- Home

- Personal Loan

- Citibank Personal Loan Eligibility Calculator

Citibank Personal Loan Eligibility Calculator

- Personalized Personal Loan solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Personal Loan Interest rate comparison

The Citibank Personal Loan Eligibility Calculator is a financial planning tool that helps personal loan seekers check loan amounts they’re eligible for without visiting the bank’s branch. Citibank is amongst India’s leading private sector banks. The bank offers the full spectrum of financial services including personal loans.

Personal loans aim to cover the personal expenses of the borrower, ranging from home renovation to foreign education to wedding planning and much more. Citibank offers personal loans up to ₹30 lakh for a maximum of 5 years. Let us learn about the Citibank’s loan eligibility calculator in detail.

Citibank Personal Loan Eligibility Calculator – Key Features & Benefits

The highlighting features of the Citibank loan eligibility calculator are listed below:

- Increases Loan Eligibility: The bank’s calculator assists in increasing an individual’s loan eligibility by helping them submit reasonable loan requests. This significantly improves their chances of approval.

- Smarter Borrowing Decisions: Loan calculators allow experimenting with different interest rates and tenures until a borrower reaches the desirable loan terms.

- Computations in a Click: Eligibility checks can be conducted with a single click using this digital calculator. There is no need to physically visit the bank.

- Basic Requirements: The Citibank calculator needs no complicated details. Personal loan estimates can be gained using basic details regarding the candidate’s monthly income.

- Quick & Accurate Results: There are no delays in the calculator’s estimations. Moreover, digital calculations help gain near-accurate results in a jiffy.

How to use Citibank Personal Loan Eligibility Calculator?

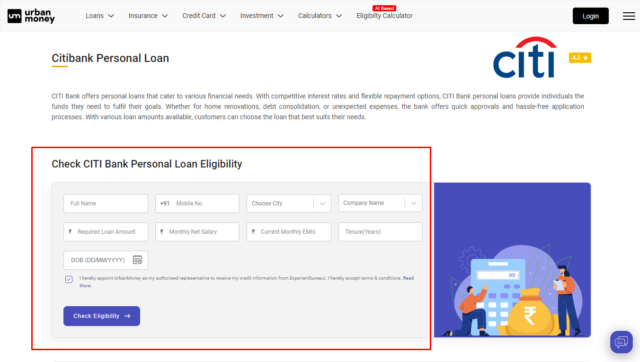

Urban Money provides easy access to the Citibank loan eligibility calculator. Follow the simple steps listed below:

- Visit www.urbanmoney.com.

- Select ‘Personal Loan’ from the ‘Loans’ category.

- Choose ‘Citibank’ from the list of Banks and NBFCs.

- You’ll be directed to the Citibank Personal Loan page.

- Fill in the fields and accept the calculator’s T&Cs.

- Click on ‘Check Eligibility’.

- Enter the OTP and get instant results.

The calculator also provides an interest rate and loan tenure on the eligible loan amount. Click on ‘Apply Now’ to go ahead with the loan or ‘View all offers’ to go through other loan offers.

Citibank Personal Loan Eligibility Criteria

Citibank loan eligibility calculator can be used to check eligibility for personal loans by the following candidates.

|

Particular |

Criterion |

|

Eligible Applicants |

Salaried/ Self-Employed Individuals |

|

Age |

21-60 years |

|

Work Experience |

1-2 years |

|

Minimum Salary |

₹15-20,000 per month |

|

Credit Score |

700 or more |

|

Residential Status |

Indian |

Factors affecting Citibank Personal Loan Eligibility Check

Citibank Personal Loan Eligibility Calculator takes several factors into consideration. These factors are:

- Age: An applicant’s age establishes their repayment potential. Citibank allows applicants from 21 to 60 years of age to apply for personal loans.

- Monthly Income: Personal loans do not require collateral submissions. Instead, loans are extended against an applicant’s income. Applicants fulfilling the monthly income requirements of the bank stand better chances of approval.

- Employment Type: Banks usually extend personal loans to salaried and self-employed individuals. All applicants, however, are required to have a work experience of 1-2 years.

