Axis Bank Home Loan Eligibility Calculator

Axis Bank provides home loans for buying, building, or renovating your home. Thus the Bank also proffers the Axis Bank home loan eligibility calculator, which helps you understand your loan eligibility and other pertinent details. By doing so, this handy tool ultimately eliminates the necessity of visiting a bank branch.

Namely, the home loan eligibility calculator in Axis Bank is an online digital calculator. To use this calculator, you must enter your age, monthly income, desired loan tenure, existing EMIs(if applicable), and the interest rate offered by Axis Bank. In a jiffy, the calculator will show you the approximate loan amount you are eligible for, along with the EMI, total interest payable, and total payment.

- Personalized Home Loan solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Home Loan Interest rate comparison

Table of Content

Axis Bank Home Loan Eligibility Calculator – Key Features & Benefits

Following are some of the key features and benefits of the housing loan eligibility calculator in Axis Bank:

Completely Digital

A home loan eligibility calculator in Axis Bank can be availed online for absolutely free of cost, making it easily accessible to you anytime and anywhere, without any time constraints or geographical limitations. Typically, you can locate access to this handy tool from the official website of Axis Bank.

Easy to understand

Axis Bank home loan eligibility calculator is renowned for its exceptional UX design. Instead of having a detailed description in a textual format, these calculators employ a more visually engaging interface to present results. Hence, you can swiftly grasp your loan eligibility and other concerning finance details with just a glance.

Comparison Capabilities

The Housing loan eligibility calculator Axis Bank enables you to compare different loan options offered by the Bank. Namely, this dynamic feature aid you in comparing interest rates, monthly repayment terms, and other associated costs of different financing options. Moreover, it empowers you to modify your inputs to achieve the desired output. By doing so, you can gain insights into the necessary alterations required in your current input, offering a clearer understanding of your financial choices.

Real-Time Updates

The home loan eligibility calculator Axis is equipped with the most up-to-date financial parameters. This ensures that individuals can perform calculations based on the latest data, enhancing accuracy and relevance.

How to Use Axis Bank Home Loan Eligibility Calculator?

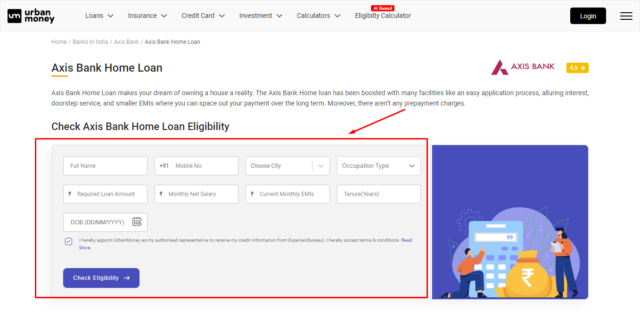

To use the Housing loan eligibility calculator Axis Bank, you can follow these simple steps:

- Visit the official website of “Urban Money.”

- There is a horizontal menu bar at the top of the home page. This menu bar entails loans, insurance, credit card, investment, etc.

- Click on the “Loans” option and “Home Loan.”

- You will then be directed to the home loan page, where you can find an array of leading banks and NBFCs in India.

- Scroll down and select “Axis Bank.”

- The calculator will be displayed under “Check Axis Bank Loan Eligibility” in “Axis Bank Home Loan” page.

- Enter the required details, such as your name, phone number, city, desired loan amount, loan tenure, etc.

- Click the “Check Eligibility” button.

- In a jiffy, a 6-digit OTP will be sent to the phone number you provided.

- Enter the OTP and click “Submit.”

- The calculator will promptly present the total amount you can receive from the bank. You can also view the interest rate, tenure, monthly EMI, and total amount.

- Moreover, if you wish to apply for an Axis Bank Home Loan, click the “Apply Now” button. Alternatively, click “View All Offers” to explore and compare offers from other lenders alongside Axis Bank.

Axis Bank Home Loan Eligibility Criteria

Axis Bank offers diverse home loan options to serve its extensive customer base. This includes salaried employees, self-employed individuals, non-resident Indians, and more. Moreover, the eligibility criteria may vary for each group. Here are the eligibility criteria for some of the most prominent home loans provided by Axis Bank.

Axis Bank Home Loan Eligibility Based on Salary

- Applicants in the Government sector or reputed companies are eligible for Axis Bank Home Loan.

