Bank of India Home Loan Eligibility Calculator

The BOI Home Loan Eligibility Calculator is an online tool designed to provide potential borrowers with an estimation of the loan amount they might be eligible for based on specific parameters. This helps streamline the loan application process by giving individuals a clearer understanding of their borrowing capacity before they apply. Read on to learn more about the BOI Home Loan eligibility calculator, features, benefits, and more.

- Personalized Home Loan solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Home Loan Interest rate comparison

Table of Content

Key Features and Benefits of Bank of India Home Loan Eligibility Calculator

Following are the features and benefits of the Bank of India home loan calculator. Let’s take a look!

- Any working individual aged between 21 to 60 can apply for a loan.

- The calculator is very easy to use and offers instant results; thus, the user doesn’t need to be a part of any documentation or verification process

- It helps the user take the right decision

- Both salaried and self-employed people can apply for a loan.

- For security, if the borrower wants, he or she can keep the mortgage on the property they are planning to purchase or construct.

- The loan to value ratio is 85%

- The time frame of a loan ranges from 5 to 30 years

- The interest rates for a home loan range anywhere between 6.95% to 7.15%

- The processing fee charged for Bank of India home loan is 0.25% of the total loan amount (with a maximum cap of INR 20,000)

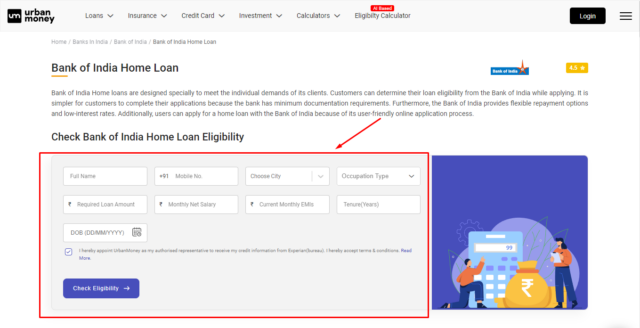

How to Use Bank of India Home Loan Eligibility Calculator?

It’s very easy to use Urban Money’s free BOI home loan eligibility calculator. All the user needs to do is follow the below given steps.

- Log on to www.urbanmoney.com

- Select ‘Home Loan’ from the ‘Loans’ category.

- Choose ‘Bank of India’ from the given list of loan providers.

- The portal will lead you to the ‘Bank of India Home Loan’ page.

- Enter the required information like Full Name, Mobile Number, City, Occupation types, required loan amount, monthly net salary etc and accept the T&Cs.

- Click on ‘Check Eligibility.’

- Enter the OTP sent to your phone and get instant eligibility results.

The Urban Money calculator offers the estimated loan amount a candidate is eligible for, along with the interest rate, EMI estimates, and loan tenure. Then, all the user needs to do is click on ‘Apply Now’ and proceed with the offer, or, if one wants to explore more, click on ‘View All Offers’.

Bank of India Home Loan Eligibility Criteria

A user can require a home loan for a variety of reasons. Anyone who ticks off the following criteria is eligible for a Bank of India Loan:

- Salaried Employees

- Self-Employed Individuals

- Pensioners

- Indian Bank staff and their spouses

- NRIs

- Existing Home Loan borrowers

Bank of India Home Loan Eligibility Based on Salary

A number of factors go into determining Bank of India home loan eligibility based on salary. The higher the monthly income, the higher the loan eligibility. For the amount of loan listed in the table below, the loan repayment time is assumed to be a total of 30 years, and the overall rate of interest is assumed to be 8.85% p.a.

| Monthly Income | Loan Amount |

| Rs.25,000 | Rs.15,26,114 |

| Rs.30,000 | Rs.20,60,253 |

| Rs.35,000 | Rs.24,03,629 |

| Rs.40,000 | Rs.27,47,004 |

| Rs.45,000 | Rs.30,90,380 |

| Rs.50,000 | Rs.34,33,756 |

| Rs.55,000 | Rs.41,96,812 |

| Rs.60,000 | Rs.45,78,341 |

| Rs.65,000 | Rs.49,59,869 |

| Rs.70,000 | Rs.53,41,398 |

| Rs.75,000 | Rs.57,22,926 |

Note: These figures are subject to change on the basis of other relevant factors, like the age of the applicant at the time of borrowing a loan.

