- Home

- Bank Calculator

- Karur Vysya Bank

- Home Loan Calculator

Karur Vysya Bank Home Loan EMI Calculator

Karur Vysya Bank (KVB) is a trusted bank established in 1916 in Karur, Tamil Nadu. It is a privately owned bank that offers an accessible way to achieve your dream home. Their home loan scheme makes the journey as smooth and rewarding as possible with their aptly named Happy Loan scheme. The online tool Karur Vysya Bank EMI Calculator provides aspiring homeowners an easy way to plan their finances with competitive interest rates and flexible repayment options. Let's get to know how KVB’s advanced tools, like the KVB Housing Loan EMI Calculator, help you easily plan your finances. These tools are your first step toward stress-free financial planning and give you a clear picture of your repayment journey before leaping.

- 5 Lac

- 20 Cr

- 5

- 30

- 6

- 20

Monthly Loan EMI

Payment Breakdown:

Principal Amount

₹10,00,000

Interest Payable

Total Amount Payable

Table of Content

Karur Vysya Bank Home Loan EMI Calculation Parameters

Several essential parameters come into play when calculating your home loan EMIs using the KVB Home Loan EMI calculator. Here’s a breakdown of the key factors considered:

- Loan Amount: The total amount you wish to borrow from the bank impacts your EMI. Higher loan amounts result in higher monthly instalments.

- Interest Rate: KVB gives you home loans at competitive rates, influencing your repayment amount. A lower rate means lower EMIs and significant savings over the loan tenure.

- Loan Tenure: The duration you choose to repay the loan is another critical factor. Longer tenures lead to smaller EMIs but increase the total interest paid, while shorter tenures result in higher EMIs with less interest.

- Down Payment: The upfront amount reduces the principal loan amount, affecting your EMI calculations.

- Processing Fee: This is a one-time charge by the bank that can slightly affect your overall loan cost.

- Repayment Type: Repayment methods, such as standard EMIs, bullet payments, or step-up EMIs, can also influence the monthly outflow.

How Do You Calculate Karur Vysya Bank Home Loan EMI Online?

Calculating your Karur Vysya Bank (KVB) home loan Equated Monthly Installment (EMI) online is straightforward. You can easily use the KVB home loan EMI calculator to plan your finances effectively. Here’s how you can do it:

Step 1: Access the EMI Calculator: You can find the KVB EMI Calculator in this page.

Step 2: Input Loan Details:

- Loan Amount

- Interest Rate

- Loan Tenure

Step 3: Calculate EMI: After entering the above details, the calculator will automatically compute your monthly EMI, total interest payable, and the overall amount payable over the loan tenure.

Benefits of Karur Vysya Bank Home Loan EMI Calculator

Using the Karur Vysya Bank Home Loan EMI Calculator has several advantages that simplify your financial planning. Here’s how it benefits you:

- Quick and Accurate Calculations: The calculator provides instant and precise EMI results, eliminating the hassle of manual calculations and potential errors.

- Customisable Loan Planning: You can experiment with different loan amounts, interest rates, and tenures to find an EMI that fits your budget perfectly.

- Improved Financial Clarity: Knowing your monthly repayment amount lets you plan your finances effectively and avoid surprises.

- Time-Saving Tool: It eliminates the need for lengthy consultations or manual computations, giving you results within seconds.

- Transparency in Loan Costs: The tool offers a detailed breakdown of your total interest payable and the overall cost of the loan, ensuring complete transparency.

- Accessible Anytime, Anywhere: This online tool is available 24/7, allowing you to use it conveniently from any device.

- Smart Decision Making: By understanding your EMI beforehand, you can confidently decide on the loan amount and tenure that best suits your needs.

Factors Affecting Karur Vysya Bank Home Loan EMIs Calculations

Several factors influence the EMI amount you will pay for your Karur Vysya Bank home loan. Understanding these factors helps you make informed decisions about your loan options and repayment strategy:

- Loan Amount: The principal amount you borrow directly impacts the EMI. Higher loan amounts translate to higher monthly instalments.