- Applicants must be at least 21 years old when the loan starts and up to 60 years old or retirement age when the loan ends.

- Minimum income should be Rs. 25,000 per month.

- Applicants should have a minimum CIBIL score of 750.

- The applicant should be an Indian resident.

Axis Bank Home Loan Eligibility Criteria for Self-Employed Individuals

- Any individual filing ITR can apply for an Axis Bank Home Loan

- Applicants must be 21 or older when the home loan starts and up to 65 or less when it matures.

- Minimum income should be Rs. 2 lakhs per annum.

- The applicant should have a clear repayment history, with no dues pending for 90 days or more and no more than three instances pending for 30 days or more.

Axis Bank Nri Home Loan Eligibility: Requirements for Non-resident Indians

- The applicant should have at least one operative overseas account and one NRE/NRO account for one year.

- Age between 24 and 60 years at loan maturity

- Applicant should have a minimum overseas work experience of six months with a total work experience of 2 years.

Special Axis Bank Home Loan Eligibility for Women Applicants

- Salaried individuals, professionals, and self-employed individuals filing income tax returns can apply.

- Applicants should be above 21 years of age at the time of loan commencement and up to 60 or 65 years, depending on their employment type, at the time of loan maturity.

- Applicants should have a minimum net monthly income of Rs. 15,000.

- Applicants must have a good credit score.

List of Factors Affecting Axis Bank Home Loan Eligibility

The factors influencing Axis Bank home loan eligibility are as follows:

- Income: Your income level and stability play a significant role in determining your eligibility. A higher and consistent income enhances your chances of loan approval.

- Credit Score: A good credit score demonstrates your creditworthiness. Axis Bank assesses your credit history to gauge your repayment behaviour.

- Age: Your age at the time of loan application affects the loan tenure and eligibility. Typically, younger applicants may have longer repayment periods.

- Employment History: A stable employment history showcases your ability to repay the loan. Namely, the applicant with a history of frequent job changes may be considered risky, impacting eligibility.

- Loan Amount: The amount you wish to borrow in relation to your income and property value influences eligibility.

- The correlation between the amount you intend to borrow, your income, and the property’s value has influenced your eligibility.

- Property Details: The type and value of the property you intend to submit as a security of your loan impact the bank’s risk assessment and, consequently, your eligibility.

- Debt-to-Income Ratio (DTI): The ratio of monthly debt payments to income is considered. A lower DTI indicates better eligibility.

- Co-applicants or Guarantors: Adding a co-applicant with a strong financial profile or providing a guarantor can enhance eligibility.

- Documentation: Providing accurate and complete documents, including income proof and property details, is essential for loan approval.

- Loan Tenure: The duration of the loan impacts your eligibility. Shorter tenures might lead to higher monthly payments but can positively affect eligibility.

How Can You Improve Your Axis Bank Home Loan Eligibility?

You can follow certain tips to improve your Axis Bank home loan eligibility. Suppose your eligibility falls short.

- Maintain a Good Credit Score: Pay your bills and existing loans on time, and strive to reduce your credit card utilisation. Adhering to this practice can significantly improve your home loan eligibility, often leading to lower interest rates and favourable terms. Typically, the bank considers a credit score of 750 and above favourable.

- Reduce Your Debt-To-Income Ratio: The DTI ratio reveals how much your monthly income goes towards your debt payments. A higher DTI implies you have fewer funds available for loan repayment, possibly prompting the bank to reject your loan application. Ideally, you can lower your DTI ratio by either increasing your income or reducing your debts.

- Affix Co-applicant: Incorporating your spouse, sibling, or other family members as co-applicants can help enhance your loan approval chances. Because in such cases, the bank assesses both applicants’ credit scores and repayment capacity, bolstering the overall loan eligibility.

- Present All Your Income Sources: Deploy all your income sources and monthly salary. This may include investments, rental properties, retail businesses, income-generating hobbies, etc. Hence, the Bank become more confident about your ability to repay the loan, ultimately enriching the chances of loan approval.

- Avoid Multiple Loan Applications: Each loan application you have applied for will be recorded on your credit report and can lower your credit score. A surplus of loan applications within a brief timeframe can trigger apprehension for Bank, as it indicates that you are credit-hungry and may have difficulty repaying your debts. Thus, to avoid multiple loan applications, it’s prudent to conduct thorough research and compare different loan options prior to applying for the loan.

