Yes Bank Home Loan Eligibility Calculator

Yes Bank home loan eligibility calculator is an online calculator that lets you estimate your home loan eligibility without visiting a bank branch. All you need to do is enter some basic information such as your name, home number, monthly income, etc. The calculator will show you the estimated loan amount you are eligible for in a jiffy. Moreover, you can also compare other home loan products that Yes Bank offers, and apply the most cost-effective financing option. You can eliminate time-consuming bank visits and tedious paperwork, making it more convenient for home loan borrowers.

- Personalized Home Loan solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Home Loan Interest rate comparison

Table of Content

Yes Bank Home Loan Eligibility Calculator – Key Features & Benefits

Following are the major features and benefits of the home loan eligibility calculator Yes Bank.

Swift and Handy

The Yes Bank housing loan eligibility calculator is remarkably fast and handy. Whether you are not tech-savvy or have limited financial acumen, it’s designed to be easily usable for people of all backgrounds. With this tool, you can swiftly calculate and obtain accurate results within seconds, eliminating the need for manual and complex calculations or dependence on financial experts. This ultimately empowers you to make quicker decisions and take timely steps towards achieving the right financial option that suits your preferences.

Comparison Capabilities

The Yes Bank home loan eligibility calculator allows you to compare various loan options Yes Bank provides. I.e., It assesses factors like interest rates, repayment terms, and associated expenses, allowing you to select the most appropriate loan option that aligns with your financial goals. Moreover, these calculators empower you to adjust your inputs to reach the desired result. This interactive feature provides insights into the necessary modifications needed in your current input to achieve the desired outcome, offering valuable guidance and a clearer understanding of your financial decisions.

User-Friendly

Yes Bank home loan eligibility calculator is well-known for its outstanding UX design (User Experience design). Instead of providing a detailed description in a textual format, these calculators utilise a visually engaging interface to present results. By presenting outcomes visually, users can quickly understand their current financial situation. Hence, this user-friendly approach improves accessibility and eliminates the need to read lengthy texts, ensuring a smooth and efficient user experience.

Free From Error

The Yes Bank housing loan eligibility calculator offers precise calculations for a range of financial scenarios. Whether you require calculations for loan amounts, loan EMIs, or interest rates, these calculators guarantee accurate results and a comprehensive insight into your financial status and possibilities concerning your home loan. Furthermore, this Yes Bank home loan eligibility calculator is equipped with the most current financial parameters, ensuring that individuals can make calculations based on the latest data, thereby improving accuracy and relevance.

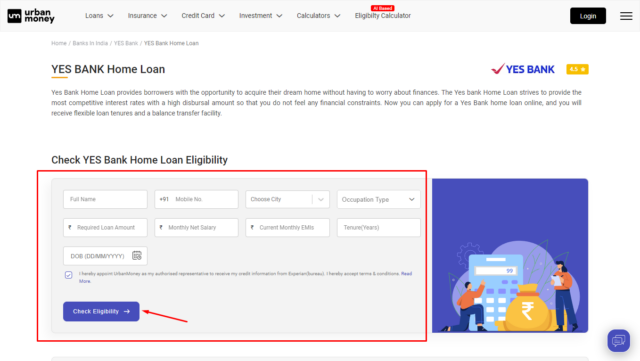

How to use Yes Bank Home Loan Eligibility Calculator?

To use the Yes bank housing loan eligibility calculator, you can follow these simple steps:

- Visit the official website of “Urban Money.”

- There is a horizontal menu bar at the top of the home page.

- Click on the “Loans” option and “Home Loan.”

- You will then be directed to the home loan page, where you can find an array of leading banks and NBFCs in India.

- Scroll down and select “Yes Bank.” This will redirect you to ‘Yes Bank Home Loan‘.

- The calculator will be displayed under “Check Yes Bank Loan Eligibility.”

- Enter the required details, such as your name, phone number, city, desired loan amount, loan tenure, etc.

- Click the “Check Eligibility” button.

- In a jiffy, a 6-digit OTP will be sent to the phone number you provided.

- Enter the OTP and click “Submit.”

- The calculator will promptly present the total amount you can receive from the bank. You can also view the interest rate, tenure, monthly EMI, and total amount.

- Moreover, if you wish to apply for a Yes Bank Home Loan, click the “Apply Now” button. Alternatively, click “View All Offers” to explore and compare offers from other lenders alongside Yes Bank.

Yes Bank Home Loan Eligibility Criteria

Mainly, the bank offers four different types of home loans. Each aims to cater for a variety of individuals and their needs. The following are the types and eligibility criteria for Yes Bank home loans.

