- Home

- Credit Score

- ICICI Bank CIBIL Score

Check ICICI CIBIL Score and Improve Your ICICI Bank CIBIL Score

- Instant Results

- No Hidden Fees

- Secure & Confidential

- No Impact on Your Credit Report

I agree to the Terms and Conditions of TUCIBIL and hereby provide explicit consent to share my Credit Information with Urban Money Private Limited.

Verify your number

Enter 6 Digit OTP

Change mobile number

Table of Content

Last Updated: 14 December 2025

The ICICI CIBIL score is a crucial metric in your financial life. Often referred to as a CIBIL score, it is a numerical representation of your credit health. It ranges from 300 to 900 and is made by TransUnion CIBIL, a major credit information company. This score plays a key role when you apply for loans or credit cards as it helps lenders assess your creditworthiness, whether to lend you cash, at what interest rates, and more. A higher CIBIL score can streamline your loan approval process and secure low interest rates.

Your CIBIL score is namely calculated based on your credit history. These can include your repayment habits, the number of active loans and credit cards, and how much of your credit limit you utilise. So, understanding your CIBIL score is the key to better credit management. It helps you pinpoint areas that need improvement. Whether you’re aiming for a major loan or just looking to enhance your financial standing, we present everything you need to know about the ICICI Bank CIBIL score. Let’s get started!

How to Check Your ICICI CIBIL Score?

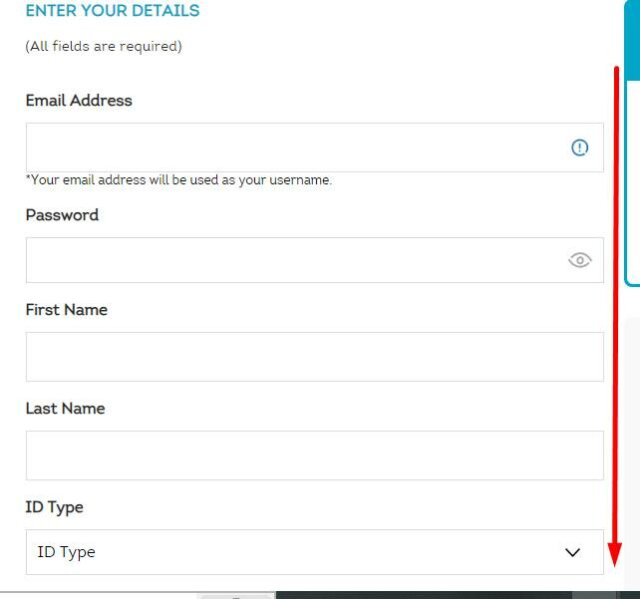

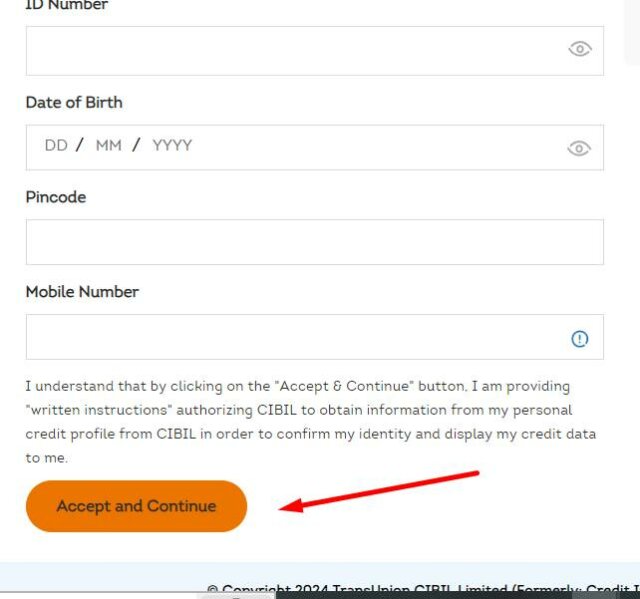

Following is the step-by-step procedure to check your ICICI CIBIL score:

