- Home

- Income Tax

- Income Tax Refund Status

How to Check Income Tax Refund Status Online For FY 2021-22 (AY 2022-23)

- Personalized solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Interest rate comparison

The Income Tax Department provides an online tool for monitoring the status of your refund. Ten days after their refund has been sent, taxpayers can check the status of their return. A taxpayer files an estimated amount of income tax on their ITR. The Income Tax Department then assesses the ITR and credits the income tax refund, if any. An income tax refund is an excess amount filed during e-filing income tax. The IT department allows taxpayers to track their income tax refund status through the e-filing and TIN-NSDL portal.

Want to check your income tax refund status? This guide will guide you through the e-filing of income tax returns and help you gauge how to check your income tax refund status.

Methods to Know Income Tax Refund Status

When you know that you are entitled to income tax returns, you can check your income tax refund status online. All you need is PAN and year assessment. Then you can quickly check the ITR return status through the available methods, including

- Income Tax E-filing Portal

- TIN NSDL Portal

To Check your ITR refund status FY 2022-23, count on any of the below-depicted procedures.

How to Check Income Tax Refund Status Through E-Filing Website

The portal for e-filing of income tax returns allows its registered users to check their income tax refund status in two different ways. The e-filing portal allows users to check their income tax refund status:

- Taxpayers who have filed an ITR using their PAN

- Authorised signatories and ERIs file income tax returns.

The services offered by the e-filing website are:

- Display the income tax return status pending verification,

- Display the ITR-V Acknowledgement, upload a JSON file (from the offline utility), and complete the ITR form in PDF format. The same thing can be downloaded as well.

One can check their ITR refund status by following the below-depicted steps:

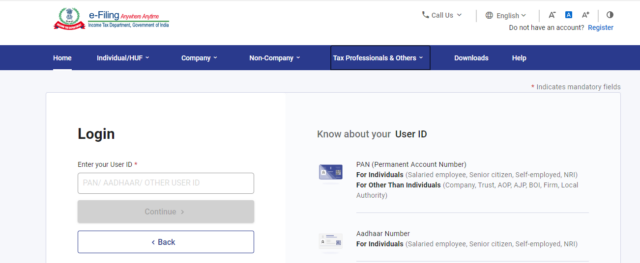

Step 1: Visit the official e-filing portal.

Step 2: After login into your account, Look for the ‘Income Tax Return (ITR) Status’ tab present on the top section of the homepage.

![]()

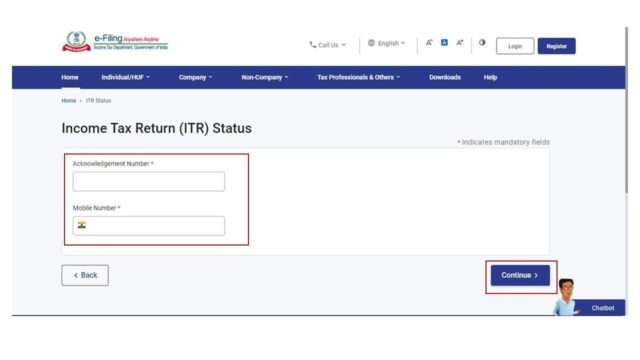

Step 4: Enter your acknowledgment number and registered mobile number in the given text fields to proceed with the process.

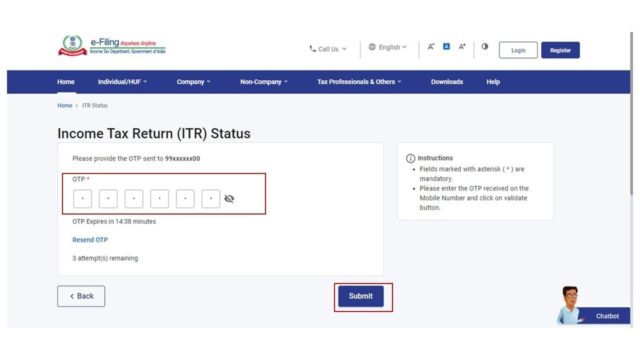

Step 5: In the next step, you will be asked to provide the portal with the OTP. This OTP will be valid for 15 minutes.