Bank of India Home Loan Eligibility Criteria for Self-Employed Individuals

Here are the eligibility criteria for a home loan for self-employed individuals:

| Credit Score | Rate of Interest for Women Borrowers (p.a.) | Rate of Interest for Other Borrowers (p.a.) |

| 760 or more | 6.85% | 6.85% |

| 725 to 759 | 7.10% | 7.15% |

| 675 to 724 | 7.70% | 7.75% |

| No credit score | 7.10% | 7.15% |

Bank of India NRI Home Loan Eligibility Requirements for Non-Resident Indians

Following is the home loan eligibility requirement for NRIs.

- Age: The borrowers must be 18 years of age or older. The bank’s management usually requires them to repay their loans when they are 70 years old.

- Salaried & Self-employed: Both salaried and self-employed individuals/business owners can apply for a home loan.

- Credit Score: Loan applicants must have a credit score of 750 or more. The higher the score, the greater the possibility of being able to get an NRI home loan.

Bank of India Home Loan Eligibility for Women Applicants

The Bank of India’s home loan eligibility criteria for women are in line with those for other borrowers. However, in the case of women borrowers, they are eligible for a special rate of interest for the loan, which is 0.5% lower than the normal rate of interest that applies to other borrowers.

List of Factors Affecting Bank of India Home Loan Eligibility

Here is the list of factors that affect Bank of India Home Loan Eligibility:

- The age of the applicant

- The credit score

- Applicant’s repayment capability

- Credit history of the applicant

- Any existing debts or current obligations that may reduce the loan eligibility of a person

- The loan repayment history of the applicant

How Can You Improve Your Bank of India Home Loan Eligibility?

Following are some of the best ways to improve your overall home loan eligibility criteria:

- Add a co-applicant – Adding a family member who is earning well as your co-applicant and has an overall healthy credit score can help you increase your chances of getting a home loan.

- Maintain a credit score above 750 – A higher credit score indicates sound financial health. Thus, by maintaining a credit score of 750 or above, one can ensure that he or she becomes eligible for a home loan.

- Repay your debts religiously – Paying your debts on a regular basis can help you build a good credit score. This, in turn, will enhance your credit score. Plus, your savings and investments might help you increase your credit score.

- Open an account with your preferred lender – A good relationship with your lender will increase your chances of getting a home loan.

- Declare your additional income sources – With extra income sources, your eligibility for getting a home loan is automatically enhanced.

- Choose a longer repayment tenure – With a longer repayment tenure, your monthly EMI amount will naturally be lower. It means that you will be able to make timely payments. To the lender, it will look as if you are a low risk borrower, and thus, in the process, your eligibility to get loans will be enhanced.

Understanding Impact of Credit Score on Bank of India Home Loan Eligibility

In essence, the credit score represents the candidate’s financial mindset and behaviour. A good credit score helps you bag a better deal from your respective lender. The banks, along with other financial institutions, prefer giving out loans to individuals who have a credit score of at least 750 and above. With a score like this, one is able to better negotiate and get a good home loan deal. In some cases, the lender might also reduce the interest rate and reward you for having a good credit score.

Comparing Eligibility across Different Bank of India Home Loan Products

The Bank of India offers various home loan products catering to the different needs of individuals. It becomes essential to compare home loan eligibility criteria across these products to select the most suitable ones. Here’s a basic rundown of comparing eligibility across different Bank of India Home Loan products.

| Product/ Criteria | Residents | Individuals | Age | Non-Individuals |

| Bank of India Star Home Loan | Indians/NRIs are eligible | Salaried/Professionals/Self-employed | 18 – 70 years | Group/Association of Individuals, HUFs, and corporates are eligible |

| Star Diamond Home Loan | Indian/NRI/PIO are eligible | Salaried/Self-employed/Professionals | 18 – 70 years | Group/Association of Individuals, HUFs, and corporates are eligible |

| Star Smart Home Loan | Existing customers with an average balance of INR 5000 for the last 1 year or new customers who must have an opening balance of INR 5000 |