- Interest Rate: The interest rate on your loan significantly affects the EMI. A lower interest rate reduces the EMI, whereas a higher rate increases it.

- Loan Tenure: The repayment period is crucial in determining your EMI. Longer tenures result in lower monthly instalments but increase the total interest paid over time. Conversely, shorter tenures lead to higher EMIs but save on interest costs.

- Repayment Type: The repayment structure, such as standard EMIs, step-up EMIs, or bullet payments, can alter the EMI amount.

- Processing Fees and Other Charges: Any additional charges levied by the bank, such as processing fees, can slightly affect your overall loan cost and impact EMI affordability.

- Prepayment and Part-Payment: Making prepayments or part-payments during the loan tenure reduces the outstanding principal, directly lowering the EMI or the tenure.

- Economic Factors: Changes in monetary policy, inflation, or economic conditions can lead to revisions in interest rates, which can subsequently affect your EMIs.

By considering these factors, you can better understand the dynamics of your home loan EMI calculations and plan your finances more effectively. The Karur Vysya Bank Home Loan EMI Calculator is an excellent tool to simulate these variations and find the most suitable repayment plan for your needs.

How Does Karur Vysya Bank Home Loan Calculator Compute EMIs?

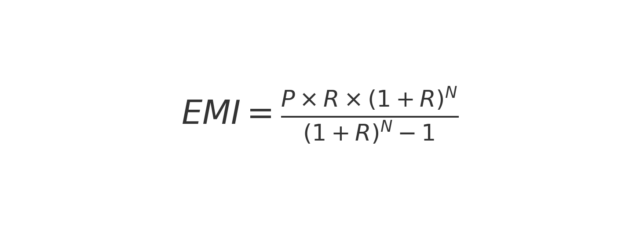

The Karur Vysya Bank Home Loan EMI Calculator uses a standard mathematical formula to compute your EMIs. The formula ensures accurate and quick calculations tailored to the inputs provided. Here’s how it works:

The EMI Formula:

Where:

- P = Principal Loan Amount (Total loan amount borrowed)

- R = Monthly Interest Rate (Annual Interest Rate divided by 12)

- N = Loan Tenure (in months)

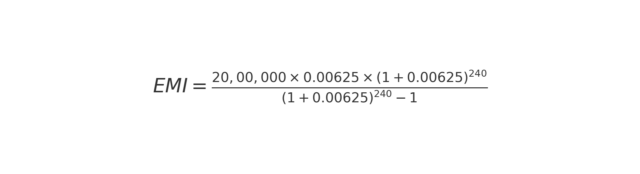

Example Calculation

Let’s say you take a home loan with the following details:

- Loan Amount (P): ₹20,00,000

- Annual Interest Rate: 7.5%

- Loan Tenure (N): 20 years (240 months)

- Convert the Annual Interest Rate to the Monthly Rate

R=7.5/12×100=0.00625

Apply the Formula

Calculate the Result

After computation, the EMI comes out to approximately ₹16,109.

Why Use the Calculator?

While the formula provides accuracy, manual calculations can be time-consuming and prone to errors. The Karur Vysya Bank Home Loan EMI Calculator automates this process, delivering instant results by factoring in variables like loan amount, interest rate, and tenure.

Frequently Asked Questions (FAQs)

Why use the Karur Vysya Bank Home Loan Calculator?

The Karur Vysya Bank Home Loan Calculator helps you accurately estimate your monthly EMIs, save time with instant results, and plan your finances effectively by adjusting loan variables to suit your budget.

What is the minimum and maximum loan tenure for Karur Vysya home loans?

The minimum loan tenure for Karur Vysya home loans is one year, and the maximum tenure is 30 years.

What is the minimum and maximum amount for Karur Vysya home loans?

The minimum and maximum loan amounts depend on your eligibility and the property’s market value, with the bank financing up to 90% of the property value.

Can I get an amortisation schedule for my Karur Vysya home loan?

