- Home

- Credit Score

- Commercial Cibil Csgen

CIBIL Commercial Report : Check Complete Details on CCR

- Instant Results

- No Hidden Fees

- Secure & Confidential

- No Impact on Your Credit Report

I agree to the Terms and Conditions of TUCIBIL and hereby provide explicit consent to share my Credit Information with Urban Money Private Limited.

Verify your number

Enter 6 Digit OTP

Change mobile number

Table of Content

A commercial CIBIL report is a type of document. It contains information about your business entity’s creditworthiness, such as CIBIL score, credit history, debt-to-income ratio, etc. When the entity’s owner applies for a business loan, the company CIBIL score is the first thing a lender may check. Whether the applicant owns a private limited company, public limited company, partnership firm, or proprietorship, the commercial CIBIL report provides the lender with a detailed insight into the company’s financial well-being and credit background. To learn more, continue to scroll down. Hereunder, Urban Money presents a comprehensive overview of commercial CIBIL. We primarily cover details such as how to get your CIBIL report, applicable features, factors affecting your company’s CIBIL score, how to improve your CIBIL score, etc.

How to Obtain Your CIBIL Commercial Report

For CIBIL commercial login, you need to follow the steps given below:

- Step 1: Visit the official website of CIBIL, a credit bureau company in India.

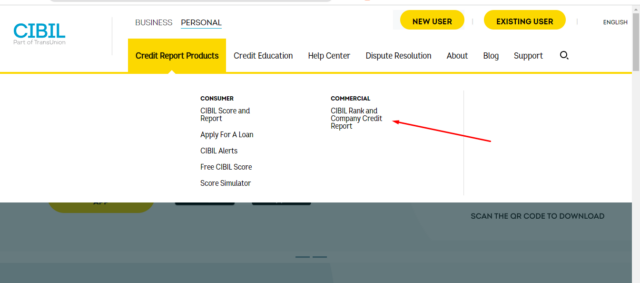

- Step 2: Go to the “Credit Report Product” menu and then select the “CIBIL Rank and Company Credit Report” option

- Step 3: Tap on the “Subscribe Now” button.

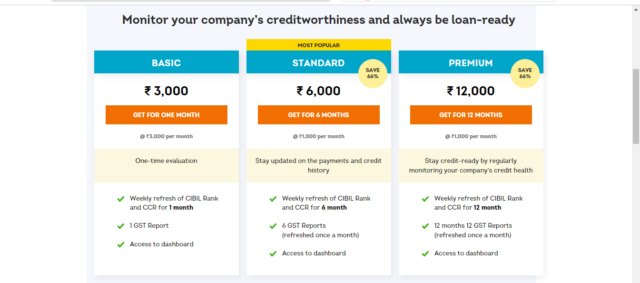

- Step 4: Choose the subscription plans that best suit you, enter the company details and complete the payment.

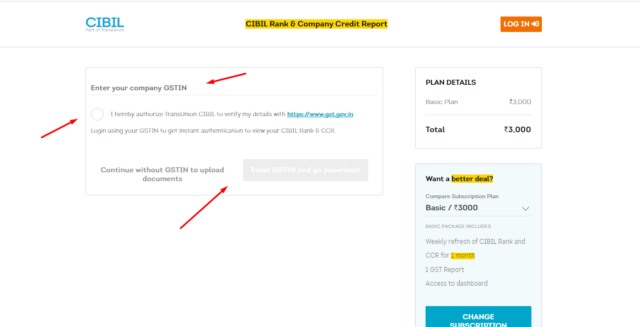

- Step 5: Complete the payment procedure and enter the company GSTIN Number

- Step 6: Upload the KYC documents and click the “Submit” button.

- Step 7: You will receive an email mentioning your transaction ID and registration ID

- Step 8: Your commercial CIBIL report will be mailed to your registered company address within a week.

