- Home

- Credit Score

- CIBIL Score with PAN Card

How to Check CIBIL Score with PAN Card

- Instant Results

- No Hidden Fees

- Secure & Confidential

- No Impact on Your Credit Report

I agree to the Terms and Conditions of TUCIBIL and hereby provide explicit consent to share my Credit Information with Urban Money Private Limited.

Verify your number

Enter 6 Digit OTP

Change mobile number

Table of Content

Your PAN card is a government-approved identity proof document linked with your financial accounts and tax payments. It is a unique 10-digit alphanumeric identity assigned to you by India’s Income Tax Department.

Your PAN card is crucial for accessing various financial services, such as opening a bank account, applying for a loan, and filing income tax returns. You can easily check and download your CIBIL report/score using your PAN card for free.

It is important to note that checking your CIBIL score using your PAN card does not impact your credit score. It is a soft inquiry that does not leave any footprints on your credit report. Therefore, you can check your CIBIL score as often as possible without worrying about any negative impact on your credit score.

Steps to Check CIBIL Score with PAN Number

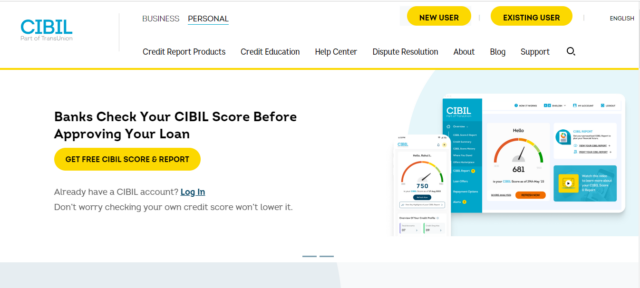

- Go to CIBIL’s official website. https://www.cibil.com/

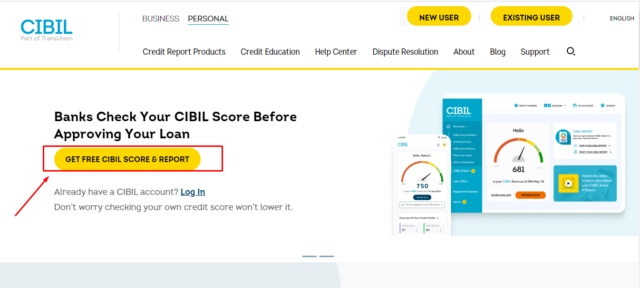

- Click on ‘Get Free Cibil Score & Report’

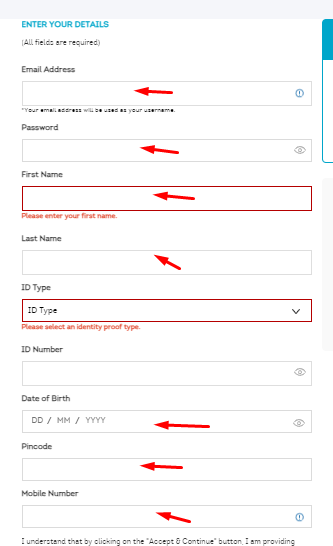

- Enter your Name, Last name, email address, password, Date of Birth, Pincode, and Mobile Number

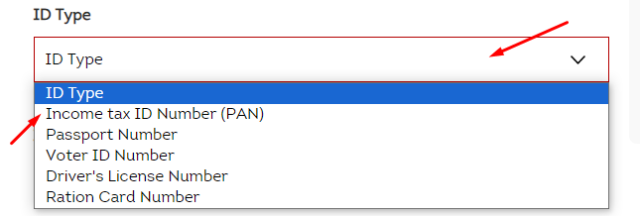

- Select Pan Card as an ID

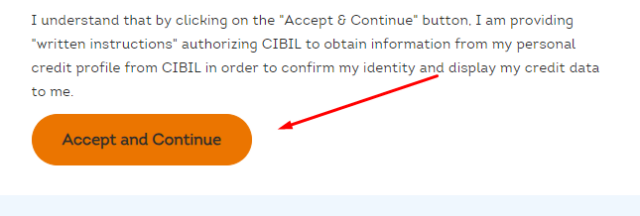

- Agree to the terms and conditions.

