- Home

- Bank Calculator

- Punjab National Bank

- Home Loan Calculator

PNB Home Loan EMI Calculator

PNB Home Loan EMI Calculator lets you calculate each month’s EMI, which helps to plan the financial budget necessary for a housing loan. An increasing number of buyers depend upon home loans for a house purchase. Therefore, borrowers can always use the housing loan EMI calculator to plan their financial budget. Borrowers can make precise, complex calculations instantaneously. Therefore, these EMI calculators play a pivotal role in budget planning for a suitable housing loan that fits their financial needs and goals.

- 5 Lac

- 20 Cr

- 5

- 30

- 6

- 20

Monthly Loan EMI

Payment Breakdown:

Principal Amount

₹10,00,000

Interest Payable

Total Amount Payable

Table of Content

What is PNB Home Loan EMI Calculator?

The PNB home loan EMI calculator provides you a convenient way to calculate your housing loan EMI and helps you to plan your budget effectively by knowing exactly how much EMI amount you need to pay each month. This innovative user friendly EMI calculator allows the potential buyers to input the key parameters for calculating housing loan EMIs. This powerful PNB housing loan EMI calculator will show you the results as mentioned below:

- Monthly Home Loan EMI

- Total interest payable during the tenure

- Total Amount Payable

You can save a lot of time and efforts by quickly evaluating different housing loan scenarios.

How to Use PNB Housing Loan EMI Calculator?

PNB Housing Loan EMI calculator is a simple and user-friendly tool designed to provide you with the precise value of the monthly EMI on a home loan. The device is very straightforward and requires you to input the following details:

- The principal home loan amount you desire to take

- Duration of home loan/loan tenure

- The expected home loan interest rate

After providing all the details, you will get the monthly EMI amount that you can avail upon maturity.

Example Calculation of 50 Lakh Home Loan EMI from Punjab National Bank for 20 Years

By using the above PNB housing loan EMI calculator, we have compiled a table for your reference only as mentioned below:

| Home Loan Amount | ₹50,00,000 |

| Loan Tenure | 20 Years |

| Rate of Interest | 8.50% p.a |

| Home Loan EMI | ₹43,391 |

| Interest Payable | ₹54,13,840 |

| Total Amount Payable | ₹1,04,13,840 |

Disclaimer: This above table is for your reference only.

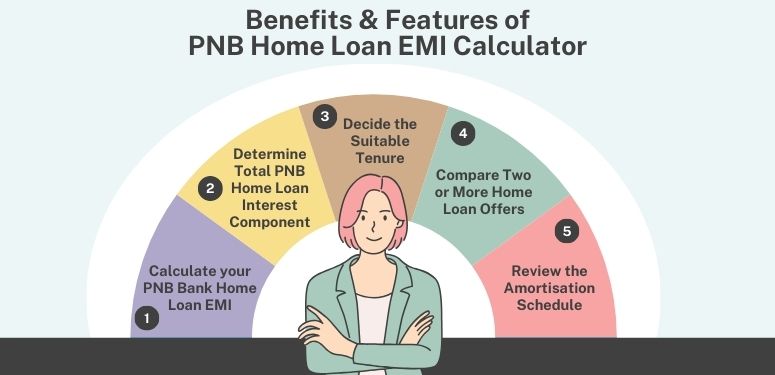

Benefits & Features of PNB Home Loan EMI Calculator

The PNB Home Loan EMI calculator is infused with various features that can benefit borrowers in various ways. They are as follows:

Calculate your PNB Bank Home Loan EMI

When it comes to a housing loan, there isn’t any tool better for financial planning. Once you have reviewed the home loan eligibility criteria and used the home loan eligibility calculator to estimate how much housing loan you can afford, you can compute the home loan EMI precisely with the PNB Home Loan EMI calculator.

Determine the Total PNB Home Loan Interest Component

Once you have furnished the desired housing loan amount, the tenure, and the home loan interest rate in the calculator, it will show the total payment amount and the total interest component. This will render you a precise idea of the interest amount you will have to pay on your loan.

Decide the Suitable Tenure

You can accurately decide the optimum EMI for a home loan by dragging the tenure slider on a home loan tenure calculator. Whatever term compares to that is the suitable term for you. The longer the tenure, the lesser the EMI.