Documents Required to Check CIBIL Commercial Report

Let’s examine the necessary documents you may require to check the company CIBIL score:

For Private and Public Limited Companies

If your company is registered as a private or public limited, then you have to present the following documents:

- Identity proof of one of the authorized signatories, which may include a Passport, PAN, or Driving License

- Anyone address proof from the following: passbook or bank account statement, telephone or electricity bill, sale agreement of office premises/registered lease, address proof issued by multinational or commercial banks, registration certificate issued under Shops & Establishment Act

- PAN card of the company

- A scanned copy of the board resolution along with the authorized specimen signature and signatory list

For Proprietorship

If you are a single owner of the business/company or have your business registered as a sole proprietorship; then you have to submit the following documents to check Commercial CIBIL Report:

- Proof of Identity of the proprietor, which could be a Driving License, PAN, or Passport

- Any of the following proof of address — registration certificate issued under the Shops & Establishment Act, electricity or telephone bill, etc

Note: The proprietor must self-attest all the above-mentioned documents.

For Partnership Firms

If you own a partnership firm with one or few other partners, then you must submit the following documents:

- PAN of the partnership firm

- Copy of certificate of registration or partnership deed

- Identity proof of partner requesting for the Company Credit Report, which may include Passport, Driving License, or PAN

- List of specimen signatures along with authorized signatories

Key Features of the CIBIL Commercial Report

Let’s examine the key features of the commercial CIBIL report:

- Company Background: It includes legal establishment, branches, ownership, and years of operation.

- Financial Information: It details the company’s credit standards based on financial data, such as outstanding loans, overdue, collateral, etc.

- CIBIL Rank: It reflects the company’s creditworthiness with a rank between 1 (highest) and 10.

- Credit History: It records the company’s financial history, including collections, repayments, and revenue generation.

Applicable Elements That Influence Your CIBIL Commercial Report

Here are the applicable elements that impact your company’s CIBIL score:

- Company Profile: The company profile mainly indicates the life and size of the corporation. Usually, older and bigger organisations have a well-established financial history. Therefore, they are considered more credible than startups and new businesses.

- Credit Repayment History: This refers to your repayment behaviour. Any default or late payment can significantly lower your credit score. On the other hand, paying your debt or EMI on time can enhance your overall commercial CIBIL report.

- Credit Utilisation Ratio: This is a metric represented by percentages. It signifies the difference between your total available credit limits and the amount you have utilised from that limit. Keeping your credit utilisation ratio low is considered ideal for a positive credit report, as the credit bureau company in India views this as a healthy financial habit.

- Credit Duration: This indicates the length of time you have been repaying your debt or EMI. Notably, the credit bureau in India views longer durations favourably, as they consider this a testament to responsible repayment. Thus, the longer the repayment period, the better the credit score.

- Outstanding Debts: This refers to any remaining debt you may have. Specifically, the total amount of money you must repay to be debt-free. Keeping your outstanding debt as low as possible helps improve your credit score, while higher outstanding debt can lower it.

- Credit Enquiries: This means how many credit applications you have raised. Multiple credit applications or inquiries in a short period can adversely affect your credit report. The credit bureau interprets this as credit-hungry behavior, indicating you may have experienced financial hardship.

- Industrial Sector: Specific industrial sectors have a higher risk and impact the company’s CIBIL Commercial Report. For instance, if your company operates in the oil and gas sector, deemed to have high volatility due to global market conditions, the lenders will consider your company less creditworthy compared to companies in other stable sectors like insurance and banking.

How to Improve Your CIBIL Commercial Report

Here are certain tips you can keep in mind to improve your commercial CIBIL report:

- Timely Payments: Ensure all dues are paid on time to maintain a good repayment history.

- Debt Management: Pay off debts to keep the outstanding debts feasible and your company’s repayment ability in good standing.

- Credit Utilisation: Lower your credit-to-debt ratio below 30% to maintain a balanced credit utilisation.

- Credit Enquiries: Avoid excessive hard inquiries in a short span of time, as this can indicate credit-hungry behaviour and cause a lower credit score.

- Financial Health: Maintain a long history of responsible credit behaviour and ensure your assets always exceed your liabilities.