Yes Bank Home Loan Eligibility Based on Salary

- Applicants employed in the government sector or reputed companies are eligible to apply for home loans with Yes Bank.

- Applicants must be at least 21 years old when the home loan begins and can be up to 70 years old or reach their retirement age, whichever happens first.

- Applicant must have a minimum income of Rs. 20,000 per month.

- The applicant must have at least 2 years of work experience.

- Applicants should have a good credit score. Typically, a credit score of 750 or above is considered favourable.

- The applicant should be an Indian resident.

Yes Bank Home Loan Eligibility Criteria for Self-Employed Individuals

- Applicants who are not professionally employed but have a consistent source of income, such as contractors, traders, commission agents, etc., are also eligible for a Yes Bank Home Loan.

- Applicants must be 23 or older when the home loan starts and up to 60 or less when it matures.

- Applicant must have a minimum income of Rs. 4 lakhs per annum.

- Applicants should have a minimum of 3 years of business continuity.

- Applicants should have a good credit score. Typically, a credit score of 750 or above is considered favourable.

- The applicant should be an Indian resident.

Yes Bank NRI Home Loan Eligibility: Requirements for Non-Resident Indians

- Applicants must be at least 21 years old when the home loan begins and can be up to 70 years old or reach their retirement age, whichever happens first.

- Applicant must have a minimum income of Rs. 20,000 per month.

- The applicant must have at least 2 years of work experience.

- Applicants should have a good credit score. Typically, a credit score of 750 or above is considered favourable.

- The applicant should be an Indian resident.

Special Yes Bank Home Loan Eligibility for Women Applicants

- Be at least 21 years old when the home loan begins and can be up to 70 years old or reach their retirement age, whichever happens first.

- Have a minimum income of Rs. 20,000 per month.

- Have at least 2 years of work experience.

- Have a good credit score; a credit score of 750 or above is typically considered favourable.

- Be an Indian resident.

List of Factors Affecting Yes Bank Home Loan Eligibility

The following is a list of factors affecting Yes Bank home loan eligibility:

- Credit Score: When evaluating your eligibility, the bank primarily looks at your credit score, which reflects your creditworthiness. Essentially, the bank reviews your credit history to gauge your repayment behaviour.

- Income: Your income and its stability are pivotal in deciding your eligibility. A higher and steady income can greatly improve your chances of getting approved for a loan.

- Age: Your age at the time of loan application influences loan tenure and eligibility. In general, younger applicants are often eligible for longer loan terms and quicker loan approval.

- Employment History: A consistent work history demonstrates your reliability and capacity to repay the loan. Conversely, applicants who frequently switch jobs may be seen as higher risk, potentially impacting their eligibility.

- Loan Amount: The correlation between the loan amount you intend to borrow, your income, and the property’s value has influenced your eligibility.

- Debt-to-Income Ratio (DTI): The debt-to-income ratio measures how much money you have remaining after you’ve paid all your debts. Ideally, the lower your debt-to-income ratio, the better your eligibility, leading to faster loan approval.

- Property Details: When you provide your property details and loan application, the bank primarily uses this information to assess the property’s resale value. A property with a high resale value may be eligible for larger loan amounts at lower interest rates.

- Documentation: Submitting accurate and complete documents, which include proof of income and property details, is also essential to ensure a seamless loan approval process.

How can you Improve your Yes Bank Home Loan Eligibility?

If you fall short of meeting the minimum eligibility criteria, there are specific tips you can follow to improve your chances of becoming eligible for a Yes Bank home loan.

Maintain a Good Credit Score

To enrich your eligibility for a home loan with IDFC, make sure to pay your bills and existing loans punctually and strive to reduce your credit card usage. Adhering to these practices can significantly improve your eligibility, often leading to lower interest rates and more favourable loan terms. Generally, the bank views a credit score of 750 or higher as favourable.

Reduce Your Debt-To-Income Ratio

The DTI (Debt-to-Income) ratio reveals how much of your monthly income goes toward debt payments. A higher DTI indicates that you have less income to cover a new loan, which could result in the bank rejecting your loan application. To improve your eligibility, you need to lower your DTI ratio by increasing your income or decreasing your debts.

Affix Co-applicant

You can also enhance your chances of loan approval by including your spouse, sibling, or other family members as co-applicants. In such cases, the bank assesses the credit scores and repayment capability of both applicants, which can bolster the overall loan eligibility.

Present All Your Income Sources

Present all your income sources in addition to your monthly salary, including investments, rental properties, retail businesses, income-generating hobbies, and more. This will instil greater confidence in the bank regarding your loan repayment capacity, ultimately improving your chances of loan approval.

