- Home

- Income Tax

- Income Tax On Pension

Income Tax on Pension: New Rules for Income Tax for Pensioners

- Personalized solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Interest rate comparison

The term ‘tax’ itself is such a nightmare for many. Every employed individual above a specific threshold income slab has to file ITR (Income Tax Return). Filing ITR is obligatory, or else you will have to pay penalties on the same. However, this doesn’t imply that retired individuals are exempted from paying income tax. If you get a monthly pension, you are still obligated to pay taxes. The Government of India and the Income Tax Department have Income Tax on Pension provisions.

A pension is a term compensation that employees receive for their services rendered in accordance with the service agreement. The amount is taxable as a part of the employees’ Income Tax assessment under the head “salaries”. Currently, no law fully exempts senior or very senior citizens from paying taxes.

The article covers the fundamentals of Income Tax for Pensioners, types of pension, eligibility criteria for ITR exemption, and more.

Latest Update

The government officials have not fully exempted senior citizens or pensioners from paying income tax, but the CBDT (Central Board of Direct Taxation) took steps to offer them some relief. It has issued a declaration form, Form CBDT 12BBA, that will be helpful in availing relief from filing the ITR. The eligible senior citizens must submit the form to the defined banks.

In Budget 2021, the finance minister presented a proposal pertaining to tax exemption for senior citizens. It said that if pension and interest income are senior citizens’ sole income sources, they must get exempt from filing income tax returns.

A new section, Section 194P, has been added to the Income Tax Act, which enforces the banks to deduct tax on senior citizens above 75 years of age, getting interest income and pension from the bank.

➡️ Read more about union budget 2022 highlights

Commuted and Uncommuted Pension

The taxpayer and employer usually contribute jointly to an annuity fund. This, in turn, pays pensions to the taxpayer out of the fund. During retirement, applicants can choose if they want to receive a specific amount of pension in advance. Such pensions that are received in advance are known as Commuted Pension.

For instance, you reach the age of 60 and decide to avail yourself of 10% of your monthly pension worth ₹ 20,000 in advance for the next ten years. You will receive the pension in a lump sum amount. Hence,

Commuted Pension = 10% of ₹ 20000 x 12 x 10 = ₹ 2,40,000.

Now for the next ten years, until you attain the age of 70, you will continue to get ₹ 18,000, which will be your Uncommuted Pension. Post 70 years of age, you will receive a full pension of ₹ 20,000.

You can use a pension income tax calculator to determine the amount of pension you may get if you draw some of it in advance.

What are the Taxation Rules for Pensions?

As mentioned above, the rules regarding income tax on pensions have changed.

As per Taxation rules, an Uncommuted Pension is deemed to be a salary under the Income Tax Act, 1961. Hence, such pensions are taxable. Nevertheless, for pensioners who get their pay from nationalised banks, Section 89(1) offers multiple tax deductions on the salary income of such pensioners. Based on the same, if TDS is applied, banks make tax rebate adjustments under Sections 88 and 88B.

Tax Rates for Individuals and HUFs

HUFs (Hindu Undivided Families) or any individuals who retire voluntarily before the age of 60 years will pay the following income tax on income received from the pension:

- NIL – if the annual pension received lies below the range of ₹ 2.5 lakhs

- 10% — if the yearly pension received ranges between ₹ 2.5 lakhs and Rupees five lakhs

- 20% — if the amount received falls between Rupees five lakhs to 10 lakhs

- 30% — if the yearly pension surpasses Rupees ten lakhs

If the total pension of the pensioner exceeds the basic exemption amount, the retired applicant must file the income tax return.

