- Home

- Pan Card

PAN Card : Overview, Eligibility and How to Apply PAN Card Online

- Personalized solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Interest rate comparison

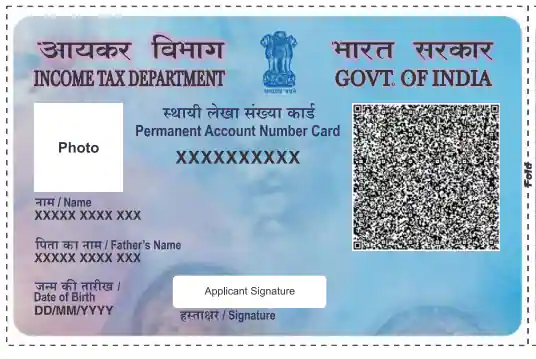

The Permanent Account Number (PAN) is among the essential identification documents in the Republic of India. A Pan card consists of a unique 10-digit identification number given to Indian citizens, primarily those who pay taxes. However, there are times when the information printed on the PAN card is inaccurate or untrue. In such cases, candidates can use the UTIITSL portal to request a modification or correction to their PAN card. This blog explores different facets of applying for an NSDL PAN card, Eligibility and getting a duplicate pan card.

What is a PAN Card?

The Income Tax Act of 1961 requires issuing a PAN card consisting of 10-digit unique letters and numbers. A virtual machine generates this code unique to the card’s owner and valid for the rest of the owner’s life.

| Name Of Authority Issuing PAN | Indian Income Tax Department, Gov of India. (Under CBDT) |

| Document Type | Identity |

| Valid In | India |

| Introduce Year | 1972 |

| Validity Of PAN Card | Lifetime |

| Who can Apply | Individuals, Companies, or anyone who pays taxes in India. |

| Cost Of Pan Card | ₹93 +GST of 18% Indian Residence

| ₹857 + 18.00% GST Foreign Residence |

| Number Of Pan card Holders in India | 37 Crore (Near About) |

| PAN Customer Care Number | 020 – 27218080 |

| Sample of Pan Card (New) |  |

History of PAN Card in India

The Pan card was first introduced in India in 1972. Previously, the income tax applicant received a General Index Register or GIR number. Initially, the PAN card series was known as the old series of 1972, but in 1976 it became official. Back then, the PAN digits were mechanically assigned, though. After researching the identifying series of numbers in different countries, including the United States and the United Kingdom, the latest PAN card series (10 digits) was introduced in 1995.

What are the Eligibility Criteria for PAN Card?

The following taxpaying individuals and organisations which come under the umbrella of income tax are expected to have a PAN (Permanent Account Number) under segment 139A of the Income Tax Act:

- Anyone who pays or is likely to pay stamp duty to the Income Tax Department. The tax slabs would determine the tax paying.

- Any individual who indulges in professional business practice and generates an annual turnover of more than INR 5 lakh in any evaluation period.

- NRI’s are required to pay a tax under the Income Tax Act. Moreover, other applicable Partnerships under law , charitable foundations, and affiliations are also required to pay tax.

Note: Youths, individual people, HUFs, alliances, corporations, authorities of folks, trusts, and others must apply for PAN.

What are the types of PAN Card?

Both individuals and organisations can obtain a PAN Card in India. All PAN card allotment requests and applications are done through from 49. Interestingly, there are different types of PAN cards based on the type of taxpayer, individual, organisation and foreign entities. Some of the wide variety of PAN cards available in India are as follows:

- Individuals PAN Card: The most popular type of NSDL PAN card issued to participants. This card is obtained by filling and submitting Form 49A, which is available on the NSDL and UTIITSL sites. Individuals, including all Indian residents like minors and students, are eligible to apply for a PAN card under this category.

- Non-Resident User of India: NRIs and PIOs can get a PAN card for tax purposes in India. Similar to residents of India, NRIs are also required to apply for PAN card by submitting Form 49A.