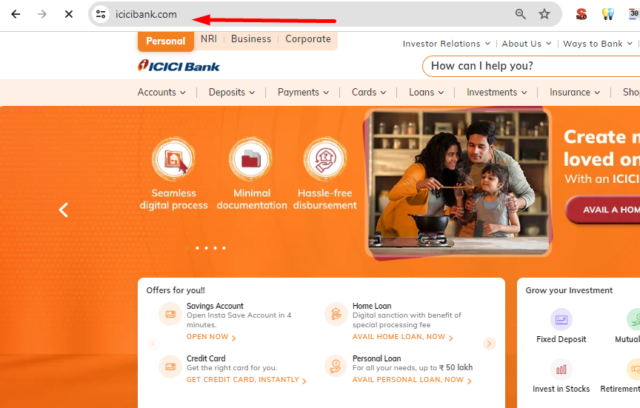

- Step 1: Browse the official ICICI Bank website.

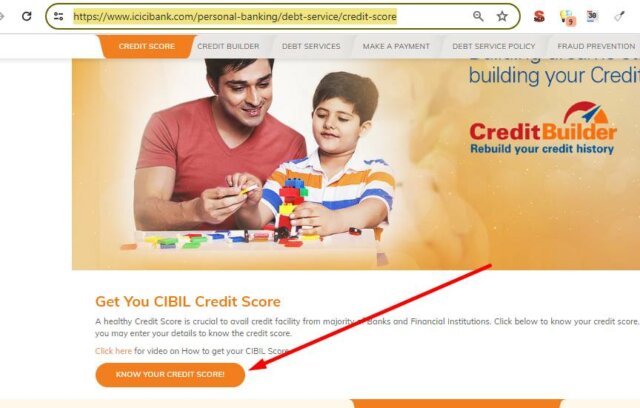

- Step 2: Click on ‘Know Your Credit Score’ to proceed.

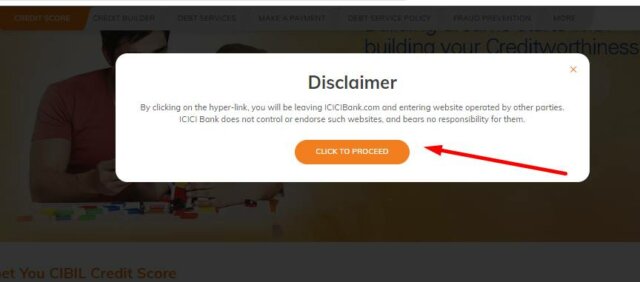

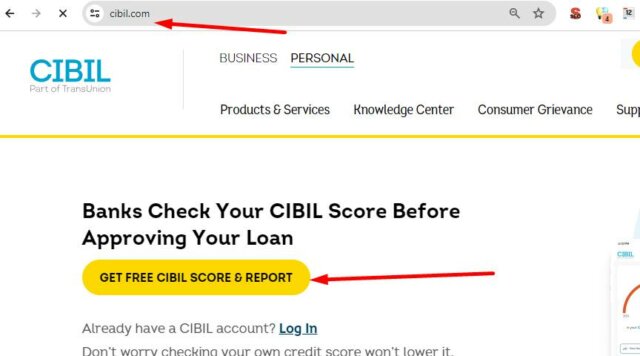

- Step 3: You will be redirected to a third-party site where you can enter your details to know your credit score.

- Step 4: Enter your basic details, such as gender, full name, email address, and mobile number.

- Step 5: Verify your identity using OTP authentication by clicking on the ‘Accept and Continue’

- Step 6: You can now view your CIBIL score and report, including your credit history and factors affecting your score.

Minimum CIBIL Score Needed for an ICICI Home Loan

Your CIBIL score is a primary factor in determining your eligibility for an ICICI home loan. A score of 750 or above is typically seen as favourable, increasing the likelihood of loan approval and favourable terms. However, securing a loan with a score of around 700 is still feasible, though you might encounter higher interest rates or stricter requirements. So, it’s prudent to keep your score higher. Even a small improvement can result in a better loan agreement and empower you to save a significant amount of your hard-earned money in the long run.

