Top 10 Best Private Banks in India List 2025

January 09, 2025

CIBIL Score Archive | Credit Rating Agencies In India

May 11, 2023

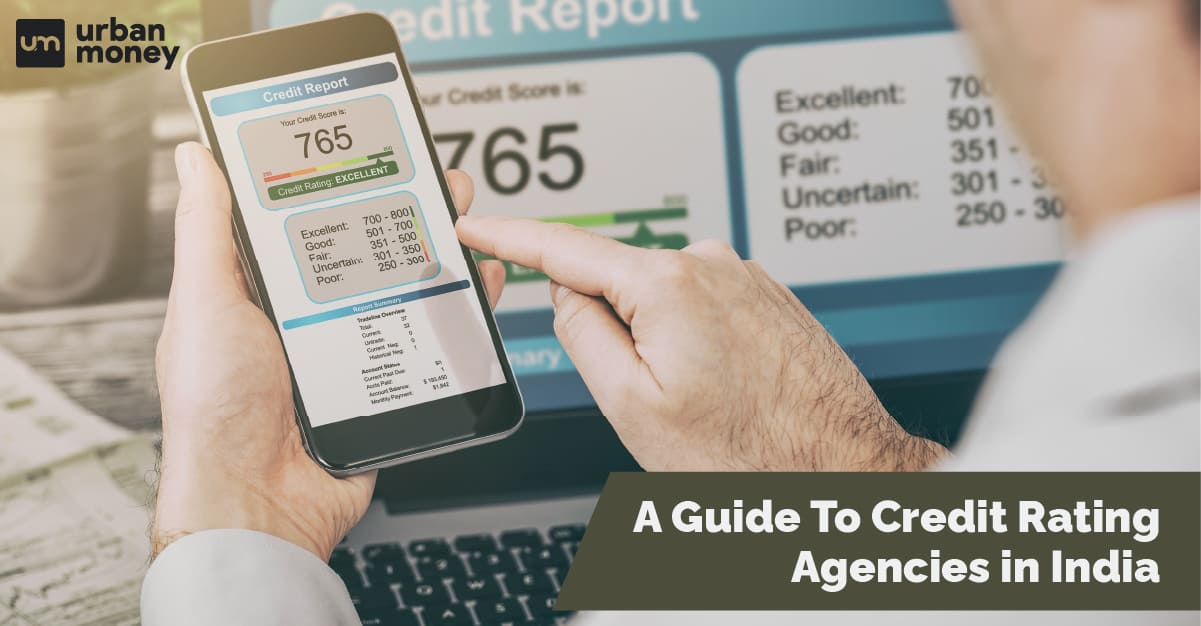

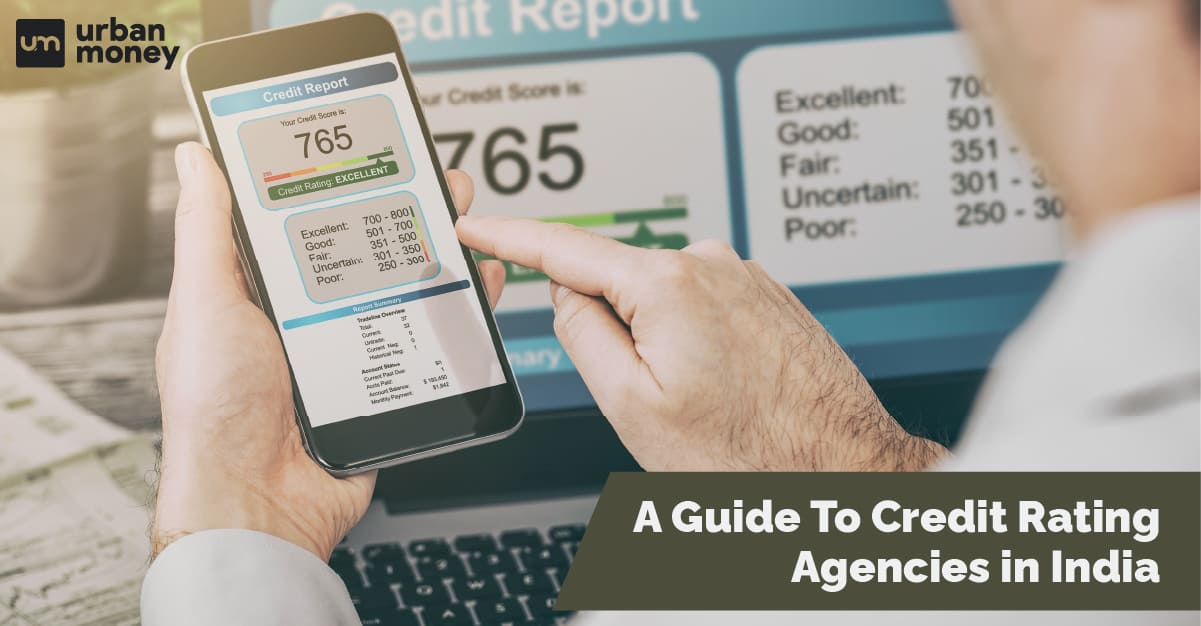

It will be intriguing to know that there are agencies that solely involve themselves with the analysis and grading of investment instruments and credit risk. These deem useful for many banks and lending institutions in determining how much capital they can deploy on an individual or entity on a credit basis. These credit ratings and credit scores have an invisibly pervasive effect on our lives. We’re given a numeric value based on our debt risk. As they say, improve your credit scores and lead a good financial life.

Although they have been set up for improving the critical barriers of risk through credits and funding, there have been speculations where ratings are simply bought off. All the conjectures aside, there is plenty of scope for individuals and entities to improve their ratings and get easy investments through credit.

In this blog, we’ll dwell on what a credit rating agency is and what are some credit rating agencies in India.

Table of Contents

ToggleA credit rating agency is an organization or entity mainly responsible for making judgments about various borrowers, including individuals, firms, etc. Moreover, these agencies also research and analyze market behavior from which they provide investment-related consultations. Some of the big names in India include CRISIL, ICRA, CARE ratings, ONICRA, Fitch India, Brickwork Rating, SMERA, and many more. In any developing country, taxes aren’t sufficient to fulfil financial obligations. They will need credits from banks. And by doing this, banks are putting themselves at financial risk by investing their capital. The main purpose of setting up a credit rating agency is to simply analyze their creditworthiness, prospectus, and ability to repay debts and provide a transparent grading structure. Banks will use these ratings to determine whether or not to lend their capital.

With regard to certain aspects of a borrower, there are entities set up to monitor the creditworthiness of these individuals, including their repayment capacity. Furthermore, these credit rating agencies assign grading systems to various financial products and their performances. Ratings play a major role in determining whether or not a certain individual or an entity can be approved for funding, and they have the capability of repayment. Lending institutions use credit ratings to ascertain the credit risk involved. This consequently determines the rate of interest and funding amount sanctioned. Here are some characteristics of a credit rating.

India is home to various credit rating agencies that involve an extensive and comprehensive analysis of prospective debtors. Here is a list of some of the top credit rating agencies in India, as given below.