Understanding the Impact of Credit Score on Axis Bank Home Loan Eligibility

A credit score is a numerical representation of an individual’s creditworthiness. It generally ranges from 300 to 850, with higher scores indicating better creditworthiness. Furthermore, your credit score is calculated based on various factors such as credit history, repayment behaviour, outstanding debts, etc. Hence, the Bank ideally use credit scores to assess your creditworthiness and risk factors. Typically, the Bank considers a credit score of 750 and above favourable.

Comparing Eligibility Across Different Axis Bank Home Loan Products

Following is the comparison of eligibility across different axis bank home loan products:

| Product Name | Minimum Age | Maximum Age | Minimum Income | Minimum Loan Amount | Maximum Loan Amount |

| Home Loan | 21 years | 60 years | Rs. 10,000 p.m. | Rs. 3 lakhs | Rs. 5 crores |

| Shubh Aarambh Home Loan | 21 years | 60 years | Rs. 10,000 p.m. | Rs. 3 lakhs | Rs. 30 lakhs |

| Fast Forward Home Loan | 21 years | 60 years | Rs. 10,000 p.m. | Rs. 30 lakhs | Rs. 5 crores |

| Asha Home Loan | 21 years | 60 years | Rs. 8,000 p.m. | Rs. 1 lakh | Rs. 35 lakhs |

| Top-Up Home Loan | NA | NA | NA | NA | Rs. 50 lakhs |

| Super Saver Home Loan | 24 years | 60 years | NA | Rs. 10 lakhs | Rs. 5 crores |

Home Loan Eligibility Calculators By Other Banks

People Also Asked

How can I check my Axis Bank home loan eligibility?

You can easily check your Axis Bank home loan eligibility by using the Axis Bank home loan eligibility calculator.

How much loan am I eligible for Axis Bank?

The loan amount you are eligible for from Axis Bank depends on various factors such as your income, repayment capacity, property value, location, credit score, and other criteria. Ideally, you can use the Axis Bank home loan eligibility calculator to estimate the maximum loan amount you are eligible for.

How will I know if my eligibility criteria have been met for Axis Bank home loans?

To know if your eligibility criteria for Axis Bank home loans are met, use the Home Loan Eligibility Calculator Axis Bank. You can easily locate this calculator on the official website of Axis Bank.

How can I increase my eligibility for a higher Axis Bank home loan amount?

Following are some tips you can keep in mind to increase your eligibility for securing a higher loan amount: maintain a good credit score, reduce your debt-to-income ratio, affix co-applicant, present all your income sources, and avoid multiple loan applications.