Avoid Multiple Loan Applications

Whenever you apply for a loan, it is recorded on your credit report, which can potentially lower your credit score. Moreover, making several loan applications within a short time frame can raise red flags for the bank, indicating that you might be too eager for credit and could face difficulties repaying your debts. To prevent multiple loan applications, it is advisable to conduct thorough research and compare different loan options before applying for one.

Understanding the Impact of Credit Score on Yes Bank Home Loan Eligibility

Your credit score is a numerical representation of your creditworthiness, determined by factors such as your credit history, repayment patterns, existing debts, and other relevant financial factors. Typically, credit scores fall within the range of 300 to 850, with higher scores signifying stronger creditworthiness.

However, a credit score of 750 or higher is usually considered ideal by the bank. Having a good credit score can significantly impact various aspects of your home loan, including your interest rate, loan amount, loan duration, approval speed, and the terms you are offered.

Comparing Eligibility across Different Yes Bank Home Loan Products

Here is a comparison of the eligibility criteria for various Yes Bank home loan products.

| Product Name | Minimum Age | Maximum Age | Minimum Income | Credit Score |

| Home Purchase Loan | 21 years | 70 years | Rs 20,000 p.m. | 700 or more |

| Self-construction Loan | 21 years | 70 years | Rs 20,000 p.m. | 700 or more |

| Home Improvement Loan | 21 years | 70 years | Rs 20,000 p.m. | 700 or more |

| Home Loan Top-up | 21 years | 70 years | Rs 20,000 p.m. | 700 or more |

| Home Loan Balance Transfer | 21 years | 70 years | Rs 20,000 p.m. | 700 or more |

| YES Khushi Home Loan | 21 years | 70 years | Rs 9,000 p.m. | 700 or above |

| NRI Home Loans | 21 years | 70 years | Rs 20,000 p.m. | 700 or more |

| Home Loans for Self Employed | 23 years | 60 years | Rs. 4 lakhs p.a. | 700 or more |

Home Loan Eligibility Calculators By Other Banks

People Also Asked About Yes Bank Home Loan Eligibility Calculator

How do I check my eligibility for a Yes Bank home loan?

You can conveniently assess your eligibility for a Yes Bank home loan by using the Yes Bank home loan eligibility calculator. Notably, you can easily locate this calculator on the official Urban Money website.

How much loan am I eligible for Yes Bank?

The eligible loan amount for a Yes Bank home loan ranges from Rs. 10 lakhs to Rs. 10 crores.

How will I know if my eligibility criteria have been met for Yes Bank home loans?

You can determine your eligibility for a Yes Bank home loan using the home loan eligibility calculator Yes Bank.

How can I increase my eligibility for a higher Yes Bank home loan amount?

Here are some tips to enhance your eligibility for obtaining a higher loan amount: maintain a good credit score, reduce your debt-to-income ratio, affix co-applicant, present all your income sources, and avoid multiple loan applications.