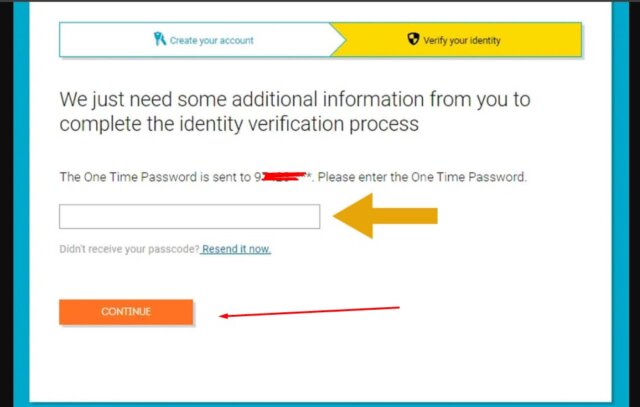

- OTP sent to your phone number

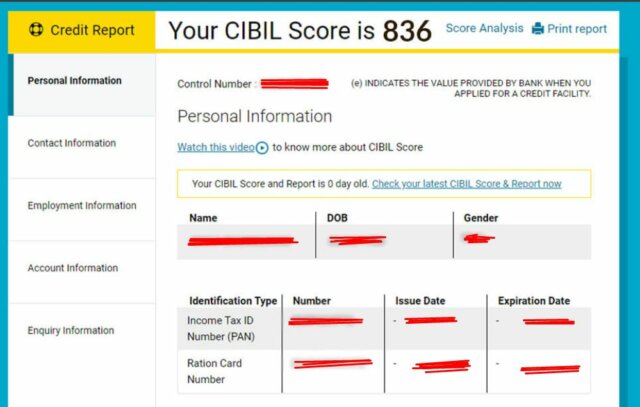

- Cibil score will be displayed here

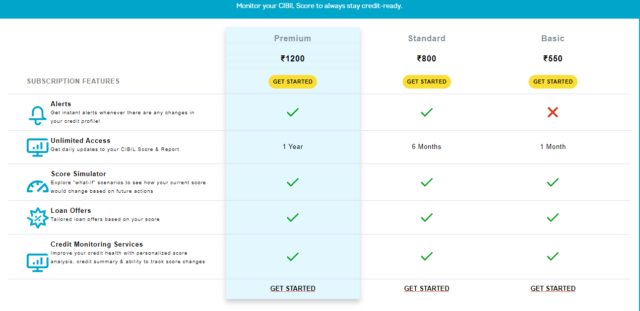

- You can check paid subscriptions also for other CIBIL services.

If you had previously checked your CIBIL Score/CIR, you could use your email address and password to retrieve the existing data. If this is your first time accessing the credit information, the website will guide you to the payment section. After completing the payment, you will be given the option to select how you would like to receive the score and report. You can opt for a physical report to be sent to your address through the postal service, or you can receive an electronic copy via email.

