How to Get SBI Mini Statement: Complete Step-by-Step Guide

The SBI Mini Statement contains the details of the transactions made through your account using various payment methods like UPI, IMPS, NEFT, RTGS, etc., provided you have a mobile number linked to your State bank account. However, to avail of this service, it is mandatory to register for the same. Once registered, the customer can obtain the mini statement via various methods. In this blog, we will look at the various ways you can get your mini statement from SBI.

- Personalized solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Interest rate comparison

Table of Content

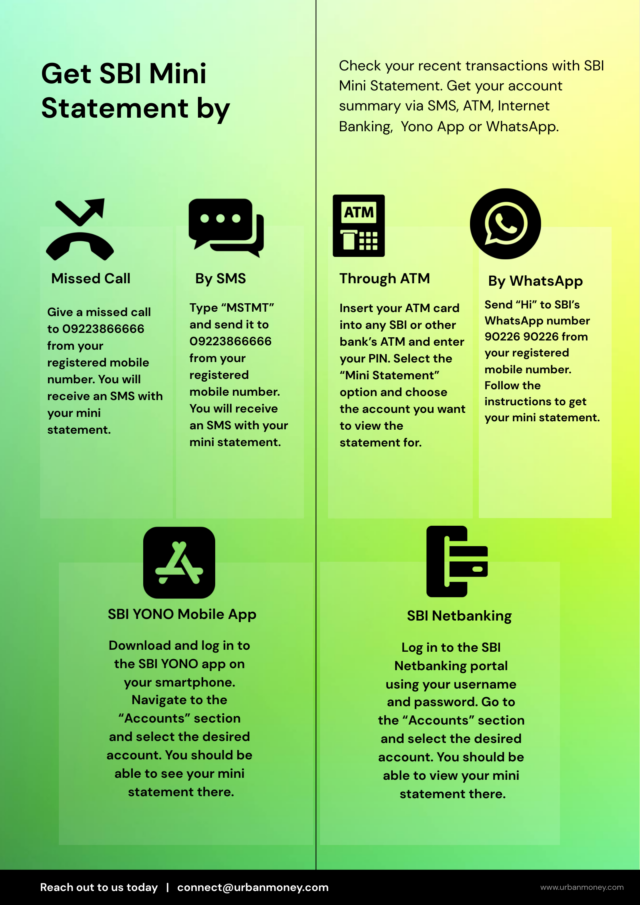

Quick Options to Check SBI Mini Statement

Once the customer registers their mobile number with the bank, they can use the below-given methods to get their mini statement from the bank:

- Missed Call: You can instantly obtain your SBI mini statement through the SBI quick missed call service. The customer will be required to give a missed call to 09223866666 from the registered mobile number. You will then receive an SMS with your mini statement.

- SMS Banking: You can also obtain your mini statement via SMS by sending ‘MSTMT’ to 09223866666 from the registered mobile number. You will then receive an SMS with the last five transactions.

- SBI Net Banking: In addition to SBI quick banking and mobile banking, customers can also log in to SBI net banking using their username and password. Once logged in, the customer can view all the transaction details in the ‘Accounts Details’ section. You can easily manage multiple accounts, access account statements, and view transaction history.

- SBI ATM: This is one of the most used methods to obtain the mini statement. You can visit the nearest ATM branch, select the ‘Mini Statement’ option on the screen, enter your four-digit PIN, and view the statement.

How to Register Mobile Number for SBI Mini Statement?

Customers can only avail themselves of the SBI mini statement facility with registered mobile numbers. So it is imperative to register your mobile number to your savings account. Typically, the mobile number is registered during the registration process. However, if you do not have any number linked, you can register the number via the method mentioned below.

To register for the quick banking service by SBI, the account holder needs to simply send an SMS to the bank on 09223488888. The format of the SMS should be REG

The account holder will be required to send an SMS to 9223440000 to register for SBI mobile banking services. The format of the message should be

SBI Mini Statement Number

Account holders can avail of their mini statement by giving a missed call to the SBI Mini Statement Number 09223866666. Given below is the step-by-step process to do so:

- Give a missed call to 09223866666 to fetch details about the last five transactions.

- The call will be automatically disconnected after two rings.

- The user will then get the mini statement containing the details of the last five transactions.

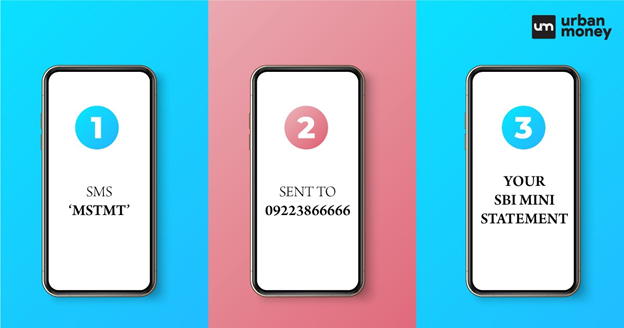

SBI Mini Statement Using SMS Banking

An SBI account holder can also view their mini statements via SMS. You can view your state bank mini statement by SMS by following the steps given below:

Step 1: Obtain SBI mini statement via SMS banking service by sending ‘MSTMT’.

Step 2: Send the message to 09223866666 from your registered mobile number.

Step 3: The State bank Mini Statement containing details of the last five transactions will then be sent to you.