Karur Vysya Bank provides an amortisation schedule that breaks down each EMI into principal and interest components. This gives you a clear view of your repayment plan over the loan tenure.

Quick Links

Bank Wise Home Loan Calculators

- Axis Bank Home Loan Calculator

- HDFC Bank Home Loan Calculator

- Bank of Baroda Home Loan Calculator

- Canara Bank Home Loan Calculator

- Union Bank of India Home Loan Calculator

- State Bank of India Home Loan Calculator

- IndusInd Bank Home Loan Calculator

- Punjab National Bank Home Loan Calculator

- YES Bank Home Loan Calculator

- Federal Bank Home Loan Calculator

- IDBI Bank Home Loan Calculator

- CITI Bank Home Loan Calculator

- IDFC FIRST Bank Home Loan Calculator

- LIC Housing Finance Home Loan Calculator

- Piramal Housing Finance Home Loan Calculator

- Bank of India Home Loan Calculator

- Bank of Maharashtra Home Loan Calculator

- karnataka bank Home Loan Calculator

- Indian bank Home Loan Calculator

- RBL Bank Home Loan Calculator

- Deutsche Bank Home Loan Calculator

- Punjab & Sind Bank Home Loan Calculator

- Tata Capital Housing Finance Limited Home Loan Calculator

- Kotak Bank Home Loan Calculator

- HSBC Home Loan Calculator

Karur Vysya Bank Calculators

Home Loan by Private Bank

- Federal Bank Home Loan

- Reliance Capital Home Loan

- DCB Bank Home Loan

- ICICI Bank Home Loan

- YES Bank Home Loan

- RBL Bank Home Loan

- IDFC FIRST Bank Home Loan

- HDFC Bank Home Loan

- Axis Bank Home Loan

- Deutsche Bank Home Loan

- karnataka bank Home Loan

- karur Vysya Bank Home Loan

- Kotak Bank Home Loan

- Housing Development Finance Corporation Home Loan

- IndusInd Bank Home Loan

- IDBI Bank Home Loan

- HSBC Home Loan

- LIC Housing Finance Home Loan

- CITI Bank Home Loan

- HDFC Sales Home Loan

Home Loan by Nationalized Bank

Home Loan by NBFC

- Clix Capital Home Loan

- Hero FinCorp Home Loan

- Cholamandalam Finance Home Loan

- Vastu Housing Finance Home Loan

- Home First Finance Company Home Loan

- Aadhar housing Finance Home Loan

- DHFL Home Loan

- Muthoot Finance Ltd Home Loan

- Edelweiss Financial Services Home Loan

- Piramal Housing Finance Home Loan

- Hero Housing Finance Home Loan

- Fullerton India Home Loan

- Capital First Ltd. Home Loan

- Poonawalla Fincorp Limited Home Loan

- IndiaBulls Home Loan

- IIFL Finance Home Loan

- Ujjivan Small Finance Bank Home Loan

- Tata Capital Housing Finance Limited Home Loan

- L&T Finance Home Loan

- Aditya Birla Finance Limited Home Loan

- Godrej Housing Finance Home Loan

- Punjab National Bank Housing Finance Home Loan

- Bajaj Finserv Home Loan

- Capri Global Home Loan

Get your latest Credit Score, FREE

Home Loan Guide

Get in-depth knowledge about all things related to Home Loan and your finances

Cost to Company (CTC)

When considering a job offer, it’s easy to become fixated on the attractive “CTC” figure. But there’s more to this figure than strikes the eye. Realising the value of CTC requi

EMI: Meaning, How It Works, Calculation Method, Benefits & Drawbacks

EMIs have become one of the most common forms of payment for any financial obligation, from college fees to purchasing a new phone. This fixed monthly amount saves lakhs of citizens annually by preven

Home Loan Exemptions : Tax Rebates, High Savings

A home loan can not only get you your dream home —it can also help you save on taxes! Home loan exemptions offered by the Income Tax Act (1961) allow borrowers to claim rebates that lower their taxabl