Quick Links

Home Loan by Private Bank

- Federal Bank Home Loan

- Reliance Capital Home Loan

- DCB Bank Home Loan

- ICICI Bank Home Loan

- YES Bank Home Loan

- RBL Bank Home Loan

- IDFC FIRST Bank Home Loan

- HDFC Bank Home Loan

- Axis Bank Home Loan

- Deutsche Bank Home Loan

- karnataka bank Home Loan

- karur Vysya Bank Home Loan

- Kotak Bank Home Loan

- Housing Development Finance Corporation Home Loan

- IndusInd Bank Home Loan

- IDBI Bank Home Loan

- HSBC Home Loan

- LIC Housing Finance Home Loan

- CITI Bank Home Loan

- HDFC Sales Home Loan

Home Loan by Nationalized Bank

Home Loan by NBFC

- Clix Capital Home Loan

- Hero FinCorp Home Loan

- Cholamandalam Finance Home Loan

- Vastu Housing Finance Home Loan

- Home First Finance Company Home Loan

- Aadhar housing Finance Home Loan

- DHFL Home Loan

- Muthoot Finance Ltd Home Loan

- Edelweiss Financial Services Home Loan

- Piramal Finance Home Loan

- Hero Housing Finance Home Loan

- Fullerton India Home Loan

- Capital First Ltd. Home Loan

- Poonawalla Fincorp Limited Home Loan

- IndiaBulls Home Loan

- IIFL Finance Home Loan

- Ujjivan Small Finance Bank Home Loan

- Tata Capital Housing Finance Limited Home Loan

- L&T Finance Home Loan

- Aditya Birla Finance Limited Home Loan

- Godrej Housing Finance Home Loan

- Punjab National Bank Housing Finance Home Loan

- Bajaj Finserv Home Loan

- Capri Global Home Loan

Home Loan Calculators

Bank wise Home Loan Calculators

- Bajaj Finserv Home Loan Calculator

- Tata Capital Financial Services Ltd Home Loan Calculator

- Hero Fincorp Home Loan Calculator

- Karur Vysya Bank Home Loan Calculator

- Piramal Housing Finance Home Loan Calculator

- Tata Capital Housing Finance Limited Home Loan Calculator

- Punjab National Bank Home Loan Calculator

- Indusind Bank Home Loan Calculator

- Bank Of India Home Loan Calculator

- Lic Housing Finance Home Loan Calculator

- Punjab Sind Bank Home Loan Calculator

- Indian Bank Home Loan Calculator

- Hdfc Bank Home Loan Calculator

- Bank Of Maharashtra Home Loan Calculator

- Hsbc Home Loan Calculator

- Citi Bank Home Loan Calculator

- Canara Bank Home Loan Calculator

- Axis Bank Home Loan Calculator

- State Bank Of India Home Loan Calculator

- Rbl Bank Home Loan Calculator

- Karnataka Bank Home Loan Calculator

- Federal Bank Home Loan Calculator

- Deutsche Bank Home Loan Calculator

- Union Bank Of India Home Loan Calculator

- Yes Bank Home Loan Calculator

- Dcb Bank Home Loan Calculator

- Idfc First Bank Home Loan Calculator

- Kotak Bank Home Loan Calculator

- Idbi Bank Home Loan Calculator

- Icici Bank Home Loan Calculator

- Bank Of Baroda Home Loan Calculator

Bank Wise Home Loan Interest Rate

- Federal Bank Home Loan Interest Rate

- Reliance Capital Home Loan Interest Rate

- DCB Bank Home Loan Interest Rate

- ICICI Bank Home Loan Interest Rate

- YES Bank Home Loan Interest Rate

- RBL Bank Home Loan Interest Rate

- IDFC FIRST Bank Home Loan Interest Rate

- HDFC Bank Home Loan Interest Rate

- Axis Bank Home Loan Interest Rate

- Deutsche Bank Home Loan Interest Rate

- karnataka bank Home Loan Interest Rate

- karur Vysya Bank Home Loan Interest Rate

- Kotak Bank Home Loan Interest Rate

- Housing Development Finance Corporation Home Loan Interest Rate

- IndusInd Bank Home Loan Interest Rate

- IDBI Bank Home Loan Interest Rate

- HSBC Home Loan Interest Rate

- LIC Housing Finance Home Loan Interest Rate

- CITI Bank Home Loan Interest Rate

- HDFC Sales Home Loan Interest Rate

- Canara Bank Home Loan Interest Rate

- Punjab National Bank Home Loan Interest Rate

- Punjab & Sind Bank Home Loan Interest Rate

- State Bank of India Home Loan Interest Rate

- Bank of Baroda Home Loan Interest Rate

- Indian bank Home Loan Interest Rate

- Bank of India Home Loan Interest Rate

- Union Bank of India Home Loan Interest Rate

- Bank of Maharashtra Home Loan Interest Rate

- Clix Capital Home Loan Interest Rate

- Hero FinCorp Home Loan Interest Rate

- Cholamandalam Finance Home Loan Interest Rate

- Vastu Housing Finance Home Loan Interest Rate

- Home First Finance Company Home Loan Interest Rate

- Aadhar housing Finance Home Loan Interest Rate

- DHFL Home Loan Interest Rate

- Muthoot Finance Ltd Home Loan Interest Rate

- Edelweiss Financial Services Home Loan Interest Rate

- Piramal Finance Home Loan Interest Rate

- Hero Housing Finance Home Loan Interest Rate

- Fullerton India Home Loan Interest Rate

- Capital First Ltd. Home Loan Interest Rate

- Poonawalla Fincorp Limited Home Loan Interest Rate

- IndiaBulls Home Loan Interest Rate

- IIFL Finance Home Loan Interest Rate

- Ujjivan Small Finance Bank Home Loan Interest Rate

- Tata Capital Housing Finance Limited Home Loan Interest Rate

- L&T Finance Home Loan Interest Rate

- Aditya Birla Finance Limited Home Loan Interest Rate

- Godrej Housing Finance Home Loan Interest Rate

- Punjab National Bank Housing Finance Home Loan Interest Rate

- Bajaj Finserv Home Loan Interest Rate

- Capri Global Home Loan Interest Rate