Compare Two or More Home Loan Offers

Before you apply for a home loan, review various multiple home loan offers with varying interest rates and tenures. Compare various home loan offers by determining the EMI for each of them using the PNB Home Loan EMI calculator.

Review the Amortisation Schedule

You can use the PNB Housing Loan EMI calculator to check the breakdown of your home loan amortisation schedule. This provides you with an insight into how the two elements of your EMI will differ throughout the tenure – the interest factor reducing and the principal factor increasing.

Formula and Working of PNB Home Loan EMI Calculator

PNB Home Loan EMI calculator is designed to help you determine the monthly EMI payments before you apply for a loan. The EMI calculator asks you to fill up the desired loan amount, and choose the interest rate and loan tenure. Based on the details furnished by you, you can plan, compute, and distribute your loan EMIs over a convenient term.

Another way to calculate PNB Home Loan EMI is through a formula, which is as follows:

E = P . R . (1+R)^N/((1+R)^N – 1)

Where E = EMI (Equated Monthly Installment)

- P = Principal Loan Amount

- R = Monthly Interest Rate

- N = Monthly Loan Tenure

Let us understand it with the help of an example.

Assume that an individual applied for a home loan of ₹50 lakhs at PNB. The bank offered him a loan duration of 25 years at an interest rate of 8.5%.

Using the PNB Home Loan EMI Calculator, you will get the following –

This individual will have to pay a monthly EMI of ₹ 40,261, while the total interest payable amount would be ₹ 70,78,406. The total payment until the end of the tenure would be ₹ 1,20,78,406.

Using the formula, you will get –

E = 50,00,000 x 8.5 x (1 + 8.5) ^ 25/((1+8.5) ^ 25 – 1)

E = ₹ 40,261.

PNB Home Loan EMI Calculations As Per Your Budget

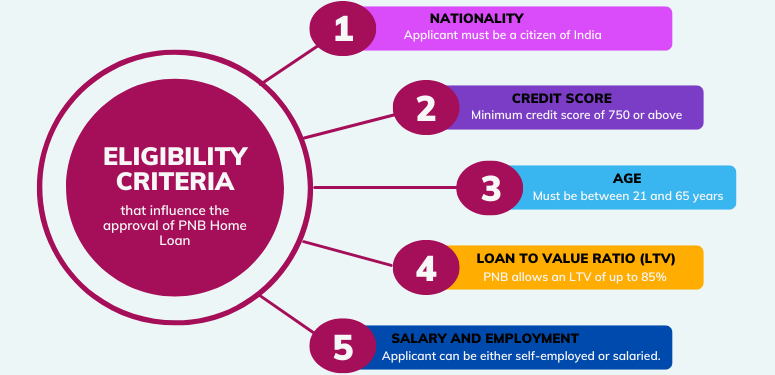

Eligibility Criteria that Influence the Approval of PNB Home Loan

Before you apply for a home loan, it is important to be aware of all the criteria that influence the chances of approval of your loan application. We have listed down the factors used by the Punjab National Bank to determine an applicant’s eligibility for a home loan:

- Nationality: The person applying for a PNB Home Loan must be a citizen of India.

- Credit Score: Like most lenders, Punjab National Bank grants home loans to individuals with a stable credit history, and a minimum credit score of 750 or above is essential.

- Age: The age of the individual opting for a loan must be between 21 and 65 years. Besides, the applicant’s age should not exceed 70 years during the loan maturity.

- Loan to Value Ratio (LTV): It is defined as the ratio of the amount of loan sanctioned to the property’s value for which the loan is obtained. LTV is usually represented in percentages. PNB allows an LTV of up to 85%, implying that an amount equivalent to 85% of the property’s value can be availed as a home loan from the bank.

- Salary and Employment: To qualify for the PNB Home Loan, you must have a regular source of income. You can be either self-employed or salaried and must have a minimum employment history of 5 years (for self-employed individuals) or three years (for salaried employees).

Home Loan EMI Calculators By Nationalized Banks

Home Loan EMI Calculators By Private Banks

Frequently Asked Questions (FAQs)

What is the maximum tenure provided by the PNB Home loan for EMI payments?

PNB offers a maximum term of 30 years for repaying home loans.

Who is eligible for a home loan at PNB?

The individual applying for a PNB home loan must be either self-employed or a salaried employee. Moreover, the minimum salary of the applicant must be at least ₹ 25,000 and the applicant must be an Indian citizen.

What are the factors that affect PNB Home Loan EMI?