- International Entities: Enterprises or global corporations enrolled outside India but paying tax in India due to business functions conducted in India can also obtain a PAN card. Moreover, being part of the PAN card registration process, they would need to submit the final Form 49AA.

- Overseas Citizen of India (OCI) and Non-Resident External (NRE): PAN cards can also be obtained by Overseas Citizens of India and Non-Resident Companies. Individuals under this category, too, are required to submit Form 49AA while applying for PAN card.

- Indian Industries: Organisations and major corporations enrolled and operating in India must apply for a PAN card for taxes and financial purposes.

How to Apply for a PAN Card?

The following are the steps which will guide you through your Pan card application online.

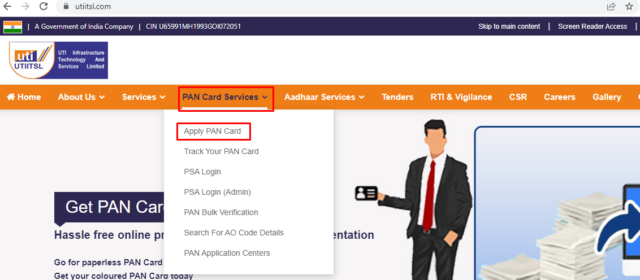

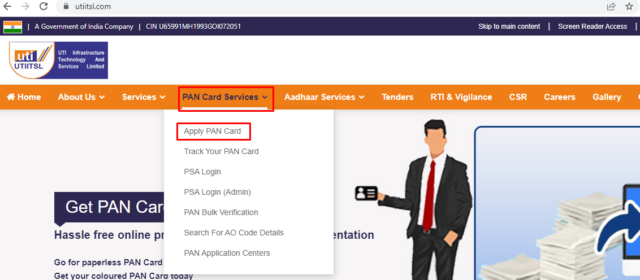

Step 1: Visit the official UTIITSL website.

Step 2: Go to the ‘PAN Card Services’ category. Choose the ‘Apply PAN Card’ option.

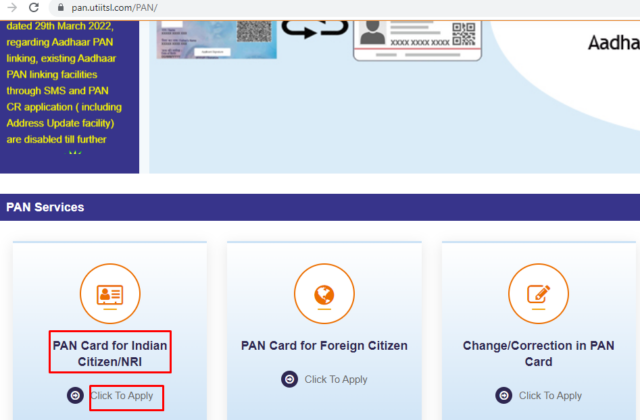

Step 3: Select the ‘ PAN Card for Indian Citizen’ and ‘Click to Apply’ option.

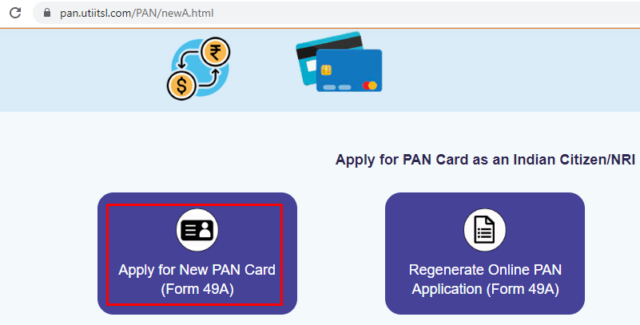

Step 4: On the new page that appears, choose the option ‘Apply for New PAN card(Form 49A)’.