Note: If the account holder has multiple active accounts with SBI, they can register only one account for Quick Service at a time. If the account holder wishes to change the registered mobile number, they will have to deregister the number from the first account.

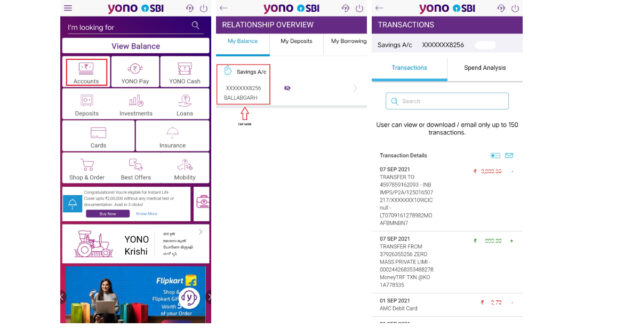

SBI Mini Statement by Mobile Banking

Given below is the step-by-step process to obtain the state bank mini statement via the mobile banking services:

Step 1: Download the SBI personal banking app from the Google or Apple Playstore.

Step 2: Log in to the app using your credentials.

Step 3: Click on the ‘My Accounts’ option on the application homepage.

Step 4: Click on the ‘Mini Statement’ option on the next page.

Step 5: You will then be able to view the mini statement with the ten most recent transactions.

SBI Mini Statement Through WhatsApp Banking

Finally, a piece of good news for SBI customers! No more standing in queues for small bank-related jobs like viewing account balances and mini statements. The bank has launched a unique customer-friendly initiative that will allow the customers of SBI to access most of its banking services through WhatsApp, a messaging app.

You can view the SBI mini statement or the details of the last five transactions instantly using the application. Given below are steps to obtain mini statements through WhatsApp:

Step 1: Send ‘Hi’ to SBI WhatsApp number – 90226 90226.

Step 2: A pop-up message will appear on the screen.

Step 3: You have to choose from the following options — Account Balance, De-Register WhatsApp Banking App, and Mini Statement.

Step 4: Type 1, to check the account balance, or type 2, to check Mini Statement.

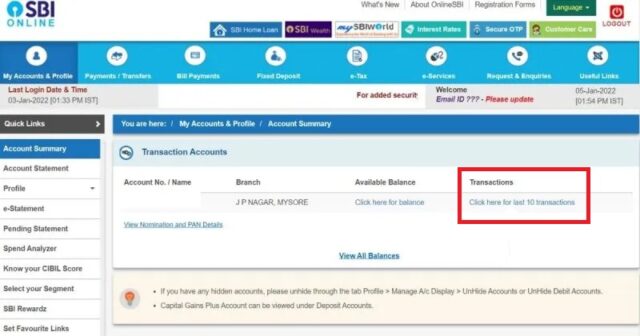

SBI Mini Statement Through Net Banking

SBI internet banking is a service provided to all SBI account holders. You can activate this service using your registered mobile number and debit card details. You can also activate this facility by visiting the nearest branch. Given below are the steps to view your mini statement via net banking:

Step 1: Log in to your SBI internet banking account using your credentials.

Step 2: Click on the ‘Account Summary’ option on the home page.

Step 3: Select the “click here for last ten transactions” option.

Step 4: You will then be able to view the mini statement with the last ten transactions.

SBI Mini Statement by Visiting ATM

This is one of the most convenient methods of obtaining the State bank Mini Statement. One can easily visit the nearest ATM and follow the steps given below:

Step 1: Visit the nearest ATM and insert your debit card.

Step 2: Enter your 4-digit PIN and click on the ” View Mini Statement ” option.

Step 3: The ATM will then dispense a mini statement containing details of the last ten transactions from your account.

Benefits of SBI Mini Statement Service

The integrated and automated services offered by SBI Quick offer several benefits, some of which are listed below:

- Customers are not required to log in to their online banking accounts to access information regarding their bank accounts.

- Viewing details about the last five transactions from your bank account is faster and easier.

- The customer does not necessarily need a laptop, computer, or smartphone to access this service. Just a phone with an SMS pack is enough.

- This service eliminates the need to physically visit the branch and stand in queues to get a mini statement or update the passbook. All the customer needs to do is send an SMS, and the mini statement will be sent to the number.

- This is a very seamless and stress-free process which is very easy to understand. Even people from rural and backwards areas can easily access this service.

More Resources for State Bank of India

FAQ's About State Bank Mini Statement

How can I view the SBI mini-statement without the internet?

If you do not have access to an internet connection, you can view the statement by giving a missed call or texting ‘MSTMT’ to 09223866666.

Read Also About SBI CalculatorsHow can I check my last five transactions in SBI?

You can check your last five transactions via mobile banking, net banking, SMS service, and missed call service.

Check More About SBIHow can I register for SBI mobile banking service?

You can register your number for SBI mobile banking services by sending an SMS or visiting your nearest branch.

Is the SBI missed call service chargeable?

No, there are no fees for the SBI missed call service. This service is available to every account holder at no extra cost.

Can I have my two bank account numbers registered with the same mobile number?

No, having the same number registered to two bank accounts is impossible. You will be required to deregister the first account if you wish to link the same phone number to another account number.

Is there any limit to checking mini statements using YONO App in a day or a month?

No, there is no specified limit to how many times you can check your mini statement on the SBI YONO mobile application.