- Home

- Credit Score

- Credit Score And Home Loan Csgen

CIBIL Score for Home Loan

A CIBIL score, also known as a credit score, is a number that represents your creditworthiness. It shows how well you manage and repay your loans and credit card bills. This score ranges from 300 to 900, with higher scores being better.

Why is this important? When you apply for a home loan or any other type of credit, banks check your CIBIL score for a home loan to decide if they should lend you money. A higher score increases your chances of getting a loan approved and can even get you better interest rates. On the other hand, a low score can make it difficult to get a loan or result in higher interest rates. But don't worry. Even if you have a low score, you can take steps to improve it and increase your financial opportunities.

- Instant Results

- No Hidden Fees

- Secure & Confidential

- No Impact on Your Credit Report

I agree to the Terms and Conditions of TUCIBIL and hereby provide explicit consent to share my Credit Information with Urban Money Private Limited.

Verify your number

Enter 6 Digit OTP

Change mobile number

Table of Content

CIBIL Score Required to Avail of a Home Loan

Lenders look for reliability in borrowers. A high CIBIL score for home loans gives them confidence, speeding up the approval process. Conversely, a low score might lead to delays in loan approval.

Remember that different lenders may have slightly different requirements, but aiming for a CIBIL score of 750 or above is generally a good idea when seeking a home loan. If your score is between 650 and 750, it’s beneficial to improve it to ensure a smoother loan approval process.

Credit Score Range and a Good Cibil Score For Home Loan

Although there is no fixed minimum, a CIBIL score of 750 or higher is typically good for home loan approval. Let’s explore the credit score range and what is considered a good CIBIL score for home loan approval:

Credit Score Range

The CIBIL score spans from 300 to 900. Here’s how it is generally classified:

| Range | Classification |

| 800 & Above | Excellent |

| 750 – 799 | Very Good |

| 700 – 749 | Good |

| 650 – 699 | Fair |

| Below 650 | Poor |

How Do Lenders Use CIBIL Scores for Home Loans?

Lenders use CIBIL scores as a key factor when you apply for a home loan. Here’s how they use these scores:

Risk Assessment

Lenders check your credit score to see how risky it is to lend you money. They look at how well you have managed credit in the past, like paying bills on time and how much debt you have. A higher CIBIL score shows that you handle credit responsibly, which makes lenders feel more confident that you will repay the loan on time.

Interest Rate Determination

Your credit score affects the interest rate you get on a home loan. A higher score usually means you will get a lower interest rate, saving you money on monthly payments and over the life of the loan. On the other hand, a lower score can lead to higher interest rates, making the loan more expensive.

Loan Approval

A high CIBIL score enhances your chances of getting your home loan approved. Lenders are more willing to approve loans for people with strong credit histories because they are seen as less likely to default. A high score makes the approval process quicker and easier.

Loan Amount and Terms

A good credit score can also influence the amount of money a lender will give you and the home loan terms. With a high CIBIL score, you can get a larger loan amount, which is helpful if you buy an expensive property. A good score can also lead to better loan terms, like a longer repayment period or lower fees, making the loan more affordable.

Keeping a good CIBIL score for a home loan is important for getting favourable terms and a smoother approval process. By managing your credit score well, you increase your chances of getting the best deal on your home loan.

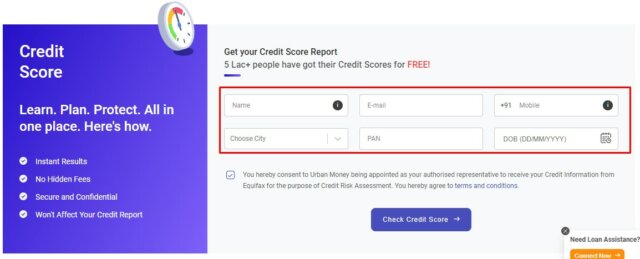

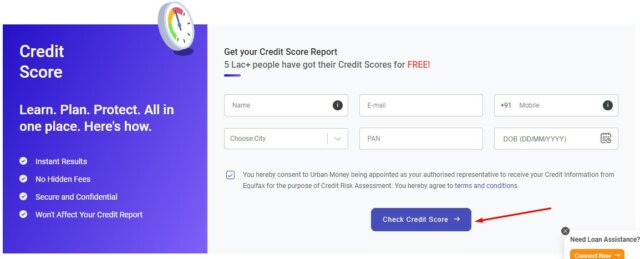

How to View Your CIBIL Score on Urban Money?

Urban Money offers a simple way to check your credit score for free! Here’s how you can do it on their website:

- Visit the Website: Go to the Urban Money website and navigate to the credit score page.

- Fill Out the Form: Enter your basic details, such as Name, Mobile Number, and Email Address. This will trigger Experian to send your phone a One-Time Password (OTP).

- Verify with OTP: Enter the OTP you received, and your credit report will appear on the screen. A copy will also be sent to your email; you can download it as a PDF.

- Provide Additional Information (If Needed): If you have trouble accessing your report, you might need to provide more details, such as your Permanent Account Number, City, and Gender. Once these are verified, you will see your report and receive an email copy.

- Complete a Verification Form (If Needed): If you still can’t view your report, you might have to answer a Q&A form from Experian to confirm your identity. Once submitted, you should be able to access your full credit report.