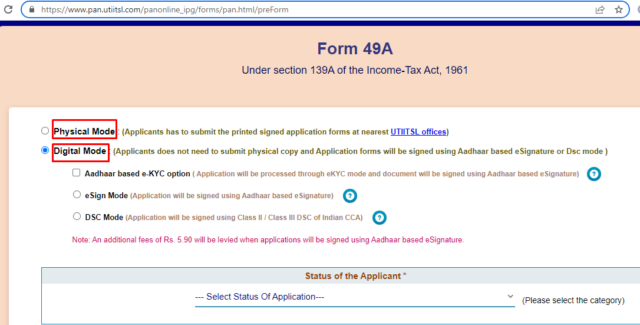

Step 5: You will be redirected to a new page consisting of Form 49A, with two available modes for submitting the form:‘ Physical Mode’ and ‘Digital Mode’. As per your convenience, select the option, fill out the details and submit it.

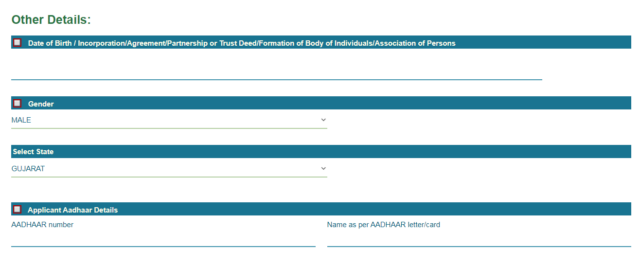

Step 6: Fill out the details under the “Personal Details” category and select the “Next” option.

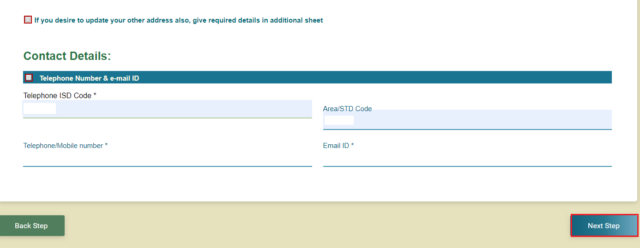

Step 7: Enter the required information like email address and phone number under the ‘Contact Details’ category and select the ‘Next’ option.

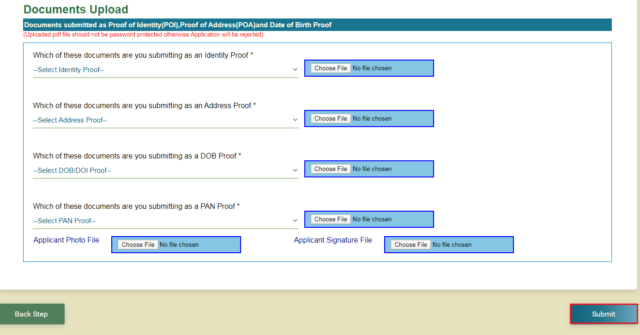

Step 8: Scan and upload your required documents. Choose the ‘Submit’ option and make the payment.

Note: In Physical mode, once your documents are verified, a copy of your PAN card will be sent to your registered address. In Digital mode, you can check your PAN card status by visiting the official NSDL website by entering a 15-digit acknowledgement number.

Documents Required for PAN Card

It is essential to fill out all the application details correctly to avoid any problems with the PAN card form. The same goes for submitting vital documents based on the type of taxpaying entity. Some of the documents required to apply for a PAN card are:

| Taxpaying Entity | Documents Required |

| Applicant | Identity of Proof, Identity of Address |

| Organisations | Certificate of Registration granted by the Companies Registrar |

| Association of Persons(AOP) | Certificate of Registration Number/ Copies of Agreement issued by Charity Commissioner or Co-operative Society Registrar |

| Limited Liability Partnership(LLP) | Registration Certificate granted by the Companies Registrar, Partnership fellow. |

| Trusts | Registration Certificate Number granted by Charity Commissioner. |

| Hindu Undivided Family(HUF) | An affidavit stating details of all coparceners issued by the Karta. |

| Foreign residents | Proof of identity such as Overseas Citizen of India (OCI) Cardholder, Passport copy, proof of address, etc. |

➡️ Read more about How to Check your CIBIL Score using your PAN Card?