Tax Rates for Senior Citizens (Above 60 Years of Age)

The following income tax rates will be applicable on a pension received by the senior citizens:

- NIL — if the annual pension received is below Rupees three lakhs

- 10% — in case the annual pension received ranges between Rupees three lakhs and five lakhs

- 20% — if the annual pension lies between Rupees 5 lakhs and 10 lakhs

- 30% — if the annual pension exceeds Rupees 10 lakhs

Tax Rates for Super-Senior Citizens (Above 80 Years of Age)

The following tax rates would apply to senior citizens of age 80 and above:

- NIL – in case the pension stays within Rupees five lakhs of range annually

- 20% — if the annual pension received is between Rupees five lakhs and ten lakhs

- 30% — if the pension received surpasses Rupees ten lakhs annually

Tax Forms for Pensioners

The Indian government has issued four types of income tax forms that are applicable to taxpayers. Out of these 4, ITR 1 or Sahaj and ITR 2 Forms are relevant for pensioners. You must know the following details about these forms to file ITR with utmost ease:

ITR-1 or SAHAJ Form

Also known as Sahaj Form, the ITR-1 form is specifically for applicants who receive an income of up to ₹ 50 lakh through the following ways:

- Income from a pension

- Income from a salary

- Income from other sources

- Income from a house property

ITR 2 Form

Applicants who don’t qualify to file taxes under the requirements of Form ITR-1 are eligible to apply for the ITR-2 form.The authority has designed this form specifically for applicants who receive their income via the following modes:

- Income from a pension

- Income from a salary

- Foreign income/assets

- Income from capital gains

- Income from a house property

- Agricultural income above Rs.5,000

- Income from other sources

Eligibility Criteria for ITR Exemption

To be eligible for ITR exemption, you must meet the following criteria:

- The age of the senior citizen must be 75 or above.

- The senior citizens have to be ‘Resident’ in the last year.

- They must submit a declaration comprising some essential information to the specified banks.

- Interest and pension income should be their only source of income. Interest income earned/accrued from the same defined bank in which they get their pension amount.

As notified by the Central Government, the bank is considered a ‘specified bank’. These banks are liable for deduction TDS of senior citizens after considering the rebate under 87A and deductions under Chapter VI-A.

Once the specified bank has deducted tax for senior citizens older than 75 years, senior citizens won’t be required to file any income tax return.

How to Report Income Received from Pension in Income Tax Return?

Given below are the following steps to mention pension income while filing income tax returns:

Step 1: Visit the official website of Income Tax e-filing and log in using your PAN details and password.

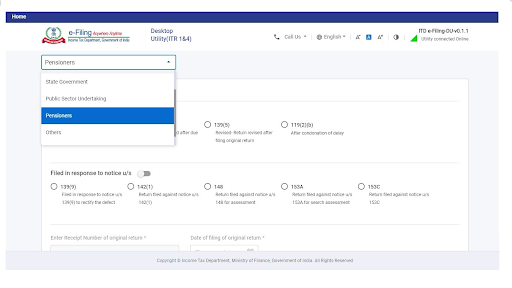

Step 2: Navigate to the salary schedule section while filing the IT returns. In the ‘Nature of Employment’ field, choose the ‘Pensioners’ option.

Step 3: You must report the taxable pension income as ‘salary’. You have to provide your name, address, the tax deducted at source (TDS) and the tax collection account number (TAN) thereafter.

It would be best if you mentioned the specific limit on the pension amount as ‘Commuted Pension’, which is spared from income tax. Under Section 17(1)’ of the Income Tax Act, 1961, you must mention any additional amount as ‘Annuity Pension’ under ‘Salary’.

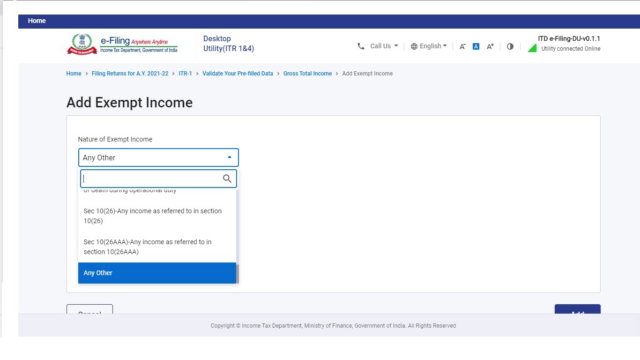

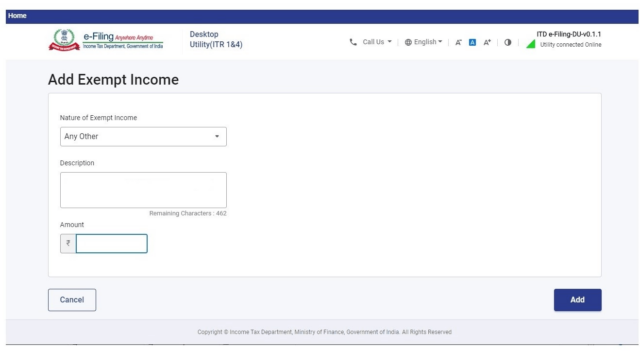

Step 4: You will come across the ‘Nature of Exempt Income’ section. Choose the ‘Any Other’ option from the drop-down menu and enter the field with the commuted pension from taxes.