Minimum CIBIL Score Needed for an ICICI Personal Loan

The minimum CIBIL score for ICICI personal loans is considered to be 700. If your score is at or above this mark, you’re typically considered a low-risk borrower, which can lead to quicker loan approval and potentially better terms. A higher CIBIL score enhances loan eligibility and positions you for more attractive rates and terms. On the other hand, if your score is below 700, you may face unfavourable rates and terms, which can even lead to your application rejection.

Minimum CIBIL Score Needed for an ICICI Credit Card

It’s better to have an ICICI CIBIL score of 750 or more when you apply for a credit card from ICICI Bank. This high score is crucial because it shows the bank you manage your money responsibly. It reflects how you’ve handled loans and credit cards in the past, including how regularly you make payments. Thus, you might get better offers from the bank, such as cards with more benefits, lower interest rates, and higher limits. A good CIBIL score tells the bank you’re a trustworthy borrower, which is pivotal when the bank issues a credit card.

Factors Influencing Your ICICI CIBIL Score

Here are the factors that influence your ICICI Bank CIBIL score:

- Payment History (35%): Your payment history is the most influential factor, accounting for 35% of your CIBIL score. Regular and timely payments of credit card bills and EMIs enhance your score, while missed and late payments can cause them to plummet. This history reflects your financial discipline and reliability as a borrower.

- Credit Utilisation Ratio (30%): This measures how much credit you use compared to your available limit. Ideally, maintaining a credit utilisation ratio under 30% is seen as responsible credit behaviour. High utilisation can indicate over-leveraging and potential financial stress, negatively affecting your score.

- Credit Mix and Duration (25%): A healthy mix of secured (like home loans) and unsecured loans (like credit cards), along with a long history of credit usage, can positively impact your score. It suggests that you have experience managing different types of credit responsibly.

- New Credit (10%): Every time you apply for new credit, a hard inquiry is made, which can slightly lower your score. Making several applications within a short period can be perceived as credit hunger, a red flag for lenders.

- Other Factors (Remaining %): Other less influential factors include the number of active loans and credit cards, the frequency of credit limit increases, and the diversity of credit accounts. A balanced approach to credit without excessive loans or credit cards can contribute to a higher score.

ICICI CIBIL Score Ranges

Here are the applicable ranges of the ICICI CIBIL score:

| Score Range | Status |

| 750-900 | Excellent |

| 700-749 | Very Good |

| 650-699 | Good |

| 600-649 | Average |

| 300-599 | Poor |

How Your ICICI CIBIL Score Affects Loan Approval

Here are the key elements that affect your CIBIL score for ICICI personal loans or other types of credit products:

- Loan Eligibility: Your CIBIL score is a primary factor that lenders consider when assessing loan eligibility. A high score indicates responsible credit behaviour and a lower risk of default, making you a more attractive candidate for loan approval. Conversely, a low score can lead to outright rejection, signalling a higher risk to lenders.

- Interest Rates: A higher CIBIL score often translates to lower loan interest rates. Lenders view a high score as a sign of good credit management and offer more favourable terms. It can significantly reduce your overall borrowing cost.

- Loan Amount: The amount of credit or loan you can approve is also influenced by your CIBIL score. A higher score can mean access to a larger loan amount because it suggests a higher likelihood of timely repayment.

- Loan Approval Process: A good CIBIL score can streamline the approval process. Lenders are more likely to expedite the application process with high scores, leading to quicker fund disbursal.

- Negotiation Power: A strong CIBIL score gives you better leverage to negotiate the terms of your loan. This can include negotiating for a higher loan amount, lower interest rates, and more flexible repayment options.

How to Calculate Your ICICI CIBIL Score

Your ICICI CIBIL score is calculated by a major credit bureau company in India called CIBIL. Lenders report your credit history to CIBIL, which analyses this data to determine your CIBIL score. Namely, CIBIL uses a complex algorithm considering various aspects of your credit behaviour. These include your repayment track record, current credit usage, the types of credit you have (like loans and credit cards), and how long you’ve been using credit.

While ICICI Bank can provide you with access to check your CIBIL score, the score itself is computed by CIBIL (Credit Information Bureau India Limited) using data from all your credit activities across different financial institutions.