PAN Card Enquiry: How Track, Check Status of PAN Card Online

- Check PAN Card Status: After applying for a PAN card, applicants can monitor their application status online by visiting the NSDL website. It also allows users to track their PAN card status and whether it has been issued or is presently in transit. The online PAN card status can also be determined by entering the applicants name and date of birth on the website.

- Correction to a PAN Card: Users can apply for updates to their existing PAN card online. Applicants must visit the Tax Information Network (TIN) network of NSDL, navigate to the “Changes or Correction in PAN Data” section, fill in the required details and submit the form. After form submission, users must also submit some required documents for reference and verification and pay the Correction fee.

- Duplicate PAN Card: For a lost NSDL PAN card, the candidate can apply for a duplicate PAN card by submitting the relevant form and paying the applicable service charges online or offline.

What happens if you lost your PAN Card? Here’s What You Can Do.

In case you have lost your PAN card, you can apply for a duplicate PAN card online and offline. The detailed process of applying for a duplicate PAN Card is:

Via Online

Some of the following steps are mentioned below for the PAN Card online procedure.

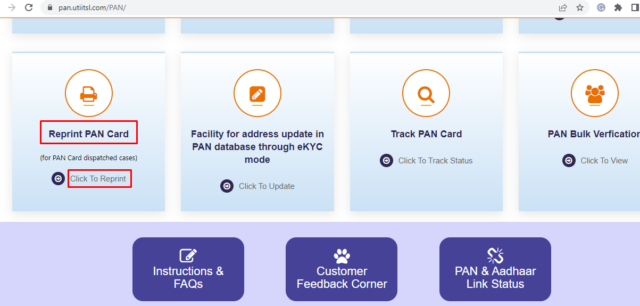

Step 1: Visit the official UTIITSL website.

Step 2: Under the ‘Reprint PAN card’ category, choose the ‘Click To Reprint’ option.

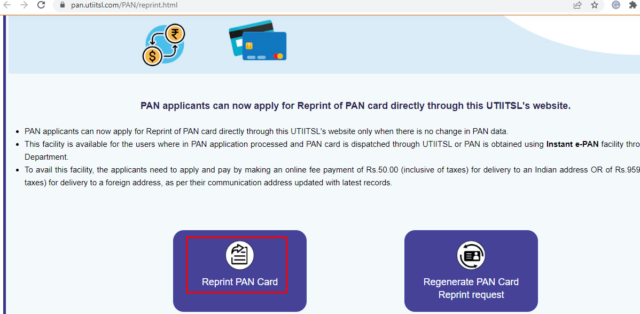

Step 3: A new page will appear; select the ‘Reprint PAN Card’ option.

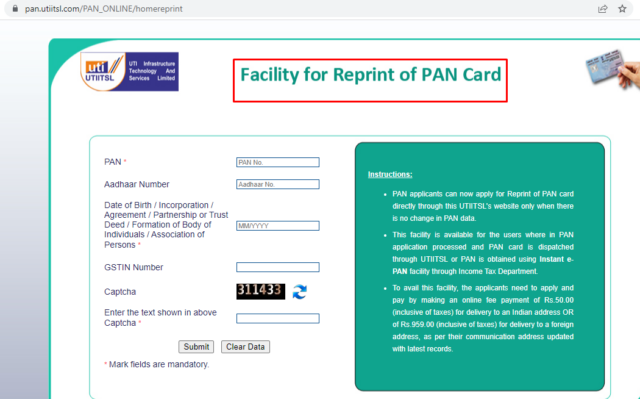

Step 4: Fill out the form for ‘Reprint the PAN Card’ by entering the details like PAN card number, Aadhaar card number, DOB, phone number, and captcha and then submit it.

Via Offline

Some of the steps are as follows for the PAN Card offline procedure.

