- Home

- Credit Score

- Credit Monitoring Csgen

Credit Monitoring

Credit monitoring is a powerful tool that empowers individuals to take control of their credit health. It involves regularly checking your credit report and score to ensure accuracy and detect abnormal activity. Your credit report, a comprehensive record of your borrowing and repayment behaviour, and your credit score, a numerical representation of your creditworthiness, are at your fingertips.

For those new to credit monitoring, understanding its importance is key to your financial security. By monitoring your credit, you can identify errors or fraudulent activity early, potentially saving you from financial harm. Moreover, credit monitoring keeps you informed about your financial standing and tracks your progress towards building good credit, providing a safety net for your financial future.

Credit monitoring services typically offer features such as alerts for changes to your credit report, identity theft protection, and credit score tracking. While some services may charge a fee, many offer free options.

This overview will explore the basics of credit monitoring, how it works, why it's important, and the available options for monitoring your credit. By the end, you will better understand how credit monitoring can benefit you on your financial journey.

- Instant Results

- No Hidden Fees

- Secure & Confidential

- No Impact on Your Credit Report

I agree to the Terms and Conditions of TUCIBIL and hereby provide explicit consent to share my Credit Information with Urban Money Private Limited.

Verify your number

Enter 6 Digit OTP

Change mobile number

Table of Content

1. How Does Credit Monitoring Work? |

2. How to Monitor Your Credit Score |

3. Benefits of Credit Monitoring |

4. What is the Fee for Credit Monitoring |

How Does Credit Monitoring Work?

Credit monitoring monitors your credit report and lets you know if anything strange happens. Here’s how it works:

- Watching Credit Reports: These services keep track of your credit history. They look at your accounts, inquiries, and other credit stuff. If something fishy happens, they’ll send you a message.

- Spotting Identity Theft and Fraud: Cybercriminals sometimes steal personal information (like credit cards or Social Security numbers) and use it without permission. Credit monitoring helps catch them before it’s too late. For example, the service will tell you if someone opens a new credit card in your name.

- Tracking Credit Scores: Some services also give updates on your credit scores. This helps you see how good your credit is, which can help you plan for things like getting a loan or a mortgage.

- Picking a Service: These services come in different types and prices. Some are free, so just watch your credit score. Others cost money, but keep an eye on more things, like your bank accounts and credit cards. Think about what you need and pick the right service for you.

How to Monitor Your Credit Score

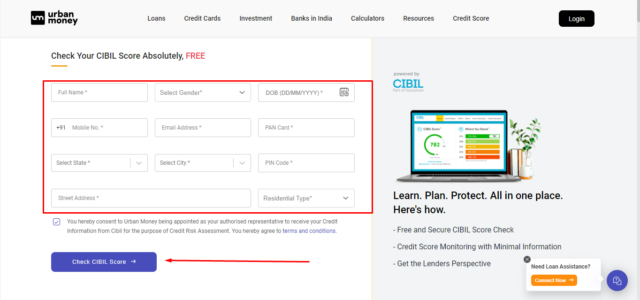

Urban Money provides you with an easy way to monitor your credit score for free! Following are the ways to access your credit score on Urban Money’s website:

- Visit the Urban Money’s website. Go to our credit score webpage. Access the credit score site.

- Complete the form with basic personal details such as Name, Mobile Number, and Email Address. This will prompt Experian to send a One-Time Password (OTP) to the provided phone number.

- Verify that the OTP was received and that your credit report will appear on the screen.

Simultaneously, Experian will send a copy to the registered email address. You also have the option to download the report in PDF format. Authenticate the OTP.

However, if you encounter difficulties accessing your credit report using this method, you may need to provide additional information such as Permanent Account Number, City, and Gender. Once these details are verified, your credit report will be displayed, and a copy will be sent to your email.

If you still cannot view your credit report, you may need to complete a Q&A form designed by Experian to verify your identity. Upon submission of this form, you should be able to access your detailed credit report.

Benefits of Credit Monitoring

Credit monitoring offers various benefits:

- Early Detection of Suspicious Activity: It helps detect any unusual or fraudulent activity on your credit report, such as unauthorised transactions or new account openings, allowing you to take action promptly.

- Protection Against Identity Theft: Credit monitoring can prevent or lessen the damage caused by identity theft by alerting you to signs of theft, such as someone using your personal information without permission.

- Maintaining Financial Health: Monitoring your credit helps you stay aware of your financial standing and track changes in your credit score over time. This awareness enables you to make informed decisions and take steps to improve your creditworthiness.

