- Home

- Income Tax

- Tds Online Payment

TDS Online Payment & Check Status

- Personalized solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Interest rate comparison

TDS online payment allows you to pay your taxes without any disruptions or documentation. It reduces all of the adverse effects associated with the offline mode of tax payment and saves a considerable lot of time and resources. All you require to pay taxes online are information, an available internet link, and your laptop or mobile phone.

Steps for Making TDS Payment Online

The procedure for TDS online payment is quite simple. Regardless, the method will be new to you if you haven’t filled out any regarding tax returns. Some steps are mentioned below for how to pay TDS online.

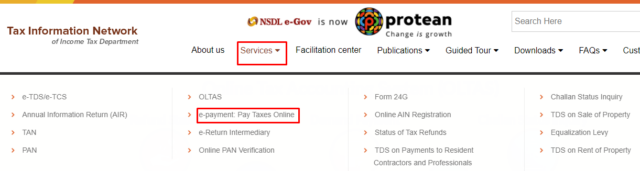

Step 1: Go to the official portal, www.protean-tinpan.com

Step 2: Select the ‘Service’ category and click on the ‘e-payment: Pay taxes online’.

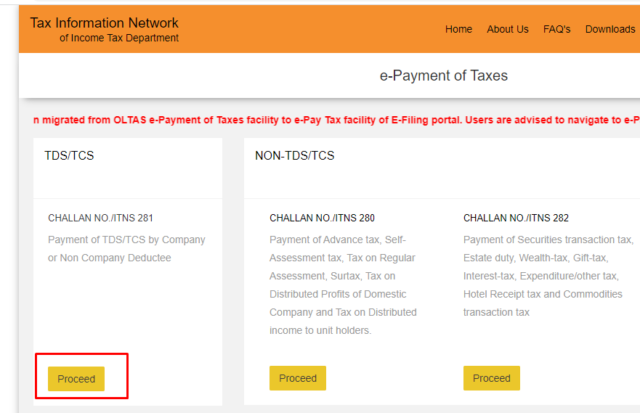

Step 3: Choose the ‘TDS/TCS’ option and ‘Proceed’ with it.

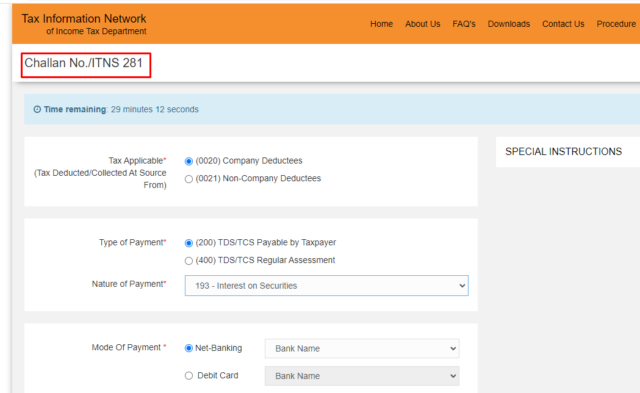

Step 4: You will be redirected to a new page, fill out the details and submit it.

Step 5: Once the application form is submitted, the TAN (Tax Collection Account Number) will get verified.

Step 6: After the successful verification, the applicant taxpayer’s name will be displayed on the screen.

Step 7: A user will be directed to the net banking gateway of the bank and can make the payment.

Steps for Making TDS Payment Offline

The following steps provide the procedure for TDS challan payment online in 2022.

Step 1: Download the “Challan 281” application form from the official portal of the Income Tax Department.

Step 2: Fill out the credentials such as full name, TAN number, address, etc.

Step 3: Submit the application form and the TDS challan payment to your proximity bank. After making the payment, don’t forget to collect the acknowledgement slip of the TDS challan payment.

What is the Due Date for TDS Online Payment?

The deadlines for the TDS challan payment online for government users and other applicants have been listed below:

- TDS payment deadline for government users: The TDS payment due dates for the government’s applicants are:

| Taxes Payment without challan | Deduction Days |

| Taxes Payment with challan | Following Month(7th) |

| Charges on tax benefits which the user cancels | Following Month(7th) |

- TDS payment deadline for all the user’s: The TDS payment due dates for all the applicant’s are:

| Deductible Taxes in March | Following year (April 30) |

| Deductible Taxes in the other months | Following month (7th) |

- Quarterly payment option: The Assessing Officer has permitted taxpayers to make TDS payments every quarter. However, this will only be accomplished with the Joint Commissioner’s permission. The following are the quarterly deposit deadlines:

| Ending Quarter | Dates |

| April 1 to June 30 | July 7 |

| July 1 to September 30 | October 7 |

| October 1st to December 31 | January 7 |

| January 1 to March 31 | April 30 |

Applicability of TDS Payment

- TDS payment is deductible only when the earnings are above the total limit. Otherwise, if the income is less than the limit, no TDS amount will be deducted.

- According to the Income Tax Department, various stages have been defined for payments like rate of interest, income, etc. For instance, if a person’s salary is less than ₹ 40,000, then no TDS will be deducted.

How Can You Check the Status of Online TDS Payments?

Refer to the following steps to check the status of the TDS online payment.

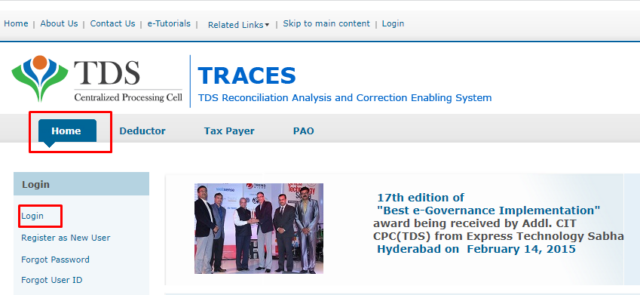

Step 1: Head over to the official website of TDS, www.tdscpc.gov.in/en/home.html

Step 2: Select the ‘Home’ category and click on the ‘Login’ option.

Step 3: Enter the credentials and submit it.

Step 4: Choose the financial year and return a type, quarter date, and year.

Step 5: Select the ‘Go’ option, and the current status of your TDS profile will be displayed on your screen.

What are the Advantages of Online TDS Payment

- TDS online payment is flexible, easy, and safe. It can be performed at any time and from anywhere.

- Online payment can easily be transferred from one bank to another.

- You can check the current status of the payments by visiting the official website of TDS.

- All the details of the e-Challan will be deposited to the ITR department. Where the bank doesn’t need any data to enter.

- You can also download the payment acknowledgement slip, which has been made to the income tax department.

Who Should Pay TDS?

TDS is a sub-part of the income tax department process. TDS online payment deduction varies from person-to-person earnings. For example, If a person’s salary is less than ₹ 40,000, then no TDS will be deducted.

Frequently Asked Questions (FAQs)

Can I view the TDS paid tax challans online?

You can view the TDS paid tax challans online by visiting the official website.

How can I get my TDS account number?

TDS Telecom customers will give a paper statement consisting of the billing address and account number. If a user doesn’t have a copy of the billing address, just call 800-605-1962.

How can I create a Nil TDS challan?

Log in to the Cleartds.com portal. Add on ‘New deductor’ or existing deductor. Further, select the Nil Challan and enter the credentials, such as the quarter's last date and submit the form.

What is the penalty for late TDS payments?

The penalty charge for late TDS payments is ₹ 200/day.