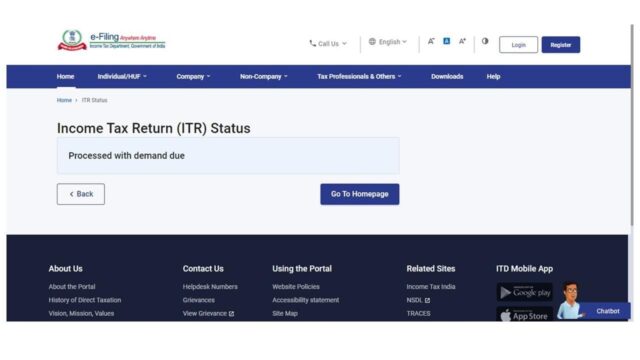

Step 6: Post this; the portal will reflect your income tax refund status.

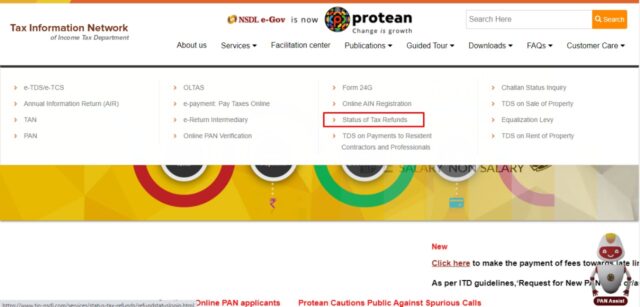

Check Income Tax Refund Detail Through TIN NSDL Official Portal

You can determine the refund status via the TIN-NSDL official website by following the depicted step-by-step procedure:

Step 1: Visit the TIN-NSDL official website.

Step 2: Under the ‘Services’ drop-down menu, click on the ‘Status Tax Refund’ section.

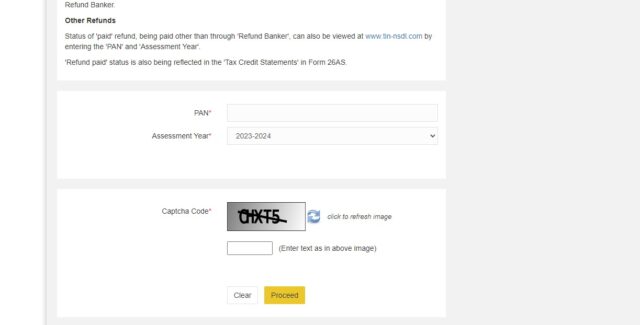

Step 3: Among the ‘Taxpayer Refund (PAN)’ option and ‘Deductor Refund (TAN)’ option, choose the ‘Taxpayer Refund (PAN)’

Step 4: Enter your PAN number, along with the Assessment Year (AY). Now, enter the captcha code and finally select ‘Proceed’.

Step 5: Your NSDL refund status will be displayed on the screen.

How to Pay Income Tax Refund via Direct Credit and Cheque?

Applicants can get their income tax refund through two payment modes, i.e. Direct Credit and Cheque.

Income Tax Refund Via Direct Credit

Income tax returns will be sent to the applicant via NECS or RTGS. If you wish to get the refund amount in the minimum possible time, ensure that all the provided information is accurate, essentially your bank account details. The specifics include your communication address and bank details such as account number, branch and IFSC code. The precision of all such information makes the transmission of income tax refunds smooth and quick.

Income Tax Refund Via Cheque

If the applicant’s bank account details are incorrect and clarified, the authority sanctions the refund through a cheque.

What Does Different Income Tax Refund Status Stand For?

The different types of income tax refund statuses are explained. The steps to action have also been discussed in the following table:

| Type of Refund and Its Meaning |

| Not Determined: Your income tax refund has yet to be processed due to the absence of a refundable amount. |

| No e-filing for this assessment year: ITR is not filed. |

| Refund paid: Your income tax refund has been transferred |

| to ITR Proceeds determined and sent to Refund Banker: Your income tax refund has been processed. |

| Refund unpaid: The IT department is yet to deliver your refund |

| No Demand No Refund: The tax deducted is correct, and the IT department owes you nothing. |

| Demand Determined: Due to the difference in tax calculations, the IT department has rejected your refund demand. |

| Contact Jurisdictional Assessing Officer: Clarifications are required. |

| Rectification Proceeds, refund determined, sent out to refund banker: The income tax department has accepted your rectified income tax refund request. |

| Rectification Proceeded on, No Demand No refund: The officials have accepted the rectification request, but demand/ refund has yet to be raised. |

| Rectification proceeded, and demand was determined: The officials have accepted the rectification request, and the refund will be provided within 30 days. |

