How to Close HDFC Bank Account: Step-by-Step Guide

The process to close an HDFC Bank account is simple and direct. To close an HDFC bank account you need some necessary documentation work, once you are done with the submission of all the required documents the bank will process the closure request. After approval, HDFC Bank will permanently close your account and give you an acknowledgment receipt for the closure. It's advisable to keep this receipt for future reference. This procedure may vary to the branch and customer account type.

- Personalized solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Interest rate comparison

Table of Content

Things to Remember Before HDFC Bank Account Closing

Before proceeding with the closure of your HDFC Bank account, it’s essential to keep several important points in mind to ensure a smooth and hassle-free process. Here are the key considerations:

| Point | Details |

|---|---|

| Clear Pending Transactions | Ensure all cheques and payments are settled. |

| Transfer Your Balance | Move funds to another bank account. |

| Notify Relevant Parties | Inform your employer and service providers, and update bank details. |

| Return Bank Materials | Return any unused cheques, debit/credit cards. |

| Check for Account Closure Charges | Understand any fees and minimize them if possible. |

| Resolve Negative Balances | Settle overdrafts to avoid penalties. |

| Transfer Securities (Demat Accounts) | Transfer or sell securities and complete necessary paperwork. |

| Consider Alternatives | Explore options like temporarily freezing the account or switching account types. |

How to Close HDFC Bank Account – Steps and Details

Follow these simple steps to seamlessly close your HDFC Bank account.

- Download and Fill the Closure Form: Get the form from the HDFC website, fill it accurately, and sign it.

- Visit the Nearest Branch: Submit the form and required documents (KYC, original passbook, and chequebook) to the nearest HDFC branch.

- Attach Self-Attested Documents: Attach self-attested copies of PAN, Aadhaar, and other KYC documents.

- Get Closure Acknowledgement: Receive an acknowledgement receipt for your account closure request.

- Account Closure Timeline: Your account will be closed within 10 days.

- Charges: No charges if closed within 14 days, Rs. 500 (Rs. 300 for seniors) if closed within 1 year, and no charges after 1 year.

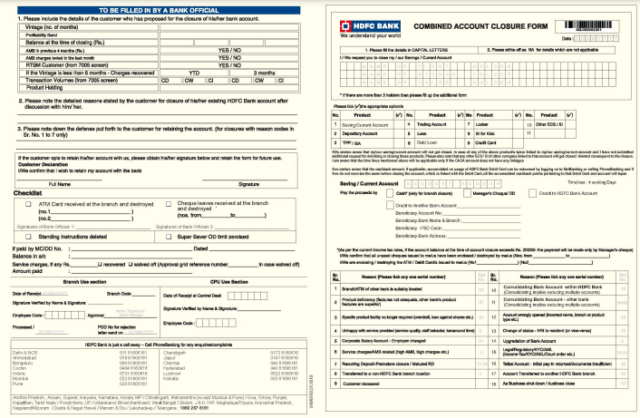

HDFC Account Closing Form Download

The procedure to download HDFC Account closure form online is as follows:

STEP 1: Mention HDFC Bank account closure in the search engine.

STEP 2: Click on the “HDFC Bank closure Form”.

STEP 3: You will find the HDFC Bank account closing form in PDF format.

STEP 4: Select the download option to obtain the HDFC Bank account closing form.

Download HDFC Bank account Closure form Now!

Reasons Of HDFC Bank Account Closure

There are several reasons why you may want to close your HDFC Bank account. Some of the common reasons include:

| Reason | Details |

|---|---|

| Switching to another bank | You may want to switch to another bank that offers better services, interest rates, or fees. |

| Closing an unused account | If you have an HDFC Bank account that you no longer use, you may want to close it to avoid maintaining a dormant account. |

| Relocating to another country | If you’re moving to another country, you may want to close your HDFC Bank account and open a new one in your new country of residence. |

| Upgrading to a premium account | You may want to upgrade to a premium account with HDFC Bank or another bank that offers more benefits and features. |

| Merging accounts | You may want to merge multiple accounts into a single account for easier management. |

| Closing a joint account | If you’re closing a joint account due to a change in circumstances, such as a divorce or separation. |

| Closing a business account | If you’re closing a business account due to the closure of your business or a change in business needs. |

| Avoiding fees | You may want to close your account to avoid fees associated with maintaining a minimum balance or other services. |

| Personal reasons | You may want to close your account for personal reasons, such as a change in financial situation or a need to simplify your finances. |

Permanently Closing HDFC Bank Account: Procedure

- Account Balance Withdrawal: Ensure your account balance is zero by transferring funds using platforms like IMPS, NEFT, RTGS, or UPI.

- Download HDFC Bank Closure Form: Download the account closure form from the official HDFC website, fill it accurately, and take it to the nearest branch.

- KYC Documents Attachment: Attach KYC documents (PAN card, Aadhaar card, voter ID) to verify your identity. Self-attestation may be required.

- Submission of Cheque Book and Passbook: Submit your cheque book, passbook, and the filled form. Bring the original identity proof for verification.

- HDFC Bank Account Closure Acknowledgement: After successful verification, the bank will issue an acknowledgement receipt, and your account will be closed within 10 days.

How to Close HDFC Bank Current, Salary and Demat Account

HDFC Bank provides a range of account options, including savings, current, salary, and demat accounts, each with unique features and requirements. The process of closing these accounts may vary. However, you can follow the general steps below to ensure your HDFC account closure process.

General Steps

1. Visit the nearest HDFC Bank branch

2. Fill out the account closure form.

3. Submit identification documents and account details.

4. Return all unused cheques and debit/credit cards.

5. Bank will process your closing request to your branch.

Note: Additional documents and procedures may be required depending on your account type.

Closing HDFC Bank Account Online with Negative Balance

- Ensure a zero balance before initiating closure.

- Download the closure form online.

- Visit the nearest branch with the form and required documents to complete the process.

Closing Without Going to a Branch

-

- Download the closure form online.

- Fill it and visit the branch with relevant documents. Closure cannot be completed online.

HDFC Customer Care for Account Closure Assistance

For any queries, contact HDFC customer care at 1800 202 6161 or 1860 267 6161, accessible across India.

Make your HDFC Bank account closure a seamless experience with these comprehensive steps.

| Related Resource |

| All-Inclusive Guide to Get HDFC Mini Statement |

| HDFC Bank Timings and Working Hours |

FAQ's About How to Close HDFC Bank Account

What Happens If The Minimum Balance Is Not Maintained In HDFC Bank account?

As per the government guidelines, if an HDFC bank account holder fails to maintain a minimum account balance, they will be obligated to pay a penalty fee. The penalty fee will be charged concerning the type of account.

Can I Close The HDFC Account Before 1 Year?

Yes, the account holder can close their HDFC Bank account within a year of opening it. However, they will have to pay charges for closing the account.

How Can I Change My HDFC Account To Zero Balance?

The account holder can avail of the option to open a zero balance account with the HDFC bank. However, it is to be noted that there are some limitations present concerning the transactions and operations.

HDFC Bank account close application charge?

The charges to close an HDFC Bank account concern the duration of the account. If the account is closed within 14 days of the opening. No charges should be levied. However, charges will be levied if the duration of the account is more than 14 days and less than a year.