- Home

- Credit Score

- Cibil Report Access Download Csgen

How to Check, Download, and Understand Your CIBIL Report

- Instant Results

- No Hidden Fees

- Secure & Confidential

- No Impact on Your Credit Report

I agree to the Terms and Conditions of TUCIBIL and hereby provide explicit consent to share my Credit Information with Urban Money Private Limited.

Verify your number

Enter 6 Digit OTP

Change mobile number

Table of Content

Do you often find that your credit score is limiting your opportunities? If yes, then you are not alone! But what if you could unlock better loan rates, lower insurance premiums, and even your dream rentals by improving your CIBIL score? The path to financial freedom starts with realising the power of your CIBIL score.

A credit score is a numerical representation of an individual’s creditworthiness, used to assess their ability to repay borrowed funds. Typically ranging from 300 to 900, the highest score signifies a reliable borrower. Having a high credit score for loan and credit card applications is good. If your score is low or in the lower range, you haven’t been responsible for paying back loans or debts on time.

A strong CIBIL score can be your greatest asset, from effortlessly securing loans to negotiating improved credit terms. However, this number remains a hurdle for many because of misunderstandings and miscommunication.

We will help you improve your financial standing. This will involve making payments on time and using credit wisely. Through this blog, we aim to ensure your CIBIL score accurately represents your ability to borrow money.

How do you check and download the CIBIL Report?

Here are three simple steps to access your CIBIL score via Urban Money without charges.

- Step 1: Go to our credit score webpage. (https://www.urbanmoney.com/credit-score)

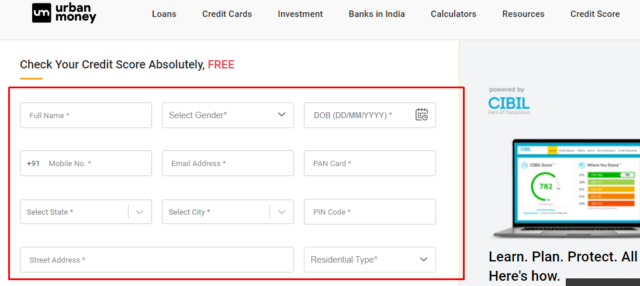

- Step 2: Fill in your personal information, such as your Name, Mobile Number, and Email Address. Experian will send you a one-time password (OTP) to your provided phone number.

- Step 3: Verify the OTP, and your credit report will appear on the screen. Experian will also send a copy to your registered email address. You can download the report as a PDF file if you prefer.

Components of a CIBIL Report

A CIBIL report, also known as a credit information report (CIR), is a detailed document that provides an overview of an individual’s credit history and score. Compiled by the Credit Information Bureau (India) Limited (CIBIL), this report plays an important role in a lender’s decision-making process regarding loan approvals and interest rates offered to the borrower.

Here are the key components of a CIBIL report:

- CIBIL Score: The CIBIL credit bureau determines a CIBIL score between 300 and 900 based on factors like credit history and repayment patterns. A score between 750 and 900 is considered favorable. A higher CIBIL score indicates that you are highly creditworthy, which improves your likelihood of obtaining favourable loan interest rates and credit card offers.

- Personal Information: This section contains all your personal details, such as your name, date of birth, and unique identification numbers, such as PAN and Aadhaar. It is important to double-check that the information provided is correct. The bank is responsible for submitting these details to the bureau.

- Contact Information: This section will include your phone number, landline number, home address, and email address.

- Employment Information: This section of the CIBIL report details your job. It will indicate the nature of your work, such as whether you are a salaried employee, a professional, or a businessperson. Additionally, it will state the amount of money you earn monthly or yearly, as reported by banks.

- Account Information: The CIBIL report provides important information about your credit accounts, including loans, cards, defaults, late payments, outstanding amounts, current balances, account opening dates, and most recent payments.

- Enquiry Information: This section records past lender enquiries, including dates, purposes, and amounts. It advises against making multiple inquiries frequently to avoid appearing credit-hungry and triggering hard inquiries from lenders.

- Days Past Due (DPD): Indicates the number of days a payment on an account is late. A value of “000” means payments were made on time, while any other number indicates a delay in payment for that many days.

Importance of a CIBIL Report

Lenders like to review your credit report when you request a loan or credit card, as it reveals your creditworthiness. By examining your past borrowing behaviour, they can determine if you have been a responsible borrower. A CIBIL report showcasing timely payments, minimal credit inquiries, and a positive credit history will increase your likelihood of getting loan approval.

Factors Affecting the CIBIL Score

The following are some significant factors that affect your credit score:

Loan Repayment History: Paying your loans on time can significantly improve your credit score. However, failing to make your EMIs or late payments will negatively affect your CIBIL score. Your repayment history plays an important role in determining your CIBIL score.

