered on the Aadhaar database

- This OTP can be utilised for verification in case of name mismatch

- However, it is important to make sure that the gender and date of birth details are the same on both the databases

What Happens if You do not Link Aadhaar and PAN?

In case you missed the deadline for linking your PAN card with Aadhaar, you will be required to submit a signed seed form at the nearest PAN centre. You should also carry all the required supporting documents. The physical Aadhaar to PAN seeding is a chargeable service.

FAQ's About Aadhaar PAN Card Link

While trying for PAN-Aadhar linking, I get a message that the authentication has failed?

How do I link PAN and Aadhaar if a name or date of birth mismatch exists?

Can I file my ITR if my PAN and Aadhaar are not linked?

Does a Non-Resident Indian (NRI) need to link PAN and Aadhaar?

Section 139 AA of the Income Tax Act makes it mandatory to link PAN with Aadhaar.

Do I have to submit any documentary proof to link my PAN and Aadhaar Card?

No, you do not submit any documentary proof to link your PAN and Aadhaar Card.

What details do I have to check when linking my PAN with my Aadhaar card?

You must scan through the details mentioned in your PAN card and match them with the details mentioned in your Aadhaar card.

My name is different on a PAN Card and Aadhaar and it is not allowing me to link both. What to do?

If there is a difference between your name on the PAN card and your Aadhaar card, then you will be prompted to change the name on either one before linking them.

Do I need to link Aadhaar to PAN even if I don’t fall in any tax bracket?

Yes, it is ideal that you apply for an Aadhaar card and link it to your PAN card. This is now mandatory to avail a majority of government benefits.

Do NRIs residing in India have to link their PAN as well?

No, the requirement to quote Aadhaar whilst filing tax returns does not apply to NRIs.