Step 5: Provide information about the pension you choose in the ‘Description’ field. Also, enter the amount of pension in the required box. Then, click on ‘Add’.

Pension Obtained by a Family Member

If the applicant’s family member receives the pension, it will be taxable under the ‘head income from other sources in the family member’s income tax return.

- If the pension is a lump sum payment or if it’s commuted, it won’t be taxed.

- Uncommuted pensions obtained by a family member are exempted to a defined limit. 1/3rd of the Pension received as Uncommuted or ₹ 15,000 — whichever is less is exempted from tax.

For instance — If the applicant’s family member gets a pension of ₹ 1,20,000, the deduction would be a minimum of ₹ 15,000 or ₹ 40,000. The taxable amount will equate to 1/3rd of ₹ 1,20,000.

Therefore, the pension amount of ₹ 1,15,000 (₹ 1,20,000 – ₹ 15,000) received by the family members would be taxable.

Is Pension Obtained from UNO Taxable?

Pensions provided to applicants or their family members by the UNO (United Nations Organisations) are exempted from the tax. Also, family members of the armed forces receiving pensions won’t be taxable.

Benefits of Pension Plans

Various retirement plans and taxpayers qualify for tax deductions of up to ₹ 1.5 lakh under Section 80C of the Income Tax Act, 1961. Given below are some of the significant benefits of investing in Pension Plans, which render the dual benefits of investment and insurance cover:

Assured Income/Pension

Based on the type of pension plan you choose, a pension plan can assure you a steady and fixed income upon retirement (deferred plan) or immediately after investing (immediate plan). In addition, it guarantees an economically independent life after retirement.

Liquidity

Retirement plans usually have low liquidity. Nevertheless, various plans let you withdraw money even during the accumulation phase. Such plans allow you to access funds in an emergency without leaning on any lender for a loan for financial needs.

Tax-Efficient

Section 80C of the Income Tax Act covers various pension plans that offer tax exemption to taxpayers. If you invest in a pension plan, the Income Tax Act 1961 provides beneficial tax respite under Chapter VI-A. Section 80C, 80CCC and 80CCD.

For example, National Pension Scheme (NPS) and Atal Pension Yojana (APY) are allowed for tax deduction under Section 80CCD.

Vesting Period

It refers to the time when the retired employee begins receiving the monthly pension. For example, several pension plans fix their minimum vesting period at 45 or 50 years. The age is flexible and can extend to 70 years, while some organisations allow the vesting age to be up to 90 years.

Accumulation Term

The plans give investors the payment choices of premium whether they want to do it at once as a lump sum investment or in periodic intervals. Concurrently, the fund will gather over time to create a sizable corpus (investment + gains). For example, if somebody begins investment at the age of 30 and continues to do so until he/she turns 70, the accumulation term will be 40 years. The investor’s pension for the given investment tenure will come from this corpus.

Payment Period

Investors often confuse the accumulation period with the payment period. It’s the term for which the organisation sends you the pension after you retire.

For instance, if you receive your pension between the age of 55 years and 70 years, then the payment period will be 15 years. While some plans let you withdraw full/partial amounts during the accumulation period, many plans keep this different from the accumulation term as well.

Surrender value

Even if you have paid the required minimum premium, do not surrender your pension plan until it reaches maturity. Otherwise, you will lose all the advantages the plan offers, including the assured sum and life insurance cover.

| Related Resource |

| Deductions Under Section 80C |

| Income Tax Slabs and Rates |

| Income Tax Refund Status |

| Income Tax e-filing |

| ITR – Income Tax Return |