Credit History Duration: The length of time you have been using credit cards or loans and consistently making payments on them also plays a role in determining your credit score. A history of responsible credit behaviour over a significant period demonstrates discipline. This factor has a moderate impact on your overall credit score.

Number of Inquiries: When you apply for a new credit item, the lender looks into your credit score. We call these inquiries by lenders and financial institutions “hard inquiries.” A substantial number of hard inquiries indicates a strong need for credit, which will lower your credit score. In the near term, having several hard inquiries at once might greatly influence your credit score. On the other hand, obtaining or reviewing your credit report is regarded as a Soft Inquiry and does not affect your credit score.

Credit Utilisation Ratio (CUR): It refers to the proportion of your credit spending to the amount you can access. Maintaining a CUR below 30% of your available credit limit is advised. Even if your CUR is slightly higher, it will not significantly affect your credit score as long as you make timely payments on your credit card bill. However, consistently reaching the maximum limit on your credit card may indicate a strong reliance on credit, which can influence your credit score.

Mix of Credit: If you have responsibly repaid your different loans, such as personal, auto, or home loans, it demonstrates your ability to manage different types of credit. This gradual development of a favourable credit mix can positively influence your credit profile. On the contrary, if you have taken on an excessive amount of unsecured loans, it suggests a strong desire for credit and an excessive reliance on it. While this may impact your credit score, it is unlikely to be significant if your repayment history is strong. However, it is important to note that having several active loans simultaneously can result in a high “EMI to NMI ratio,” which may reduce your chances of getting additional credit.

In addition to the five main factors mentioned above that determine your CIBIL score, other elements can also affect it. These include mistakes in your credit report, a limited credit history, and an inability to fulfil your responsibilities as a loan guarantor. While these factors may negatively impact your credit score, they are not as significant as the primary factors.

Importance of Reviewing CIBIL Credit Report Regularly:

Monitoring your credit report is important to stay informed about your credit score. This report contains important details such as personal information, account specifics, payment history, outstanding balance, Days Past Due (DPD), if applicable, as well as active and closed accounts, recent inquiries, and collateral/security information. Most lenders require this information to process new credit applications.

By regularly checking your credit report, you can identify any errors or inaccurate/incomplete information that may impact your creditworthiness and potentially lower your credit score. If you discover any errors, it is important to report and resolve them promptly by submitting an online dispute resolution form through CIBIL’s official website using the Consumer Dispute Resolution Process.

Impact of CIBIL Credit Report on Loan Approvals

The CIBIL credit report is important in India’s loan approval process. Its impact on loan approvals is significant for several reasons:

Assessment of Creditworthiness: Lenders use the CIBIL report as a primary tool to assess an applicant’s creditworthiness. It helps them evaluate the risk associated with lending to the individual.

Interest Rates: Applicants with higher CIBIL scores often qualify for loans with more favourable interest rates. Lenders view them as low-risk borrowers willing to offer loans at lower rates.

Loan Amount and Tenure: The CIBIL report also impacts the loan amount and tenure that lenders are willing to offer. A strong credit history can lead to higher loan amounts and more flexible repayment periods.

Quick Processing and Approval: A clean and strong CIBIL report can lead to quicker loan processing.

Pre-approved Offers: Individuals with excellent credit histories often receive pre-approved loan offers based on the lender’s assessment of the CIBIL report. These offers come with expedited approval processes and attractive terms.

Impact on Unsecured Loans: Unsecured loans, such as personal loans and credit cards, rely heavily on the CIBIL report for approval, given the lack of collateral. A good report is essential for approval and favourable terms.

Risk Evaluation: The repayment history and credit utilisation ratio detailed in the report give lenders insight into the applicant’s financial management skills, which are necessary for unsecured loan approvals.

Better Negotiating Power: Applicants with high CIBIL scores have better leverage in negotiating loan terms, including interest rates, processing fees, and repayment schedules.

Documents Required for the CIBIL Credit Report

To get your CIBIL credit report, you must submit a request to CIBIL online or by mail. The process involves verifying your identity to ensure that sensitive financial information is securely and correctly handed over. Here is a list of documents commonly required to get your CIBIL report:

- Identity Proof: PAN Card/ Aadhaar Card/ Passport/ Voter ID Card/ Driver’s License

- Address Proof: Aadhaar Card/ Passport/ Voter ID Card/ Utility bills (electricity, water, gas) not older than 3 months/ Bank statements or passbook with current address/ Rental agreement or lease deed

CIBIL Customer Care

Contact CIBIL customer care via

Phone: Monday to Friday (10:00 a.m. to 6:00 p.m.)