Step 1: If one’s PAN card is lost or stolen, they should immediately file a complaint with the nearest police station and obtain an affirmation or allegation replica of the FIR. Making a police complaint and obtaining a duplicate of the FIR will help ensure that your PAN Card is not used dishonestly by anybody. This will protect you from being identified as a perpetrator.

Step 2: The applicant must visit the Protean eGov Technologies Limited; TIN Facilitation Centre and fill out form 49A. To submit the application form, the applicant must bring a letter of request to be acknowledged by the IT Branch, one photocopy of the passport-size coloured photo, proof of identity, proof of address, and a duplicate copy of the FIR.

Step 3: After filling out the application form, the applicant must attach a DD or Cheque for the payment, including the required documents.

Step 4: Submit the form to the PAN/Protean eGov Technologies Limited office. Moreover, the applicant should write ‘Application for PAN change request’ on the top of the cover. The applicant can also send the request complaint to the PAN head-office address by post at:

National Securities Depository Limited,

3rd Floor, Sapphire Chambers,

Near Baner Telephone Exchange, Baner,

Pune – 411045

What Information is Available on a PAN Card?

Here is a list of information available for an individual PAN Card in India.

- Name of cardholder

- Father’s name

- Date of birth

- 10-character PAN number

- Cardholder’s photo and signature

When it comes to a PAN card for business, there won’t be any photographs or a father’s name. Also, the date of birth is replaced with the date of company registration, while the cardholder’s name is replaced with the company name.

Unfortunately, on several occasions, cardholders find discrepancies in the information on their PAN card. The good news, however, is that the authorities offer provisions for correcting these details like a PAN card address change and a PAN card name change.

What do the Alphabet and Numbers on PAN Card Mean?

Your Permanent Account Number is not a random string of digits and characters. PAN’s layout is undoubtedly intriguing. Let’s see what each PAN Card in India element means:

First Three letters: This is an alphabetical sequence ranging from AAA to ZZZ.

Fourth letter: The fourth character represents the type of taxpaying entity, which comprises of:

A: Association of Persons (AOP)

B: Body of Individuals (BOI)

C: Company

F: Firm/Limited Liability Partnership

G: Agency of Government

H: HUF (Hindu Undivided Family)

L: Authority of Locals

J: Artificial Judicial Person

P: Individual

T: Trust

Fifth letter: The fifth character in the PAN card represents the first letter of your surname. For example, if a person is named ‘ABC XYZ’, the fifth letter of their PAN card will be ‘X’.

Sixth to the Ninth letter: This represents the sequence of numbers from 0001 to 9999.

Last letter: This is known as an alphabet checker character.

How to Correct PAN Card Information?

Here’s a brief list of steps that you should follow to correct/ update your NSDL PAN card information:

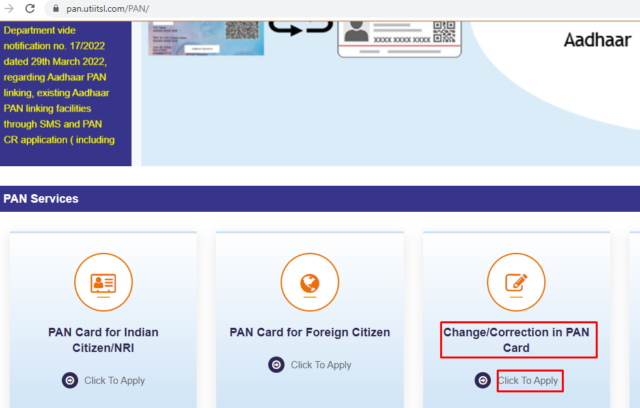

Step 1: Visit the official UTIITSL website.

Step 2: Go to the ‘PAN Card Services’ category. Choose the ‘Apply PAN Card’ option.

Step 3: Select the ‘Change/ Correction in PAN Card’ category and then the ‘Click To Apply’ option.