Only individuals who have had a Salary Account with BOI |

|

|

| Star Pravasi Home Loan | Both NRI/PIO are eligible | Indian Citizen(s) who are working in merchant navy and are having NRI status/

Indian citizens who are working abroad on an assignment with National/International government agencies |

18 – 70 years |

|

| Star Home Loan – Furnishing | Resident Indian/NRI/PIO are eligible | Salaried/Self-employed/Professionals are eligible | 18 – 70 years | Group/Association of Individuals, HUFs, and corporates are eligible |

| Star Top Up Loan | Resident Indian/NRI/PIO can apply for the loan |

Salaried/Self-employed/Professionals are eligible |

18-70 years of age | Group/Association of Individuals, HUFs, and corporates are eligible |

Wrapping Up

The Bank of India is one of the leading public banks in the Indian banking landscape and has been working to provide its citizens with a top-notch banking experience for over a century. And when it comes to home loans, one can explore a wide range of home loan products offered by the Bank of India as per one’s needs, and with the Bank of India Home loan eligibility calculator one can easily get to know about the loan amount they can apply for.

Home Loan Eligibility Calculators By Other Banks

People Also Asked

How can I check my Bank of India home loan eligibility?

You can use the Bank of India home loan eligibility calculator to check your eligibility. Also, you can visit the BOI website and check your eligibility there.

How much loan am I eligible to avail from the Bank of India?

Depending on various factors such as one’s income, profession, and age, the loan amount can vary.

How will I know if my eligibility criteria have been met for Bank of India home loans?

To know about your Bank of India Home Loan eligibility, you can check the details of the particular home loan product on the Bank of India website.

How can I increase my eligibility for a higher Bank of India home loan amount?

To increase your eligibility criteria, you can add a co-applicant, maintain a healthy credit score (a good credit score is 750), repay your debts religiously, and choose a longer tenure of work.

