- Home

- Home Loan

- State Bank Of India

- SBI Home Loan Statement

SBI Home Loan Statement - Provisional Interest Certificate

The State Bank of India (SBI) offers its home loan customers a detailed document called the SBI Bank Home Loan Statement. This statement provides a comprehensive overview of the borrower's home loan account, including the loan amount, interest rate, tenure, repayment history, outstanding balance, and the division of payments between principal and interest. It plays a significant role in helping borrowers track their loan progress, effectively manage their finances, and plan for future payments. The statement is easily accessible through the bank's online portal, allowing customers to view and download it whenever possible. By providing transparency, it ensures that borrowers are well-informed about the status of their loans and stay on track with their repayment plans.

- Personalized Home Loan solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Home Loan Interest rate comparison

Table of Content

1. Why is an SBI Bank Home Loan Statement necessary? |

2. How do you view and download SBI Bank Home Loan Statement online? |

3. How do you get the SBI Bank Home Loan Statement Offline? |

Why is an SBI Bank Home Loan Statement necessary?

An SBI Bank Home Loan Statement is necessary for several reasons:

- Track Repayment Progress: It helps borrowers monitor how much of the loan principal and interest has been repaid over time, allowing them to see the progress made towards completing their loan repayment.

- Financial Planning: By providing a detailed breakdown of the loan repayment schedule, including future EMIs, it assists borrowers in budgeting and financial planning, ensuring they can manage other financial commitments in addition to their home loan.

- Tax Documentation: The statement is important for tax purposes, as it details the interest paid during the financial year. Borrowers can use this information to claim tax deductions on home loan interest under Section 24 of the Income Tax Act.

- Loan Management: It helps manage the loan more efficiently by providing insights into its current status, including outstanding balance, tenure remaining, and interest rate. This information is useful for making decisions about loan prepayment or refinancing.

- Error Identification: Regularly reviewing the home loan statement allows borrowers to spot discrepancies or errors in transactions, interest charges, or principal repayments, ensuring any issues can be promptly addressed with the bank.

- Proof of Loan: An official loan record detailing the loan terms can be useful in disputes or when applying for other financial products or services.

- Loan Closure: Upon the completion of the loan repayment, the statement can act as evidence that the loan has been fully repaid, which is necessary for obtaining the loan closure certificate and removing the lien on the property.

How do you view and download SBI Bank Home Loan Statement online?

SBI customers who have taken a home loan can conveniently access their loan statements online through SBI Internet Banking and the SBI Quick Mobile App, which are located in the Account Services section.

Borrowers can follow a simple process to obtain the SBI Home Loan Provisional Interest Certificate.

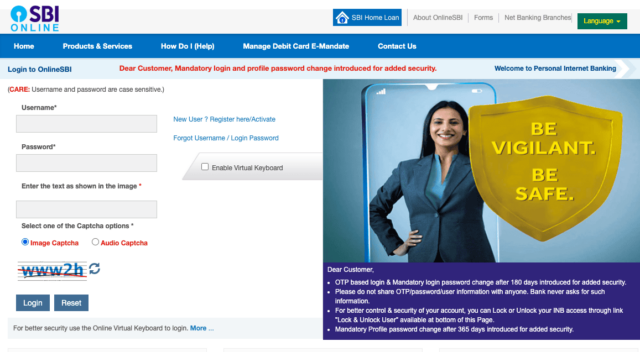

- Step 1: The applicant must log in to their SBI Personal Banking account (https://retail.onlinesbi.sbi/npersonal/) using their credentials.

- Step 2: On the personal banking page, log in using the bank’s details, such as username and password.

- Step 3: In the ‘Enquiries’ tab, they should select the ‘Home Loan Int.Cert (Prov)’ section.

- Step 4: From there, they can choose the specific account number for which they require the certificate. The certificate can be accessed online, printed, or downloaded in PDF format.

After the financial year ends, borrowers will receive the final SBI home loan interest certificate. This certificate summarises the interest and principal payments made by the borrower throughout the year. It is essential to claim tax deductions under Section 80C and 24b for the principal and home loan interest, respectively.

How do you get the SBI Bank Home Loan Statement Offline?

Customers can physically obtain their SBI home loan statements or interest certificates by visiting their nearest SBI branch.

Fill in the required form provided with relevant information such as:

- Name

- Address

- Date of Birth

- PAN Number

- Home Loan Account Number

- Email ID

- Telephone Number

Bring any of the subsequent documents that serve as evidence of identification, including:

- PAN Card

- Passport copy

- Aadhaar Card

Quick Links

Loan Offers By State Bank Of India's

Home Loan Calculators

State Bank Of India Calculators

Bank wise Home Loan Calculators

- Bajaj Finserv Home Loan Calculator

- Tata Capital Financial Services Ltd Home Loan Calculator

- Hero Fincorp Home Loan Calculator

- Karur Vysya Bank Home Loan Calculator

- Piramal Housing Finance Home Loan Calculator

- Tata Capital Housing Finance Limited Home Loan Calculator

- Punjab National Bank Home Loan Calculator

- Indusind Bank Home Loan Calculator

- Bank Of India Home Loan Calculator

- Lic Housing Finance Home Loan Calculator

- Punjab Sind Bank Home Loan Calculator

- Indian Bank Home Loan Calculator

- Hdfc Bank Home Loan Calculator

- Bank Of Maharashtra Home Loan Calculator

- Hsbc Home Loan Calculator

- Citi Bank Home Loan Calculator

- Canara Bank Home Loan Calculator

- Axis Bank Home Loan Calculator

- State Bank Of India Home Loan Calculator

- Rbl Bank Home Loan Calculator

- Karnataka Bank Home Loan Calculator

- Federal Bank Home Loan Calculator

- Deutsche Bank Home Loan Calculator

- Union Bank Of India Home Loan Calculator

- Yes Bank Home Loan Calculator

- Dcb Bank Home Loan Calculator

- Idfc First Bank Home Loan Calculator

- Kotak Bank Home Loan Calculator

- Idbi Bank Home Loan Calculator

- Icici Bank Home Loan Calculator

- Bank Of Baroda Home Loan Calculator