- Credit Score: Citibank prefers candidates with high credit scores while approving personal loan applications. Candidates with low scores face difficulty in loan approvals.

- Residential Status: Personal loans are provided only to Indian residents by the bank.

Improve your Citibank Personal Loan Eligibility

There might also be loan seekers who are unable to clear the Citibank personal loan eligibility checks. Such borrowers can follow these tips and increase their loan eligibility over time.

- Maintain high credit scores by ensuring appropriate financial behaviour. The higher the scores, the better will be your chances.

- Use the Citibank personal loan eligibility calculator and apply for the right loan amount.

- Submit joint loan applications with your spouse or parent to increase your chances of approval.

- Maintain a low debt-to-income ratio. This allows you to showcase high repayment potential and gain faster loan approvals.

- Save more. Regular deposits are seen positively by lenders and are, thus, helpful in increasing personal loan eligibility.

Impact of Credit Score on Citibank Personal Loan Eligibility

Credit Score indicates an applicant’s financial history. The higher the scores, higher will be the chances of approval. An applicant with high credit scores reflects greater chances of repaying the loan. Thereby, minimising risk for the bank. Conversely, candidates with poor ratings make the bank hesitant to sanction the loan.

Credit scores between 700-750 are rated positively by lenders. Loan seekers with low scores can follow these steps and improve their ratings over time:

- Ensure timely repayments

- Pay off credit card bills

- Use different types of credit

- Stay updated with your credit reports

Frequently Asked Questions (FAQs)

How much salary is required for a Citibank personal loan?

A monthly salary ranging from ₹15,000-20,000 will be good enough to apply for a personal loan.

What is the minimum CIBIL Score requirement for a Citibank Personal Loan?

CIBIL score requirement varies for different applicants. Generally, a score of 700 or more is considered a good score.

Are Citibank personal loans available only to existing customers?

Existing as well as new customers can apply for Citibank personal loans.

Is income an important factor?

Yes. Since personal loans require no collateral, an applicant’s income becomes the guarantee for the lender.

What are some ways to increase Citibank's personal loan eligibility?

Personal loan eligibility can be improved by maintaining a high credit score and submitting a strong application.