Quick Links

Home Loan by Private Bank

- Reliance Capital Home Loan

- DCB Bank Home Loan

- ICICI Bank Home Loan

- YES Bank Home Loan

- RBL Bank Home Loan

- Federal Bank Home Loan

- IDFC FIRST Bank Home Loan

- HDFC Bank Home Loan

- Axis Bank Home Loan

- Kotak Bank Home Loan

- Deutsche Bank Home Loan

- karur Vysya Bank Home Loan

- Housing Development Finance Corporation Home Loan

- IndusInd Bank Home Loan

- karnataka bank Home Loan

- LIC Housing Finance Home Loan

- HSBC Home Loan

- IDBI Bank Home Loan

- CITI Bank Home Loan

- HDFC Sales Home Loan

Home Loan by Nationalized Bank

Home Loan by NBFC

- Clix Capital Home Loan

- Hero Housing Finance Home Loan

- Hero FinCorp Home Loan

- Vastu Housing Finance Home Loan

- Aadhar housing Finance Home Loan

- DHFL Home Loan

- Muthoot Finance Ltd Home Loan

- Edelweiss Financial Services Home Loan

- Piramal Housing Finance Home Loan

- Fullerton India Home Loan

- Capri Global Home Loan

- Capital First Ltd. Home Loan

- Poonawalla Fincorp Limited Home Loan

- Cholamandalam Finance Home Loan

- IndiaBulls Home Loan

- Ujjivan Small Finance Bank Home Loan

- Tata Capital Housing Finance Limited Home Loan

- L&T Finance Home Loan

- Aditya Birla Finance Limited Home Loan

- Godrej Housing Finance Home Loan

- Punjab National Bank Housing Finance Home Loan

- IIFL Finance Home Loan

- Bajaj Finserv Home Loan

- Home First Finance Company Home Loan

Home Loan Calculators

Bank wise Home Loan Calculators

- Karur Vysya Bank Home Loan Calculator

- Piramal Housing Finance Home Loan Calculator

- Tata Capital Housing Finance Limited Home Loan Calculator

- Punjab National Bank Home Loan Calculator

- Indusind Bank Home Loan Calculator

- Bank Of India Home Loan Calculator

- Lic Housing Finance Home Loan Calculator

- Punjab Sind Bank Home Loan Calculator

- Indian Bank Home Loan Calculator

- Hdfc Bank Home Loan Calculator

- Bank Of Maharashtra Home Loan Calculator

- Hsbc Home Loan Calculator

- Citi Bank Home Loan Calculator

- Canara Bank Home Loan Calculator

- Axis Bank Home Loan Calculator

- State Bank Of India Home Loan Calculator

- Rbl Bank Home Loan Calculator

- Karnataka Bank Home Loan Calculator

- Federal Bank Home Loan Calculator

- Deutsche Bank Home Loan Calculator

- Union Bank Of India Home Loan Calculator

- Yes Bank Home Loan Calculator

- Dcb Bank Home Loan Calculator

- Idfc First Bank Home Loan Calculator

- Kotak Bank Home Loan Calculator

- Idbi Bank Home Loan Calculator

- Icici Bank Home Loan Calculator

- Bank Of Baroda Home Loan Calculator

Bank Wise Home Loan Interest Rate

- Reliance Capital Home Loan Interest Rate

- DCB Bank Home Loan Interest Rate

- ICICI Bank Home Loan Interest Rate

- YES Bank Home Loan Interest Rate

- RBL Bank Home Loan Interest Rate

- Federal Bank Home Loan Interest Rate

- IDFC FIRST Bank Home Loan Interest Rate

- HDFC Bank Home Loan Interest Rate

- Axis Bank Home Loan Interest Rate

- Kotak Bank Home Loan Interest Rate

- Deutsche Bank Home Loan Interest Rate

- karur Vysya Bank Home Loan Interest Rate

- Housing Development Finance Corporation Home Loan Interest Rate

- IndusInd Bank Home Loan Interest Rate

- karnataka bank Home Loan Interest Rate

- LIC Housing Finance Home Loan Interest Rate

- HSBC Home Loan Interest Rate

- IDBI Bank Home Loan Interest Rate

- CITI Bank Home Loan Interest Rate

- HDFC Sales Home Loan Interest Rate

- Punjab National Bank Home Loan Interest Rate

- Canara Bank Home Loan Interest Rate

- State Bank of India Home Loan Interest Rate

- Bank of India Home Loan Interest Rate

- Union Bank of India Home Loan Interest Rate

- Punjab & Sind Bank Home Loan Interest Rate

- Bank of Baroda Home Loan Interest Rate

- Indian bank Home Loan Interest Rate

- Bank of Maharashtra Home Loan Interest Rate

- Clix Capital Home Loan Interest Rate

- Hero Housing Finance Home Loan Interest Rate

- Hero FinCorp Home Loan Interest Rate

- Vastu Housing Finance Home Loan Interest Rate

- Aadhar housing Finance Home Loan Interest Rate

- DHFL Home Loan Interest Rate

- Muthoot Finance Ltd Home Loan Interest Rate

- Edelweiss Financial Services Home Loan Interest Rate

- Piramal Housing Finance Home Loan Interest Rate

- Fullerton India Home Loan Interest Rate

- Capri Global Home Loan Interest Rate

- Capital First Ltd. Home Loan Interest Rate

- Poonawalla Fincorp Limited Home Loan Interest Rate

- Cholamandalam Finance Home Loan Interest Rate

- IndiaBulls Home Loan Interest Rate

- Ujjivan Small Finance Bank Home Loan Interest Rate

- Tata Capital Housing Finance Limited Home Loan Interest Rate

- L&T Finance Home Loan Interest Rate

- Aditya Birla Finance Limited Home Loan Interest Rate

- Godrej Housing Finance Home Loan Interest Rate

- Punjab National Bank Housing Finance Home Loan Interest Rate

- IIFL Finance Home Loan Interest Rate

- Bajaj Finserv Home Loan Interest Rate

- Home First Finance Company Home Loan Interest Rate