Why Your CIBIL Commercial Report Matter

Let’s examine the importance of CIBIL commercial login:

- Loan Approval: A positive report can lead to quicker credit approvals and potentially better interest rates.

- Business Insights: It provides a comprehensive view of your business’s financial health and credit performance.

- Risk Mitigation: It helps lenders assess the level of risk associated with lending to your company.

Comparison of Commercial CIBIL vs Consumer CIBIL

Below is the comparison of commercial CIBIL and consumer CIBIL:

| Aspect | Commercial CIBIL | Consumer CIBIL |

| Target | Businesses and commercial entities | Individual consumers |

| Purpose | To assess the credit histories of business entities for loan eligibility | To assess the credit history of individuals for loan eligibility |

| Credit Model | CIBIL rank between 1 and 10 | CIBIL scores between 300 and 900 |

| Report Type | Commercial Credit Report | Credit Information Report (CIR) |

| Key Attributes | Payment history, credit mix, credit utilisation, financial stability | Number of accounts, loans, credit cards, repayment patterns |

Comparison of CIBIL Commercial Report vs Individual’s Credit Report

Below is the comparison of a company credit report and an individual Credit report:

| Aspect | CIBIL Commercial Report | Individual’s Credit Report |

| Focus | Creditworthiness and financial history of businesses | Creditworthiness of individuals |

| Aim | To evaluate credit risk and financial transactions with businesses | To evaluate credit risk with the individuals |

| Content | Business’s credit history, loan repayment, financial stability | Individual’s credit accounts, repayment history, outstanding debts |

| Scoring/Ranking | Rank between 1 (highest creditworthiness) and 10 | Score between 300 (lowest) to 900 (highest creditworthiness) |

| Analysis | A rank closer to 1 results in more favourable loan terms and interest rates | A higher score can lead to better loan terms and interest rates |

What Details Are Included in a CIBIL Business Credit Report

Following are the key details that are included in a commercial CIBIL report:

- Company Details: Company name, industry type, number of employees, legal constitution, etc.

- Contact Information: Registered office address, mobile number, telephone number, and fax numbers.

- Identification Details: Registration number, Taxpayer Identification Number (TIN), Corporate Identification Number (CIN), Service Tax Number, PAN card number, etc.

- Delinquency Reports: Financial creditworthiness of the company and guarantors, including current and past due status, outstanding amounts, etc.

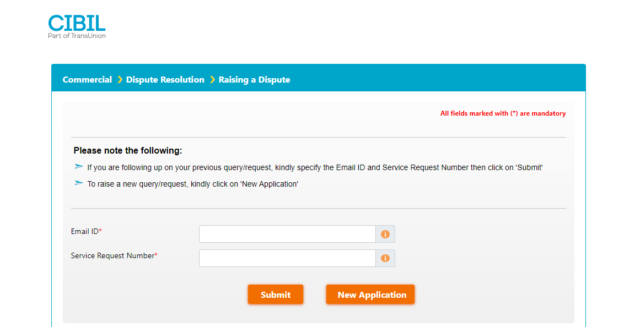

How do I Rectify Information on CCR?

If the information registered on your CCR seems incorrect, you can raise a dispute with CIBIL. The portal offers an online commercial dispute form where you can provide details of the dispute, such as —

- Company Name and Registered Address

- Branch Address, if any (optional)

- Name of Authorised Signatory

- Contact details such as your phone number and email address

- Company PAN

- Report Order Number — a unique 10-digit number that reflects on the top right-hand side of your Credit Information Report (CIR)

- Date of Report

- Reason for Dispute

Click on the following link to access the dispute form — https://www.cibil.com/online/file-company-dispute.do.

Once you have furnished the required information, enter the CAPTCHA code and click on the ‘Submit’ button.

| Related Guide |

| How is your CIBIL score calculated? |

| Written Off in CIBIL Reports |

| How to Check CIBIL Score with PAN Card |

FAQs

Can lenders use a CIBIL commercial report to assess a business's creditworthiness?

How frequently should businesses review their CIBIL commercial report?

Are there laws regulating CIBIL commercial reports?