Moreover, you can visit the official CIBIL or ICICI website to get your ICICI Bank CIBIL score. You must provide the necessary personal and financial details and follow the steps to receive your credit report.

Latest from the Credit Score Blog

Get in-depth knowledge about all things related to Credit Score and your finances

Is 750 a Good Credit Score? Benefits and How to Achieve It

Easy Ways to Achieve a Credit Score of 750 A credit score of 750 is considered very good. It helps you get loans easily with low interest rates. You must manage your credit well and follow good financial habits to achiev

CIBIL Score Check For Union Bank of India

How to Check Union Bank of India CIBIL Score Urban Money offers a simple method to check your Union Bank of India cibil score at no cost! Here’s how to check your credit score on Urban Money’s website: Visit the Urban M

How a Single Missed Payment Can Impact Your CIBIL Score

Short-Term Consequences of Defaulted Repayments Defaulting on a repayment can hurt your financial reputation and lead to several immediate effects. Here are a few short-term consequences that can happen if you miss a sin

How to Resolve CRIF High Mark Credit Report Errors

Common Errors Found in CRIF High Mark Credit Reports Here are the common errors found in CRIF High Mark credit reports: Closed Accounts Showing as Open: Accounts you have paid off may still appear open. This can affect

Why Checking Your CIBIL Score is Crucial Before Applying for a Loan

Understanding CIBIL Score A CIBIL score is a three-digit number that shows how responsible you are with money and credit. It ranges from 300 to 900, with a higher score meaning you handle credit well. Credit Information

How Gold Loans Affect Your CIBIL Score and Tips to Protect It

Does Taking a Gold Loan Affect Your CIBIL Score? The short answer is yes, it does. However, whether the impact is positive or negative depends entirely on how you manage your gold loan. When you take out a gold loan, you

Managing CIBIL Score and Financial Emergencies

Understanding CIBIL Score Basics A CIBIL score is a three-digit number between 300 and 900 that shows your creditworthiness. It is based on your credit history, which includes how you have handled loans and credit cards.

Role of CIBIL Score in Car Loan Approval and Terms

How CIBIL Scores Influence Car Loan Approval? The CIBIL score is a three-digit number that ranges between 300 and 900. A higher score indicates better creditworthiness and vice versa. Lenders typically prefer applicants

Kotak CIBIL Score: How to Check & Loan Requirements

How to Check Your Kotak CIBIL Score? Checking your CIBIL score regularly is crucial for maintaining a healthy credit profile. Here is a step-by-step details to checking your Kotak CIBIL score: Visit the Official CIBIL W

CIBIL Score for Car Loans: Top Picks for 2025

List of Best Car Loan in India 2025 Here are some of the best available car loan options in India with minimal interest rates and low processing fees: State Bank of India Car Loan SBI offers a fantastic deal to finance

Does Checking Your CIBIL Score Impact Your Credit Score?

Does Checking Your CIBIL Score Affect It? True or False? The short answer is false. Checking your CIBIL score is considered a soft inquiry and does not impact your credit score. People often get confused because they fai

How to Avoid Credit Repair Scams and Protect Your Credit Score

Understanding Credit Repair Scams Credit repair scams are traps set by individuals into luring you by offering you a magical solution that practically holds no meaning. They use sneaky tricks to make you believe they can

Difference Between Equifax & CIBIL Score

Equifax Vs CIBIL Understanding credit scores is paramount for securing loans and credit cards in India. Equifax and CIBIL (TransUnion CIBIL) are prominent players in this arena. While both provide credit information to l

How Student Loans Influence Your Credit Score

The Impact of Student Loans on Your Credit Score The impact of education loans on CIBIL scores can be positive and negative. As mentioned above, the outcome largely depends on managing your credits. For a more detailed i

How Bankruptcy Impacts Your Credit Score

Impact of Bankruptcy on Your Credit Score Here are the key aspects of how bankruptcy impacts on your credit score and beyond: 1. Significant Drop in Credit Score Your credit score takes a massive hit when you file for ba