Steps to Check CIBIL Score with PAN Number on Urban Money

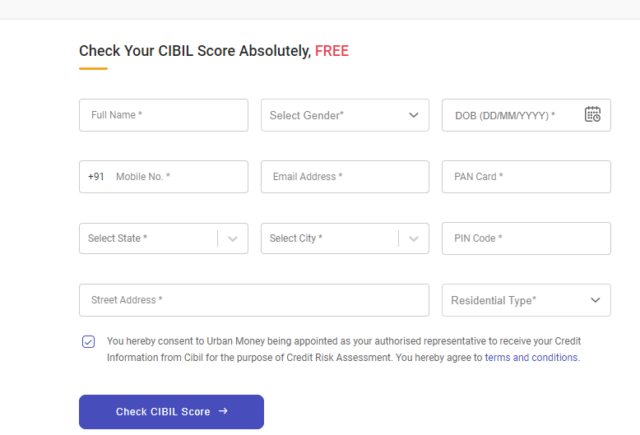

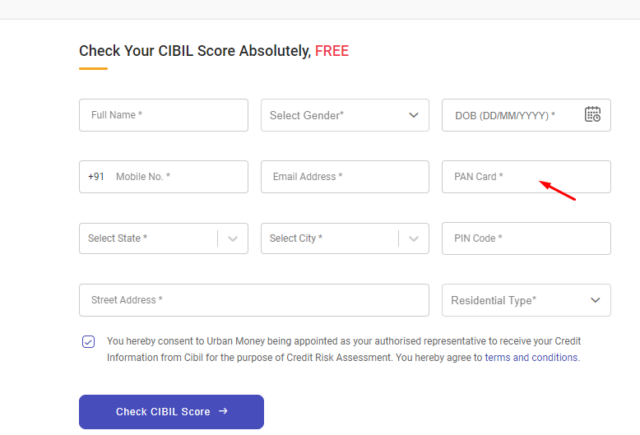

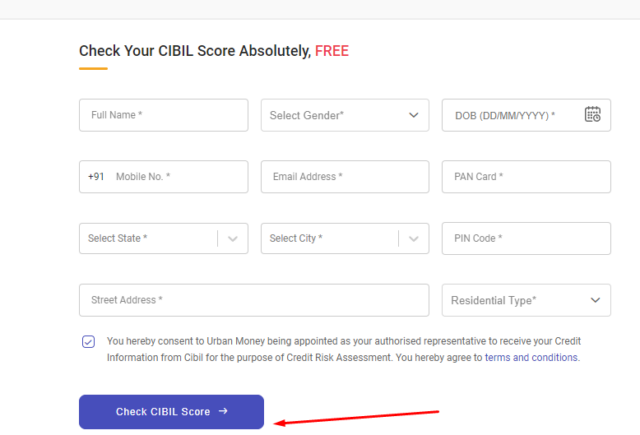

To use the PAN card to verify your CIBIL score, follow the steps listed below:

- To access your credit score, enter your personal basic details.

- Enter your mobile number and e-mail address.

- Enter your Date of Birth.

- Enter your PAN or permanent account number.

- Now click on the ‘Check CIBIL Score’ option.

It’s free and really that easy. The best part? Checking your CIBIL Score on the Urban Money website does not impact your credit score.

Why PAN Card Necessary for a CIBIL score?

The PAN Card serves as a means of identification through its unique number, allowing individuals to be easily recognised. Additionally, PAN is linked to most individuals’ financial and banking accounts. This connection allows credit bureaus to access and verify your information quickly. When you use your PAN Card number to view your CIBIL score, it is solely used for locating and verifying your credit information.

If you do not have a PAN Card, you can still get your CIBIL Score by providing the identification number on your Passport, Voter ID, or Driver’s License.

Impact of Changing Your PAN Card on Your CIBIL Score

Changing your PAN card does not directly impact your CIBIL score, as it is calculated based on your credit history and repayment behaviour rather than your PAN card. However, your PAN card is a unique identifier for financial and credit institutions to track your financial transactions, including credit applications, repayments, and utilisation. Here’s how a change in your PAN card might indirectly affect your CIBIL score:

- If you lose or have your PAN card stolen and need a new one, it will not impact your CIBIL score. This is because your PAN number and past information will remain unchanged. However, if you own two PAN cards, it is recommended that you surrender one to prevent any future problems.

- When you provide your PAN details to the lenders, they will inform the credit bureaus, like CIBIL. This ensures that your credit information is correctly linked to your new PAN number, which keeps your credit report trustworthy. Failing to update your PAN information can lead to errors in your credit report, which may impact your credit score if it shows incomplete or incorrect credit behaviour.

- Applying for a new PAN card can have a detrimental effect on your CIBIL score. This is because your credit history, linked to your current PAN card, determines your credit score. Consequently, if you request a new PAN card, the TransUnion CIBIL database may raise concerns about your account.

How Does PAN Card Help In Checking Your CIBIL Score?

Using your PAN card to check your CIBIL score is important for several reasons. This is a summary of its importance:

- Unique Identifier: Your PAN card serves as a unique identifier, distinguishing your credit activities and financial transactions from those of others. Since it is unique to each individual, it helps ensure that credit bureau databases, such as CIBIL’s, appropriately retrieve your credit record.

- Access to Credit Score: You must usually provide your PAN number to check your CIBIL score. This is because your PAN is connected to your credit activities and history, enabling credit bureaus to create your credit report by examining transactions and accounts linked to your PAN.

- Accuracy in Credit Reporting: The PAN card guarantees accuracy in credit reporting. It ensures that credit information is correctly linked to the right person, which is important for maintaining a reliable CIBIL score. Any mistakes or inconsistencies can negatively affect your creditworthiness evaluation.

- Loan and Credit Card Application: When you apply for a loan or a credit card, lenders will ask for your PAN to review your CIBIL score. This allows them to evaluate your credit reliability and make a decision on your loan application. Having a strong credit score associated with your PAN can improve your chances of getting approved for a loan and potentially secure more favourable interest rates.

How to Solve CIBIL Disputes?

CIBIL disputes refer to impertinent information present on your credit report. You must contact a credit institution or the credit bureau in case you encounter any misspelt or strange detail. As there is an involvement of both the credit bureau and the credit institution or lender, the process takes approximately 30 days to complete. The below-mentioned steps must be followed to resolve the CIBIL disputes and increase the amount of interest:

- Get a better understanding of the issue that is affecting your credit report.

- Once you know the issue, visit the credit agency’s official website and fill out the dispute resolution form online.

- Upon successful submission of the form, a dispute ID or compliant ID will be received by you.

- The credit bureau will forward a correction report to your credit institution or lender.