Steps of Action Towards each Income Tax Refund Status:

| Type of Return | Steps of Action |

| Not Determined | Post one week, recheck income tax refund status |

| No e-filing for this assessment year. | Verify the assessment year and amount of tax paid and check your income tax return status. |

| Refund paid | You can raise a request for reissue of income tax refund |

| ITR Proceeds determined and sent to Refund Banker | Wait for some time and check the TIN NSDL website or e-filing website |

| Refund unpaid | You can raise a reissue request after verifying your bank details |

| No Demand No Refund | Revise your income tax return |

| Demand Determined to | Crosscheck your e-filing record and verify the information. If more tax needs to be deducted, make the payment |

| Contact Jurisdictional Assessing Officer | Contact your jurisdictional Assessing Officer. |

| Rectification Proceeds, refund determined, sent out to refund banker. | Check your income tax refund status after a wait of a few days. |

| Rectification Proceeded on, No Demand No refund | No money is owed |

| Rectification proceeded, demand determined | Crosscheck e-filing of income tax return |

What is Income Tax Refund?

The income tax refund is a process that allows business organisations and individuals to reclaim money they have already paid over their income tax obligations. Income tax authorities determine how much you can claim as a tax refund as soon as the applicant submits a refund claim.

Processing a refund can take up to three months. The income tax refund may be delayed based on several circumstances. The causes for this delay can range from incomplete or incorrect bank account information to the closing of the assessment of your tax refund claim to a delay in filing for a tax refund.

When are you Entitled to a Refund of your Income Taxes?

Before approaching income tax return filing, you must know whether you are entitled to the claim. The following pointers will help you determine your income tax refund entitlement.

- Employers frequently deduct taxes after considering various documentation evidence provided by an employee, such as Section 80C investments, Section 80D medical insurance premiums, or something similar. As a result, if an employee confirms these assets by the end of the financial year, the employer might deduct additional money from their paycheck. However, when filing their tax returns, the employee may ask for a reimbursement for the extra taxes they paid as a consequence of this investment.

- You can claim an income tax refund for unpaid income tax adjustments from the previous fiscal year while filing income tax for the current fiscal year.

- You are eligible for an ITR refund when your tax returns have already been submitted since the allowable deductions have decreased your tax liability.

- You can submit an income tax refund claim if your employer has already withheld your income tax (TDS). You have yet to take advantage of any Section 80C deductions, investments, or charges that qualify for a tax benefit.

- This issue might arise when a person has citizenship in one country but receives funding from another. India has signed a Double Taxation Avoidance Agreement (DTAA) that permits tax refunds in certain situations for non-resident Indians who have income that is taxed in other nations. All overpaid taxes may be requested as refunds following the rules of this DTAA agreement.

- If applicants figure out that they have paid more taxes than necessary, they can request a tax refund by submitting an ITR to the Income Tax Department.

Process for ITR Refund Reissue

The need to request a refund reissue arises when in an assessment year, the income tax refund fails to get credited to the taxpayer’s bank account. You can make a reissue request with the e-filing of the income tax return portal. The steps to carry forward the income tax refund reissue request are as follows:

- Log in to the income tax return filing.

- Under the ‘My Account’ menu, click on the ‘Service Request’ link.

- Click on the ‘Refund Reissue Request’ button and choose the ‘Create Refund Reissue Request.’

- The next step will be to provide the portal with a confirmation of details like acknowledgement number, PAN, assessment year, ITR type, CRN, and income tax refund failure reason.

- You will need to check the bank name and verify the bank accounts details like account number, IFSC, name, and type of the bank account. Once verified, click on ‘Continue.’

- Seal the details by generating and entering the Aadhaar OTP or Digital Signature Certificate (DSC).

- A ‘Submitted Successfully’ message, including your transaction ID, will pop up.

- You can view your request by clicking on the ‘View Refund Reissue Requests.’

What to Do If Income Tax Refund is Not Processed?

The income tax refund is generally processed within 20 to 45 days after processing income tax returns. If you do not receive the refund within the given time, you can visit the official e-filing portal or NSDL portal to check the income tax return status. Based on the showcased status, you might need to resubmit the returns or wait a few more days. If you are not satisfied with the status, you can reach out to the jurisdictional officer and figure out the actual reason for the delay.

You can get in touch with the Notification and Processing Centre for any query. Just dial 18001034455 or +91-80-46605200 and resolve your query.

Note: These numbers are accessible only on weekdays from 8 am to 8 pm.

You can also drop an email to refunds@incometaxindia.gov.in.

| Related Resource |

| Income Tax |

| Income Tax Slabs and Rates |

| Deductions Under Section 80c |

| Income Tax Customer Care |

| ITR – Income Tax Return |