+91-22-6140-4300

Fax:

+91 – 22 – 6638 4666

Address:-

TransUnion CIBIL Limited (Formerly: Credit Information Bureau (India) Limited)

One Indiabulls Centre, Tower 2A, 19th Floor, Senapati Bapat Marg, Elphinstone Road, Mumbai – 400013

Website:

To get in touch, simply go to https://www.CIBIL.com and click on ‘Contact Us’. Select ‘To Contact Us Online’ from there and click ‘Click here’. Fill in the required information and hit ‘Submit’.

FAQs

Can I access my CIBIL credit report for free?

How do you download the CIBIL report PDF for free?

How is the CIBIL score calculated?

How can I pay for the credit report?

What if I send the wrong details by mistake?

Credit Score Guide

Get in-depth knowledge about all things related to Credit Score and your finances

Is 750 a Good Credit Score? Benefits and How to Achieve It

Easy Ways to Achieve a Credit Score of 750 A credit score of 750 is considered very good. It helps you get loans easily with low interest rates. You must manage your credit well and follow good financial habits to achiev

CIBIL Score Check For Union Bank of India

How to Check Union Bank of India CIBIL Score Urban Money offers a simple method to check your Union Bank of India cibil score at no cost! Here’s how to check your credit score on Urban Money’s website: Visit the Urban M

How a Single Missed Payment Can Impact Your CIBIL Score

Short-Term Consequences of Defaulted Repayments Defaulting on a repayment can hurt your financial reputation and lead to several immediate effects. Here are a few short-term consequences that can happen if you miss a sin

How to Resolve CRIF High Mark Credit Report Errors

Common Errors Found in CRIF High Mark Credit Reports Here are the common errors found in CRIF High Mark credit reports: Closed Accounts Showing as Open: Accounts you have paid off may still appear open. This can affect

Why Checking Your CIBIL Score is Crucial Before Applying for a Loan

Understanding CIBIL Score A CIBIL score is a three-digit number that shows how responsible you are with money and credit. It ranges from 300 to 900, with a higher score meaning you handle credit well. Credit Information

How Gold Loans Affect Your CIBIL Score and Tips to Protect It

Does Taking a Gold Loan Affect Your CIBIL Score? The short answer is yes, it does. However, whether the impact is positive or negative depends entirely on how you manage your gold loan. When you take out a gold loan, you

Managing CIBIL Score and Financial Emergencies

Understanding CIBIL Score Basics A CIBIL score is a three-digit number between 300 and 900 that shows your creditworthiness. It is based on your credit history, which includes how you have handled loans and credit cards.

Role of CIBIL Score in Car Loan Approval and Terms

How CIBIL Scores Influence Car Loan Approval? The CIBIL score is a three-digit number that ranges between 300 and 900. A higher score indicates better creditworthiness and vice versa. Lenders typically prefer applicants

Kotak CIBIL Score: How to Check & Loan Requirements

How to Check Your Kotak CIBIL Score? Checking your CIBIL score regularly is crucial for maintaining a healthy credit profile. Here is a step-by-step details to checking your Kotak CIBIL score: Visit the Official CIBIL W

CIBIL Score for Car Loans: Top Picks for 2025

List of Best Car Loan in India 2025 Here are some of the best available car loan options in India with minimal interest rates and low processing fees: State Bank of India Car Loan SBI offers a fantastic deal to finance

Does Checking Your CIBIL Score Impact Your Credit Score?

Does Checking Your CIBIL Score Affect It? True or False? The short answer is false. Checking your CIBIL score is considered a soft inquiry and does not impact your credit score. People often get confused because they fai

How to Avoid Credit Repair Scams and Protect Your Credit Score

Understanding Credit Repair Scams Credit repair scams are traps set by individuals into luring you by offering you a magical solution that practically holds no meaning. They use sneaky tricks to make you believe they can

Difference Between Equifax & CIBIL Score

Equifax Vs CIBIL Understanding credit scores is paramount for securing loans and credit cards in India. Equifax and CIBIL (TransUnion CIBIL) are prominent players in this arena. While both provide credit information to l

How Student Loans Influence Your Credit Score

The Impact of Student Loans on Your Credit Score The impact of education loans on CIBIL scores can be positive and negative. As mentioned above, the outcome largely depends on managing your credits. For a more detailed i

How Bankruptcy Impacts Your Credit Score

Impact of Bankruptcy on Your Credit Score Here are the key aspects of how bankruptcy impacts on your credit score and beyond: 1. Significant Drop in Credit Score Your credit score takes a massive hit when you file for ba