Quick Links

Home Loan by Private Bank

- Federal Bank Home Loan

- Reliance Capital Home Loan

- DCB Bank Home Loan

- ICICI Bank Home Loan

- YES Bank Home Loan

- RBL Bank Home Loan

- IDFC FIRST Bank Home Loan

- HDFC Bank Home Loan

- Axis Bank Home Loan

- Deutsche Bank Home Loan

- karnataka bank Home Loan

- karur Vysya Bank Home Loan

- Kotak Bank Home Loan

- Housing Development Finance Corporation Home Loan

- IndusInd Bank Home Loan

- IDBI Bank Home Loan

- HSBC Home Loan

- LIC Housing Finance Home Loan

- CITI Bank Home Loan

- HDFC Sales Home Loan

Home Loan by Nationalized Bank

Home Loan by NBFC

- Clix Capital Home Loan

- Hero FinCorp Home Loan

- Cholamandalam Finance Home Loan

- Vastu Housing Finance Home Loan

- Home First Finance Company Home Loan

- Aadhar housing Finance Home Loan

- DHFL Home Loan

- Muthoot Finance Ltd Home Loan

- Edelweiss Financial Services Home Loan

- Piramal Finance Home Loan

- Hero Housing Finance Home Loan

- Fullerton India Home Loan

- Capital First Ltd. Home Loan

- Poonawalla Fincorp Limited Home Loan

- IndiaBulls Home Loan

- IIFL Finance Home Loan

- Ujjivan Small Finance Bank Home Loan

- Tata Capital Housing Finance Limited Home Loan

- L&T Finance Home Loan

- Aditya Birla Finance Limited Home Loan

- Godrej Housing Finance Home Loan

- Punjab National Bank Housing Finance Home Loan

- Bajaj Finserv Home Loan

- Capri Global Home Loan

Home Loan Calculators

Bank wise Home Loan Calculators

- Bajaj Finserv Home Loan Calculator

- Tata Capital Financial Services Ltd Home Loan Calculator

- Hero Fincorp Home Loan Calculator

- Karur Vysya Bank Home Loan Calculator

- Piramal Housing Finance Home Loan Calculator

- Tata Capital Housing Finance Limited Home Loan Calculator

- Punjab National Bank Home Loan Calculator

- Indusind Bank Home Loan Calculator

- Bank Of India Home Loan Calculator

- Lic Housing Finance Home Loan Calculator

- Punjab Sind Bank Home Loan Calculator

- Indian Bank Home Loan Calculator

- Hdfc Bank Home Loan Calculator

- Bank Of Maharashtra Home Loan Calculator

- Hsbc Home Loan Calculator

- Citi Bank Home Loan Calculator

- Canara Bank Home Loan Calculator

- Axis Bank Home Loan Calculator

- State Bank Of India Home Loan Calculator

- Rbl Bank Home Loan Calculator

- Karnataka Bank Home Loan Calculator

- Federal Bank Home Loan Calculator

- Deutsche Bank Home Loan Calculator

- Union Bank Of India Home Loan Calculator

- Yes Bank Home Loan Calculator

- Dcb Bank Home Loan Calculator

- Idfc First Bank Home Loan Calculator

- Kotak Bank Home Loan Calculator

- Idbi Bank Home Loan Calculator

- Icici Bank Home Loan Calculator

- Bank Of Baroda Home Loan Calculator

Bank Wise Home Loan Interest Rate

- Federal Bank Home Loan Interest Rate

- Reliance Capital Home Loan Interest Rate

- DCB Bank Home Loan Interest Rate

- ICICI Bank Home Loan Interest Rate

- YES Bank Home Loan Interest Rate

- RBL Bank Home Loan Interest Rate

- IDFC FIRST Bank Home Loan Interest Rate

- HDFC Bank Home Loan Interest Rate

- Axis Bank Home Loan Interest Rate

- Deutsche Bank Home Loan Interest Rate

- karnataka bank Home Loan Interest Rate

- karur Vysya Bank Home Loan Interest Rate

- Kotak Bank Home Loan Interest Rate

- Housing Development Finance Corporation Home Loan Interest Rate

- IndusInd Bank Home Loan Interest Rate

- IDBI Bank Home Loan Interest Rate

- HSBC Home Loan Interest Rate

- LIC Housing Finance Home Loan Interest Rate

- CITI Bank Home Loan Interest Rate

- HDFC Sales Home Loan Interest Rate

- Canara Bank Home Loan Interest Rate

- Punjab National Bank Home Loan Interest Rate

- Punjab & Sind Bank Home Loan Interest Rate

- State Bank of India Home Loan Interest Rate

- Bank of Baroda Home Loan Interest Rate

- Indian bank Home Loan Interest Rate

- Bank of India Home Loan Interest Rate

- Union Bank of India Home Loan Interest Rate

- Bank of Maharashtra Home Loan Interest Rate

- Clix Capital Home Loan Interest Rate

- Hero FinCorp Home Loan Interest Rate

- Cholamandalam Finance Home Loan Interest Rate

- Vastu Housing Finance Home Loan Interest Rate

- Home First Finance Company Home Loan Interest Rate

- Aadhar housing Finance Home Loan Interest Rate

- DHFL Home Loan Interest Rate

- Muthoot Finance Ltd Home Loan Interest Rate

- Edelweiss Financial Services Home Loan Interest Rate

- Piramal Finance Home Loan Interest Rate

- Hero Housing Finance Home Loan Interest Rate

- Fullerton India Home Loan Interest Rate

- Capital First Ltd. Home Loan Interest Rate

- Poonawalla Fincorp Limited Home Loan Interest Rate

- IndiaBulls Home Loan Interest Rate

- IIFL Finance Home Loan Interest Rate

- Ujjivan Small Finance Bank Home Loan Interest Rate

- Tata Capital Housing Finance Limited Home Loan Interest Rate

- L&T Finance Home Loan Interest Rate

- Aditya Birla Finance Limited Home Loan Interest Rate

- Godrej Housing Finance Home Loan Interest Rate

- Punjab National Bank Housing Finance Home Loan Interest Rate

- Bajaj Finserv Home Loan Interest Rate

- Capri Global Home Loan Interest Rate