- The changes will be made to your report upon approval of the lender

- You will receive an email from the agency confirming the same.

| Related Guide |

| How is your CIBIL score calculated? |

| Written Off in CIBIL Reports |

FAQs

What is the CIBIL score for a new PAN card?

. Will checking your CIBIL score with your PAN card affect it negatively?

When PAN card details are involved, is a minimum CIBIL score required for loan approval?

Is checking my CIBIL score online through a PAN card safe?

Can I dispute any inaccuracies in my CIBIL report linked to my PAN card?

How can I ensure the security of my PAN card information when it's used for CIBIL score verification?

Can I link multiple PAN cards to a single CIBIL score, such as in the case of joint accounts?

Can employers or landlords access my CIBIL score linked to my PAN card without my consent?

Credit Score Guide

Get in-depth knowledge about all things related to Credit Score and your finances

Is 750 a Good Credit Score? Benefits and How to Achieve It

Easy Ways to Achieve a Credit Score of 750 A credit score of 750 is considered very good. It helps you get loans easily with low interest rates. You must manage your credit well and follow good financial habits to achiev

CIBIL Score Check For Union Bank of India

How to Check Union Bank of India CIBIL Score Urban Money offers a simple method to check your Union Bank of India cibil score at no cost! Here’s how to check your credit score on Urban Money’s website: Visit the Urban M

How a Single Missed Payment Can Impact Your CIBIL Score

Short-Term Consequences of Defaulted Repayments Defaulting on a repayment can hurt your financial reputation and lead to several immediate effects. Here are a few short-term consequences that can happen if you miss a sin

How to Resolve CRIF High Mark Credit Report Errors

Common Errors Found in CRIF High Mark Credit Reports Here are the common errors found in CRIF High Mark credit reports: Closed Accounts Showing as Open: Accounts you have paid off may still appear open. This can affect

Why Checking Your CIBIL Score is Crucial Before Applying for a Loan

Understanding CIBIL Score A CIBIL score is a three-digit number that shows how responsible you are with money and credit. It ranges from 300 to 900, with a higher score meaning you handle credit well. Credit Information

How Gold Loans Affect Your CIBIL Score and Tips to Protect It

Does Taking a Gold Loan Affect Your CIBIL Score? The short answer is yes, it does. However, whether the impact is positive or negative depends entirely on how you manage your gold loan. When you take out a gold loan, you

Managing CIBIL Score and Financial Emergencies

Understanding CIBIL Score Basics A CIBIL score is a three-digit number between 300 and 900 that shows your creditworthiness. It is based on your credit history, which includes how you have handled loans and credit cards.

Role of CIBIL Score in Car Loan Approval and Terms

How CIBIL Scores Influence Car Loan Approval? The CIBIL score is a three-digit number that ranges between 300 and 900. A higher score indicates better creditworthiness and vice versa. Lenders typically prefer applicants

Kotak CIBIL Score: How to Check & Loan Requirements

How to Check Your Kotak CIBIL Score? Checking your CIBIL score regularly is crucial for maintaining a healthy credit profile. Here is a step-by-step details to checking your Kotak CIBIL score: Visit the Official CIBIL W

CIBIL Score for Car Loans: Top Picks for 2025

List of Best Car Loan in India 2025 Here are some of the best available car loan options in India with minimal interest rates and low processing fees: State Bank of India Car Loan SBI offers a fantastic deal to finance

Does Checking Your CIBIL Score Impact Your Credit Score?

Does Checking Your CIBIL Score Affect It? True or False? The short answer is false. Checking your CIBIL score is considered a soft inquiry and does not impact your credit score. People often get confused because they fai

How to Avoid Credit Repair Scams and Protect Your Credit Score

Understanding Credit Repair Scams Credit repair scams are traps set by individuals into luring you by offering you a magical solution that practically holds no meaning. They use sneaky tricks to make you believe they can

Difference Between Equifax & CIBIL Score

Equifax Vs CIBIL Understanding credit scores is paramount for securing loans and credit cards in India. Equifax and CIBIL (TransUnion CIBIL) are prominent players in this arena. While both provide credit information to l

How Student Loans Influence Your Credit Score

The Impact of Student Loans on Your Credit Score The impact of education loans on CIBIL scores can be positive and negative. As mentioned above, the outcome largely depends on managing your credits. For a more detailed i

How Bankruptcy Impacts Your Credit Score

Impact of Bankruptcy on Your Credit Score Here are the key aspects of how bankruptcy impacts on your credit score and beyond: 1. Significant Drop in Credit Score Your credit score takes a massive hit when you file for ba