- Peace of Mind: Knowing your credit is being monitored can provide peace of mind. You will be notified promptly of any suspicious activity, allowing you to address issues before they escalate.

- Access to Credit Score Information: Some credit monitoring services provide regular updates on your credit score, giving you insight into your creditworthiness and helping you understand how lenders may view you.

- Assistance in Financial Planning: Understanding your credit status through monitoring can aid in financial planning, such as preparing for major credit-related decisions like applying for loans or mortgages.

What is the Fee for Credit Monitoring

Urban Money offers free credit monitoring. All you have to do is visit the official Urban Money website and monitor your credit score for free!

Credit Score Guide

Get in-depth knowledge about all things related to Credit Score and your finances

Is 750 a Good Credit Score? Benefits and How to Achieve It

Easy Ways to Achieve a Credit Score of 750 A credit score of 750 is considered very good. It helps you get loans easily with low interest rates. You must manage your credit well and follow good financial habits to achiev

CIBIL Score Check For Union Bank of India

How to Check Union Bank of India CIBIL Score Urban Money offers a simple method to check your Union Bank of India cibil score at no cost! Here’s how to check your credit score on Urban Money’s website: Visit the Urban M

How a Single Missed Payment Can Impact Your CIBIL Score

Short-Term Consequences of Defaulted Repayments Defaulting on a repayment can hurt your financial reputation and lead to several immediate effects. Here are a few short-term consequences that can happen if you miss a sin

How to Resolve CRIF High Mark Credit Report Errors

Common Errors Found in CRIF High Mark Credit Reports Here are the common errors found in CRIF High Mark credit reports: Closed Accounts Showing as Open: Accounts you have paid off may still appear open. This can affect

Why Checking Your CIBIL Score is Crucial Before Applying for a Loan

Understanding CIBIL Score A CIBIL score is a three-digit number that shows how responsible you are with money and credit. It ranges from 300 to 900, with a higher score meaning you handle credit well. Credit Information

How Gold Loans Affect Your CIBIL Score and Tips to Protect It

Does Taking a Gold Loan Affect Your CIBIL Score? The short answer is yes, it does. However, whether the impact is positive or negative depends entirely on how you manage your gold loan. When you take out a gold loan, you

Managing CIBIL Score and Financial Emergencies

Understanding CIBIL Score Basics A CIBIL score is a three-digit number between 300 and 900 that shows your creditworthiness. It is based on your credit history, which includes how you have handled loans and credit cards.

Role of CIBIL Score in Car Loan Approval and Terms

How CIBIL Scores Influence Car Loan Approval? The CIBIL score is a three-digit number that ranges between 300 and 900. A higher score indicates better creditworthiness and vice versa. Lenders typically prefer applicants

Kotak CIBIL Score: How to Check & Loan Requirements

How to Check Your Kotak CIBIL Score? Checking your CIBIL score regularly is crucial for maintaining a healthy credit profile. Here is a step-by-step details to checking your Kotak CIBIL score: Visit the Official CIBIL W

CIBIL Score for Car Loans: Top Picks for 2025

List of Best Car Loan in India 2025 Here are some of the best available car loan options in India with minimal interest rates and low processing fees: State Bank of India Car Loan SBI offers a fantastic deal to finance

Does Checking Your CIBIL Score Impact Your Credit Score?

Does Checking Your CIBIL Score Affect It? True or False? The short answer is false. Checking your CIBIL score is considered a soft inquiry and does not impact your credit score. People often get confused because they fai

How to Avoid Credit Repair Scams and Protect Your Credit Score

Understanding Credit Repair Scams Credit repair scams are traps set by individuals into luring you by offering you a magical solution that practically holds no meaning. They use sneaky tricks to make you believe they can

Difference Between Equifax & CIBIL Score

Equifax Vs CIBIL Understanding credit scores is paramount for securing loans and credit cards in India. Equifax and CIBIL (TransUnion CIBIL) are prominent players in this arena. While both provide credit information to l

How Student Loans Influence Your Credit Score

The Impact of Student Loans on Your Credit Score The impact of education loans on CIBIL scores can be positive and negative. As mentioned above, the outcome largely depends on managing your credits. For a more detailed i

How Bankruptcy Impacts Your Credit Score

Impact of Bankruptcy on Your Credit Score Here are the key aspects of how bankruptcy impacts on your credit score and beyond: 1. Significant Drop in Credit Score Your credit score takes a massive hit when you file for ba