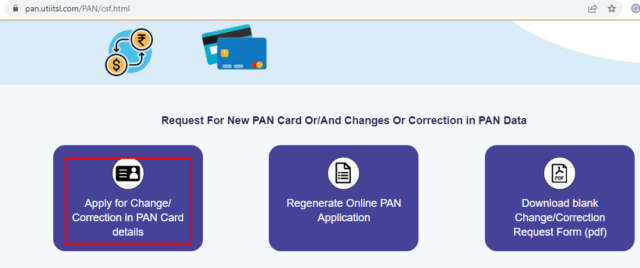

Step 4: You will be redirected to a new page where you must select the ‘Apply for Change/Correction in PAN Card details’ option.

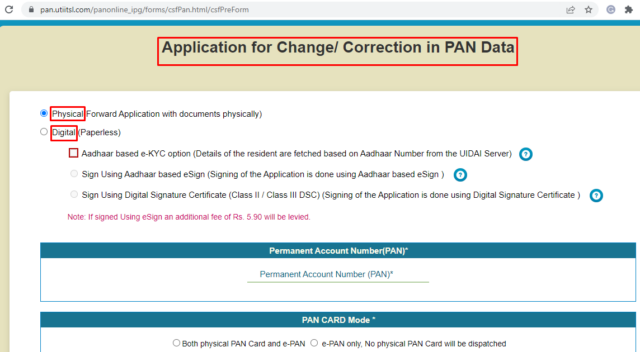

Step 5: You will again be redirected to a new page consisting of the Application for Change/ Correction in the PAN Data option. You will have to choose from two available modes for submitting the form: ‘Physical Mode’ and ‘Digital Mode’. As per your convenience, please select the option, fill out the details and submit it.

Step 6: Enter the information under the “Personal Details” category and select the “Next” option.

Step 7: Fill out the details such as email address and phone number under the ‘Contact Details’ category and select the ‘Next’ option.

Step 8: Scan and upload your required documents. Choose the ‘Submit’ option and make the payment.

How to Apply for a Duplicate Version if a PAN card is lost?

If you want to submit an offline application for a duplicate PAN Card form, you must do the following:

Step 1: Visit the nearest centre and collect the form ‘Request for New PAN Card or/and Changes or Corrections in PAN Data’.

Step 2: Fill out the form details such as 10-digits NSDL PAN Card number, DOB, Aadhaar card number and so on.

Step 3: Attach two recent size photographs with signatures across them.

Step 5: You must submit the form and all other appropriate documentation like identity verification and address proof to the Protean eGov Technology solutions Limited facilities that are available nearby.

Step 6: Next, verify the payment. Protean eGov Technologies Limited will evaluate your form and provide you with a 15-digit registration number.

Step 7: You can also check the status of the online application form using the 15-digit code number.

Step 8: The Income-tax PAN services unit will receive the proposal. If the data you provide is accurate, you should receive your updated PAN Card status or reissued PAN card within 14 – 20 days of applying.

What are the Benefits of a PAN Card?

Some of the benefits of a PAN card are given below:

- Filing tax Returns: Users and organisations (enterprises, general partnerships, HUFs, etc.) must include their PAN when filing a tax return. It is a legal necessity because participants and agencies, based on their income and tax slabs, are required to pay up to a flat income tax of 30% of their total earnings.

- Business Registration: Enterprises, cooperation companies, Hindu Undivided Communities, and other organisations seeking to register their businesses cannot do so unless they have a PAN card during registration.

- Financial Transactions: A variety of monetary operations are only possible if the person’s or investor’s PAN card is accessible. Popular transactions you won’t be able to do without a PAN card include selling or purchasing any property valued at Rs. 5 lakh or more. Moreover, the sale or purchase of any vehicle other than a two-wheeler, depositing any amount greater than Rs.50,000 in a bank and so on, also requires the PAN number of the seller/ purchaser or the account holder.

- Providing Utility Link: A PAN card is helpful in many situations where utilities such as a post-paid smartphone link, LPG correlation, electricity relation, wifi connection, and so on are needed. However, it’s always good to use a substitute ID proof, including a driver’s licence, voter ID card, and so on, if feasible.