The factors that affect the PNB Home loan are: The tenure of the home loan, the interest rate, and the principal amount you have decided to invest

How to reduce your PNB Home Loan EMI?

You can opt for either a lower amount or choose a shorter loan tenure so that you can pay off early and save an additional interest amount.

What is the minimum amount for PNB Home Loan EMI?

You can opt for as low as ₹ 50,000 for a home loan from PNB.

When does my PNB Home Loan EMI start?

It starts after your loan has been sanctioned and the date that the lender has fixed.

Quick Links

Bank Wise Home Loan Calculators

- Axis Bank Home Loan Calculator

- HDFC Bank Home Loan Calculator

- Bank of Baroda Home Loan Calculator

- Canara Bank Home Loan Calculator

- Union Bank of India Home Loan Calculator

- State Bank of India Home Loan Calculator

- IndusInd Bank Home Loan Calculator

- YES Bank Home Loan Calculator

- Federal Bank Home Loan Calculator

- IDBI Bank Home Loan Calculator

- CITI Bank Home Loan Calculator

- IDFC FIRST Bank Home Loan Calculator

- LIC Housing Finance Home Loan Calculator

- Piramal Housing Finance Home Loan Calculator

- Bank of India Home Loan Calculator

- Bank of Maharashtra Home Loan Calculator

- karnataka bank Home Loan Calculator

- Indian bank Home Loan Calculator

- RBL Bank Home Loan Calculator

- Deutsche Bank Home Loan Calculator

- Punjab & Sind Bank Home Loan Calculator

- Tata Capital Housing Finance Limited Home Loan Calculator

- Kotak Bank Home Loan Calculator

- HSBC Home Loan Calculator

- karur Vysya Bank Home Loan Calculator

Punjab National Bank Calculators

Home Loan by Private Bank

- Federal Bank Home Loan

- Reliance Capital Home Loan

- DCB Bank Home Loan

- ICICI Bank Home Loan

- YES Bank Home Loan

- RBL Bank Home Loan

- IDFC FIRST Bank Home Loan

- HDFC Bank Home Loan

- Axis Bank Home Loan

- Deutsche Bank Home Loan

- karnataka bank Home Loan

- karur Vysya Bank Home Loan

- Kotak Bank Home Loan

- Housing Development Finance Corporation Home Loan

- IndusInd Bank Home Loan

- IDBI Bank Home Loan

- HSBC Home Loan

- LIC Housing Finance Home Loan

- CITI Bank Home Loan

- HDFC Sales Home Loan

Home Loan by Nationalized Bank

Home Loan by NBFC

- Clix Capital Home Loan

- Hero FinCorp Home Loan

- Cholamandalam Finance Home Loan

- Vastu Housing Finance Home Loan

- Home First Finance Company Home Loan

- Aadhar housing Finance Home Loan

- DHFL Home Loan

- Muthoot Finance Ltd Home Loan

- Edelweiss Financial Services Home Loan

- Piramal Housing Finance Home Loan

- Hero Housing Finance Home Loan

- Fullerton India Home Loan

- Capital First Ltd. Home Loan

- Poonawalla Fincorp Limited Home Loan

- IndiaBulls Home Loan

- IIFL Finance Home Loan

- Ujjivan Small Finance Bank Home Loan

- Tata Capital Housing Finance Limited Home Loan

- L&T Finance Home Loan

- Aditya Birla Finance Limited Home Loan

- Godrej Housing Finance Home Loan

- Punjab National Bank Housing Finance Home Loan

- Bajaj Finserv Home Loan

- Capri Global Home Loan

Get your latest Credit Score, FREE

Home Loan Guide

Get in-depth knowledge about all things related to Home Loan and your finances

Cost to Company (CTC)

When considering a job offer, it’s easy to become fixated on the attractive “CTC” figure. But there’s more to this figure than strikes the eye. Realising the value of CTC requi

EMI: Meaning, How It Works, Calculation Method, Benefits & Drawbacks

EMIs have become one of the most common forms of payment for any financial obligation, from college fees to purchasing a new phone. This fixed monthly amount saves lakhs of citizens annually by preven

Home Loan Exemptions : Tax Rebates, High Savings

A home loan can not only get you your dream home —it can also help you save on taxes! Home loan exemptions offered by the Income Tax Act (1961) allow borrowers to claim rebates that lower their taxabl