Do strong CIBIL commercial reports help businesses get better financing?

What does Credit Order Number mean in CIBIL Commercial Report?

Who can access CIBIL rank and CCR?

Can I download the Company Credit Report?

Credit Score Guide

Get in-depth knowledge about all things related to Credit Score and your finances

Is 750 a Good Credit Score? Benefits and How to Achieve It

Easy Ways to Achieve a Credit Score of 750 A credit score of 750 is considered very good. It helps you get loans easily with low interest rates. You must manage your credit well and follow good financial habits to achiev

CIBIL Score Check For Union Bank of India

How to Check Union Bank of India CIBIL Score Urban Money offers a simple method to check your Union Bank of India cibil score at no cost! Here’s how to check your credit score on Urban Money’s website: Visit the Urban M

How a Single Missed Payment Can Impact Your CIBIL Score

Short-Term Consequences of Defaulted Repayments Defaulting on a repayment can hurt your financial reputation and lead to several immediate effects. Here are a few short-term consequences that can happen if you miss a sin

How to Resolve CRIF High Mark Credit Report Errors

Common Errors Found in CRIF High Mark Credit Reports Here are the common errors found in CRIF High Mark credit reports: Closed Accounts Showing as Open: Accounts you have paid off may still appear open. This can affect

Why Checking Your CIBIL Score is Crucial Before Applying for a Loan

Understanding CIBIL Score A CIBIL score is a three-digit number that shows how responsible you are with money and credit. It ranges from 300 to 900, with a higher score meaning you handle credit well. Credit Information

How Gold Loans Affect Your CIBIL Score and Tips to Protect It

Does Taking a Gold Loan Affect Your CIBIL Score? The short answer is yes, it does. However, whether the impact is positive or negative depends entirely on how you manage your gold loan. When you take out a gold loan, you

Managing CIBIL Score and Financial Emergencies

Understanding CIBIL Score Basics A CIBIL score is a three-digit number between 300 and 900 that shows your creditworthiness. It is based on your credit history, which includes how you have handled loans and credit cards.

Role of CIBIL Score in Car Loan Approval and Terms

How CIBIL Scores Influence Car Loan Approval? The CIBIL score is a three-digit number that ranges between 300 and 900. A higher score indicates better creditworthiness and vice versa. Lenders typically prefer applicants

Kotak CIBIL Score: How to Check & Loan Requirements

How to Check Your Kotak CIBIL Score? Checking your CIBIL score regularly is crucial for maintaining a healthy credit profile. Here is a step-by-step details to checking your Kotak CIBIL score: Visit the Official CIBIL W

CIBIL Score for Car Loans: Top Picks for 2025

List of Best Car Loan in India 2025 Here are some of the best available car loan options in India with minimal interest rates and low processing fees: State Bank of India Car Loan SBI offers a fantastic deal to finance

Does Checking Your CIBIL Score Impact Your Credit Score?

Does Checking Your CIBIL Score Affect It? True or False? The short answer is false. Checking your CIBIL score is considered a soft inquiry and does not impact your credit score. People often get confused because they fai

How to Avoid Credit Repair Scams and Protect Your Credit Score

Understanding Credit Repair Scams Credit repair scams are traps set by individuals into luring you by offering you a magical solution that practically holds no meaning. They use sneaky tricks to make you believe they can

Difference Between Equifax & CIBIL Score

Equifax Vs CIBIL Understanding credit scores is paramount for securing loans and credit cards in India. Equifax and CIBIL (TransUnion CIBIL) are prominent players in this arena. While both provide credit information to l

How Student Loans Influence Your Credit Score

The Impact of Student Loans on Your Credit Score The impact of education loans on CIBIL scores can be positive and negative. As mentioned above, the outcome largely depends on managing your credits. For a more detailed i

How Bankruptcy Impacts Your Credit Score

Impact of Bankruptcy on Your Credit Score Here are the key aspects of how bankruptcy impacts on your credit score and beyond: 1. Significant Drop in Credit Score Your credit score takes a massive hit when you file for ba