- Opening a Savings Bank Account: Nowadays, banks have made it compulsory to carry out individual number identification when opening a savings account. Moreover, the Know Your Customer (KYC) rules are becoming quite stringent, incorporating several informational aspects of users, and the PAN card is one of the main aspects here.

PAN Card Application: Do’s and Don’ts

Despite knowing all the processes and steps regarding PAN card application, correction or duplicate PAN card application, there are certain necessary things note while venturing into PAN services. Some of the important Do’s and Dont’s of PAN card application are as follows:

Do’s

- By using Form 49A, you can make an application for PAN allocation.

- Fill out the application details in English capital blocks.

- Always upload recent photographs (size 3.5 cm X 2.5 cm). Make sure to sign within the box.

- If a left thumb impression is used on the application form, it must be affirmed by a Magistrate. For an official seal and stamp, visit a Notary Public or a Gazetted Officer.

- In the application, always enter the correct Area code.

- Enclose Proof of Identity (POI) and Proof of Address (POA) by Income Tax Rules, 1962, Rule 114 (4). The POA must include the address listed on the registration form.

- In the application form, provide the POI and POA names identically as they appear in the proposal.

- Fill out the application form with your complete postal address, landmark, phone number, and email address and include the correct ZIP code in the address field.

Don’ts

- Avoid making changes or overwriting text in the application form.

- The photograph should not be pinned or stapled; use fevicol or fevistick.

- Avoid signing all across the box (i.e. signature must be signed within the box).

- Don’t provide any POI and POA which are not assigned in the individual’s name.

- Do not include any additional information like date, designation and so on in your signature box.

- Avoid using abbreviating or using the full form in the application form.

- If you already have a PAN card, you do not have to ask for a new one until and unless you have lost it or want to change your current PAN card.

To Sum Up

The Indian government has made system and data centralisation much faster and easier. Attaching your bank accounts to PAN card via Aadhaar cards is one such instance that is available and actionable regardless of time or location. This protects your funds from any unpredictability and gives the government a broad range of awareness around your identity. This data centralization also helps people access many government programmes, schemes and benefits. If you haven’t yet linked your Pan card to your bank account, do so right away using the internet services listed above for secure, structured, and happy payments in the future.

Frequently Asked Questions (FAQs)

How can I check my PAN Card status?

Visit the official NSDL website. Select “Track Your PAN Card” in the PAN card services category. Enter the 10-digit PAN card number, Date of Birth and valid captcha.

Can I get a PAN Card online?

How can I apply for my PAN Card?

Go to the official NSDL website. Select the option ’Apply PAN card’ under the ‘PAN Card services’ category.

What happens if you don't have PAN Card?

Nowadays, in case you don’t have a PAN card, then you will not be entitled to taxation benefits. Moreover, you will not be able to get a loan from the bank and also miss out on online transaction perks.

To procure a PAN Card, can I write an application on plain paper?

No, an application on plain paper can not be made for PAN card. The application for a PAN card needs to be made a prescribed in Form No. 49A.

How should I fill out the PAN application form?

Go to the official website of the PAN card application; https://www[dot]tin-nsdl[dot]com/, and Fill out the details such as name, DOB, email address and phone number.

Is it necessary to furnish 2 photos for the application?

Yes, it is necessary to furnish two recent photos, if you are applying for a PAN card application.

Should I mention my email ID or telephone number on the form?

Yes, it is compulsory to mention your contact number or email id in the PAN card application form to receive information like the status of the PAN card.

Where should the PAN Card application form be submitted?

Two options are available to submit the PAN card application: physical mode and digital mode. Visit the official NSDL website, read out the details and choose as per your choice.

How can I change the photograph on my PAN Card?

Visit the official website of NSDL. Click on the ‘Changes or correction in existing PAN Data’ option under ‘Application Type'. Choose the ‘Individual’ option from the ‘Category’ menu. Now fill out the ‘Applicant Information’ and click on the ‘Submit’ button.