CRISIL is a credit rating agency that analyses different financial products with varying parameters. These parameters include superior return score, portfolio consistency, volatility analysis, exposure to sensitive sectors, etc. They assign numeric and alphanumeric ratings to the respective financial product. The credit rating is collectively mapped for the entity’s performance in 3, 5, and 10 years.

ICRA is a credit rating company standing at the forefront that provides ratings, data, research, analytics, and financial solutions. ICRA was set up in the year 1991 for investment-related advisory services.

Started in 1993, CARE ratings are one of the leading CRA in India. They manage various sectors, including manufacturing, infrastructure, and finance. Furthermore, they also develop money market instruments such as corporate bonds, commercial papers, debt instruments, etc.

ONICRA is another leading credit rating company involved in rating assignment, risk assessment, and analysis of individuals, corporations, and financial products. Borrowers are scrutinized for their creditworthiness, and extensive reports are prepared, which become the basis for their ratings.

Fitch India is an unsolicited Indian credit rating entity that operates in various regions, including the Asia Pacific. They use rating systems with denotations such as BBB, F3, BBB -, etc. They make their reports clearer by incorporating positive, negative, evolving, and stable aspects.

Any kind of government entity, company, or organization is assigned a rating based on several criteria, including market value, net worth, profit, credit history, etc., for establishing creditworthiness by credit rating agencies. Lending institutions use these ratings to assess the credit risk involved. A good credit rating, denoted by alphabetic symbols such as AAA, AA, A+, and so on, denotes a low-risk assessment. In contrast, a bad credit score depicts a higher risk for investors. These credit rating agencies also provide valuable inputs based on their analysis of the said entities for better assistance for investors and lending institutions. Credit rating agencies are regulated by the Securities and Exchange Board of India.

Some of the functions of a Credit Rating Agency is as listed below.

Some of India's top credit rating agencies include CRISIL, ICRA Limited, Credit Analysis, and Research Limited.

Credit rating agencies in India are regulated by the Securities and Exchange Board of India (SEBI).

Indian banks use the Transunion credit agency to formulate the credibility of their borrowers.

No, RBI does not regulate credit rating agencies in India. Rather, it is the responsibility of the Securities and Exchange Board of India (SEBI).

© 2025 www.urbanmoney.com. All rights reserved.

Need Loan Assistance?

Thank you for showing your interest. Our agent will get in touch with you soon.