Quick Links

Personal Loan by Private Bank

- RBL Bank Personal Loan

- DCB Bank Personal Loan

- karnataka bank Personal Loan

- Reliance Capital Personal Loan

- Federal Bank Personal Loan

- IDBI Bank Personal Loan

- karur Vysya Bank Personal Loan

- IDFC FIRST Bank Personal Loan

- YES Bank Personal Loan

- Kotak Bank Personal Loan

- ICICI Bank Personal Loan

- CITI Bank Personal Loan

- Deutsche Bank Personal Loan

- HDFC Bank Personal Loan

- HDFC Sales Personal Loan

- Axis Bank Personal Loan

- IndusInd Bank Personal Loan

- HSBC Personal Loan

Personal Loan by Nationalized Bank

Personal Loan by NBFC

- CASHe Personal Loan

- Prefr Personal Loan

- Tata Capital Financial Services LTD Personal Loan

- Ujjivan Small Finance Bank Personal Loan

- Edelweiss Financial Services Personal Loan

- PaySense Personal Loan

- MoneyWide Personal Loan

- Clix Capital Personal Loan

- Muthoot Finance Ltd Personal Loan

- InCred Financial Services Personal Loan

- IndiaBulls Personal Loan

- DHFL Personal Loan

- IIFL Finance Personal Loan

- FT Cash Personal Loan

- Shriram Urban Co Operative Bank Limited Personal Loan

- Fullerton India Personal Loan

- L&T Finance Personal Loan

- Bajaj Finserv Personal Loan

- Loantap Credit Products Private Limited Personal Loan

- AU Small Finance Bank Personal Loan

- Tata Capital Housing Finance Limited Personal Loan

- Capital First Ltd. Personal Loan

- Aditya Birla Finance Limited Personal Loan

- Poonawalla Fincorp Limited Personal Loan

- Privo Personal Loan

- Hero FinCorp Personal Loan

Personal Loan Calculators

Bank wise Personal Loan Calculators

- Punjab National Bank Personal Loan Calculator

- Indusind Bank Personal Loan Calculator

- Bank Of India Personal Loan Calculator

- Lic Housing Finance Personal Loan Calculator

- Punjab Sind Bank Personal Loan Calculator

- Indian Bank Personal Loan Calculator

- Hdfc Bank Personal Loan Calculator

- Bank Of Maharashtra Personal Loan Calculator

- Hsbc Personal Loan Calculator

- Citi Bank Personal Loan Calculator

- Canara Bank Personal Loan Calculator

- Axis Bank Personal Loan Calculator

- State Bank Of India Personal Loan Calculator

- Rbl Bank Personal Loan Calculator

- Karnataka Bank Personal Loan Calculator

- Federal Bank Personal Loan Calculator

- Deutsche Bank Personal Loan Calculator

- Union Bank Of India Personal Loan Calculator

- Yes Bank Personal Loan Calculator

- Dcb Bank Personal Loan Calculator

- Idfc First Bank Personal Loan Calculator

- Kotak Bank Personal Loan Calculator

- Idbi Bank Personal Loan Calculator

- Icici Bank Personal Loan Calculator

- Bank Of Baroda Personal Loan Calculator

Bank Wise Personal Loan Interest Rate

- RBL Bank Personal Loan Interest Rate

- DCB Bank Personal Loan Interest Rate

- karnataka bank Personal Loan Interest Rate

- Reliance Capital Personal Loan Interest Rate

- Federal Bank Personal Loan Interest Rate

- IDBI Bank Personal Loan Interest Rate

- karur Vysya Bank Personal Loan Interest Rate

- IDFC FIRST Bank Personal Loan Interest Rate

- YES Bank Personal Loan Interest Rate

- Kotak Bank Personal Loan Interest Rate

- ICICI Bank Personal Loan Interest Rate

- CITI Bank Personal Loan Interest Rate

- Deutsche Bank Personal Loan Interest Rate

- HDFC Bank Personal Loan Interest Rate

- HDFC Sales Personal Loan Interest Rate

- Axis Bank Personal Loan Interest Rate

- IndusInd Bank Personal Loan Interest Rate

- HSBC Personal Loan Interest Rate

- Union Bank of India Personal Loan Interest Rate

- Punjab & Sind Bank Personal Loan Interest Rate

- State Bank of India Personal Loan Interest Rate

- Indian bank Personal Loan Interest Rate

- Canara Bank Personal Loan Interest Rate

- Punjab National Bank Personal Loan Interest Rate

- Bank of Baroda Personal Loan Interest Rate

- Bank of India Personal Loan Interest Rate

- Bank of Maharashtra Personal Loan Interest Rate

- CASHe Personal Loan Interest Rate

- Prefr Personal Loan Interest Rate

- Tata Capital Financial Services LTD Personal Loan Interest Rate

- Ujjivan Small Finance Bank Personal Loan Interest Rate

- Edelweiss Financial Services Personal Loan Interest Rate

- PaySense Personal Loan Interest Rate

- MoneyWide Personal Loan Interest Rate

- Clix Capital Personal Loan Interest Rate

- Muthoot Finance Ltd Personal Loan Interest Rate

- InCred Financial Services Personal Loan Interest Rate

- IndiaBulls Personal Loan Interest Rate

- DHFL Personal Loan Interest Rate

- IIFL Finance Personal Loan Interest Rate

- FT Cash Personal Loan Interest Rate

- Shriram Urban Co Operative Bank Limited Personal Loan Interest Rate

- Fullerton India Personal Loan Interest Rate

- L&T Finance Personal Loan Interest Rate

- Bajaj Finserv Personal Loan Interest Rate

- Loantap Credit Products Private Limited Personal Loan Interest Rate

- AU Small Finance Bank Personal Loan Interest Rate

- Tata Capital Housing Finance Limited Personal Loan Interest Rate

- Capital First Ltd. Personal Loan Interest Rate

- Aditya Birla Finance Limited Personal Loan Interest Rate

- Poonawalla Fincorp Limited Personal Loan Interest Rate

- Privo Personal Loan Interest Rate

- Hero FinCorp Personal Loan Interest Rate