Ways to Boost Your CIBIL Score for Home Loan Approval

Improving your CIBIL score is important before applying for a home loan. Here are some easy tips to boost your credit score:

Timely Payments

Always pay your EMIs and credit card bills on time. Regularly spending time shows you are responsible with credit and helps increase your score.

Credit Card Management

Use your credit card wisely. Don’t max out your credit limit; keep your credit utilisation low. Regularly using your card and paying off the balance can help improve your score.

Loan Tenure

When you take loans, choose longer repayment periods. Longer tenures help you manage your finances better and ease the impact on your credit score.

Avoid Frequent Loan Applications

Don’t apply for many loans at once. Each application checks your credit, which can temporarily lower your score. Focus on making quality applications instead of many.

Monitor Your Credit Report

Check your credit report regularly for mistakes and fix any errors quickly. Knowing your credit history can help you take the right actions if needed.

Remember, a good CIBIL score increases your chances of getting a home loan with good terms and low interest rates.

Can a CIBIL Defaulter get a Home Loan?

Banks might approve a home loan for someone with a bad CIBIL score if the applicant’s overall profile is strong. If you are in this situation, here’s what you can do:

Pay Off Outstanding Debts

Clear any unpaid debts. This shows that you are serious about fixing your finances and paying off any outstanding debts to improve your credit score.

Work on Your Credit Score

Focus on raising your credit score before applying for a home loan.

Make timely payments, use credit cards responsibly, and manage your existing loans well.

Remember, having a bad CIBIL score makes getting a home loan harder, but taking these steps can improve your chances.

Credit Score Guide

Get in-depth knowledge about all things related to Credit Score and your finances

Is 750 a Good Credit Score? Benefits and How to Achieve It

Easy Ways to Achieve a Credit Score of 750 A credit score of 750 is considered very good. It helps you get loans easily with low interest rates. You must manage your credit well and follow good financial habits to achiev

CIBIL Score Check For Union Bank of India

How to Check Union Bank of India CIBIL Score Urban Money offers a simple method to check your Union Bank of India cibil score at no cost! Here’s how to check your credit score on Urban Money’s website: Visit the Urban M

How a Single Missed Payment Can Impact Your CIBIL Score

Short-Term Consequences of Defaulted Repayments Defaulting on a repayment can hurt your financial reputation and lead to several immediate effects. Here are a few short-term consequences that can happen if you miss a sin

How to Resolve CRIF High Mark Credit Report Errors

Common Errors Found in CRIF High Mark Credit Reports Here are the common errors found in CRIF High Mark credit reports: Closed Accounts Showing as Open: Accounts you have paid off may still appear open. This can affect

Why Checking Your CIBIL Score is Crucial Before Applying for a Loan

Understanding CIBIL Score A CIBIL score is a three-digit number that shows how responsible you are with money and credit. It ranges from 300 to 900, with a higher score meaning you handle credit well. Credit Information

How Gold Loans Affect Your CIBIL Score and Tips to Protect It

Does Taking a Gold Loan Affect Your CIBIL Score? The short answer is yes, it does. However, whether the impact is positive or negative depends entirely on how you manage your gold loan. When you take out a gold loan, you

Managing CIBIL Score and Financial Emergencies

Understanding CIBIL Score Basics A CIBIL score is a three-digit number between 300 and 900 that shows your creditworthiness. It is based on your credit history, which includes how you have handled loans and credit cards.

Role of CIBIL Score in Car Loan Approval and Terms

How CIBIL Scores Influence Car Loan Approval? The CIBIL score is a three-digit number that ranges between 300 and 900. A higher score indicates better creditworthiness and vice versa. Lenders typically prefer applicants

Kotak CIBIL Score: How to Check & Loan Requirements

How to Check Your Kotak CIBIL Score? Checking your CIBIL score regularly is crucial for maintaining a healthy credit profile. Here is a step-by-step details to checking your Kotak CIBIL score: Visit the Official CIBIL W

CIBIL Score for Car Loans: Top Picks for 2025

List of Best Car Loan in India 2025 Here are some of the best available car loan options in India with minimal interest rates and low processing fees: State Bank of India Car Loan SBI offers a fantastic deal to finance

Does Checking Your CIBIL Score Impact Your Credit Score?

Does Checking Your CIBIL Score Affect It? True or False? The short answer is false. Checking your CIBIL score is considered a soft inquiry and does not impact your credit score. People often get confused because they fai

How to Avoid Credit Repair Scams and Protect Your Credit Score

Understanding Credit Repair Scams Credit repair scams are traps set by individuals into luring you by offering you a magical solution that practically holds no meaning. They use sneaky tricks to make you believe they can

Difference Between Equifax & CIBIL Score

Equifax Vs CIBIL Understanding credit scores is paramount for securing loans and credit cards in India. Equifax and CIBIL (TransUnion CIBIL) are prominent players in this arena. While both provide credit information to l

How Student Loans Influence Your Credit Score

The Impact of Student Loans on Your Credit Score The impact of education loans on CIBIL scores can be positive and negative. As mentioned above, the outcome largely depends on managing your credits. For a more detailed i

How Bankruptcy Impacts Your Credit Score

Impact of Bankruptcy on Your Credit Score Here are the key aspects of how bankruptcy impacts on your credit score and beyond: 1. Significant Drop in Credit Score Your credit score takes a massive hit when you file for ba